Deepak Gupta | Dec 29, 2019 |

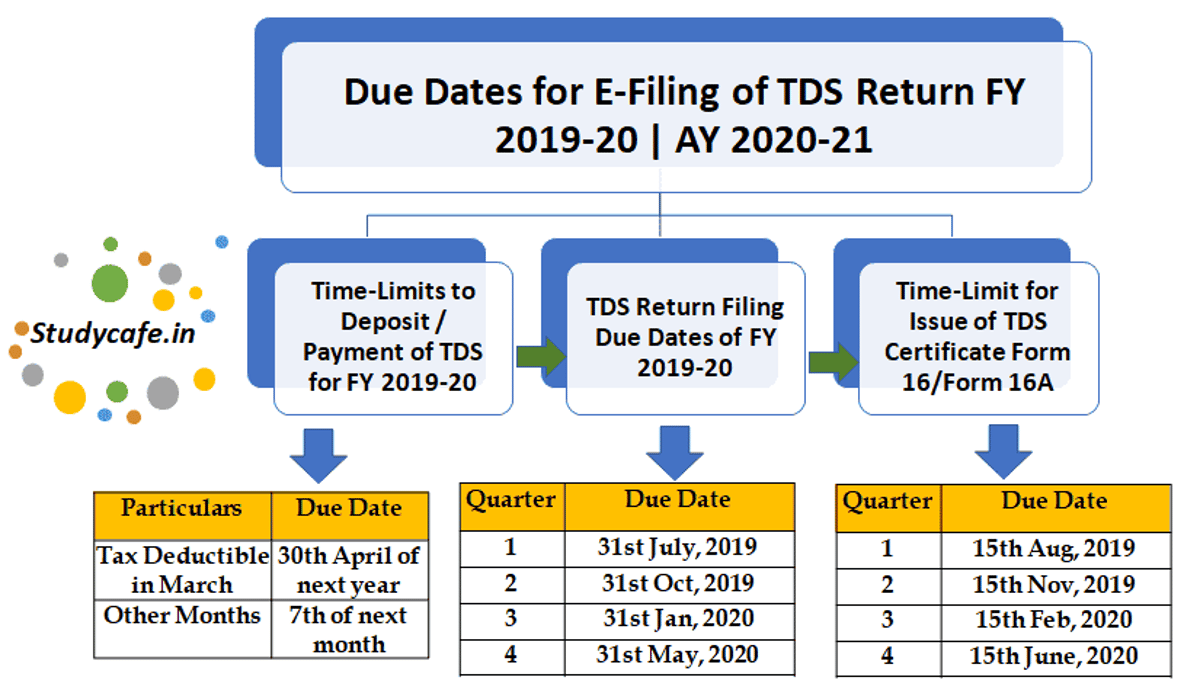

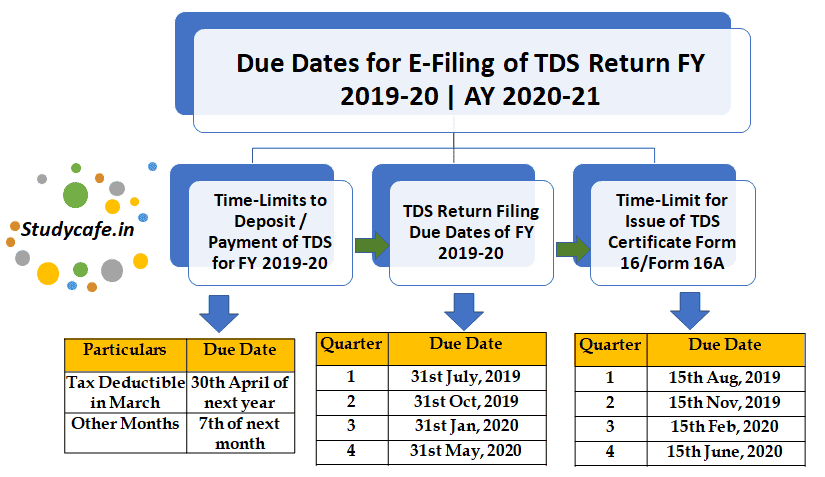

Due Dates for E-Filing of TDS/TCS Return FY 2019-20 | AY 2020-21

tds return due date for fy 2019-20, tds payment due date for fy 2019-20, tds payment due dates, tds return filing due date for fy 2019-20, how to pay penalty for late filing of tds return online, tcs return due date for fy 2019-20

Timely Deposit of TDS, filing of TDS Return and issuing TDS certificates is an important compliance for an organisation. Not doing this compliance can land you in big trouble as heavy penalty and even prosecution is there for the person who is not complying this mechanism properly.

Through this article we are sharing Due Date for Filing TDS/TCS Return, Issuance of Form 16 and Form 16A and TDS Payment for FY 2019-20 | AY 2020-21.

Where tax is deducted by the office of the Government:

| S. No. | Particulars | Due Date |

| 1. | Tax Deposited without Challan | Same Day |

| 2. | Tax Deposited with Challan | 7th of next month |

| 3. | Tax on perquisites opted to be deposited by the employer | 7th of next month |

In any other case :

| S. No. | Particulars | Due Date |

| 1. | Tax Deductible in March | 30th April of next year |

| 2. | Other Months | 7th of next month |

Where tax is collected by the office of the Government:

| S. No. | Particulars | Due Date |

| 1. | Tax Collected without Challan | Same Day |

| 2. | Tax Collected with Challan | 7th of next month |

In any other case :

Tax collected will be deposited upto 7th of next month

| Quarter | Quarter Period | TDS Return Due Date | TCS Return Due Date |

|---|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July, 2019 | 15th July, 2019 |

| 2nd Quarter | 1st July to 30th September | 31st Oct, 2019 | 15th Oct, 2019 |

| 3rd Quarter | 1st October to 31st December | 31st Jan, 2020 | 15th Jan, 2020 |

| 4th Quarter | 1st January to 31st March | 31st May, 2020 | 15th May, 2020 |

Form 16A should be issued within 15 days from the due date for furnishing the statement of tax deducted at source.

| Quarter | Quarter Period | TDS Return Due Date | FORM 16 A Due Date |

|---|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July, 2019 | 15th Aug, 2019 |

| 2nd Quarter | 1st July to 30th September | 31st Oct, 2019 | 15th Nov, 2019 |

| 3rd Quarter | 1st October to 31st December | 31st Jan, 2020 | 15th Feb, 2020 |

| 4th Quarter | 1st January to 31st March | 31st May, 2020 | 15th June, 2020 |

Form 16 is issued for cumulative period i.e. 1st April to 30th June and therefore Due date for issuing Form 16 for FY 19-20 would be 15th June 2020.

| SECTION | NATURE OF DEFAULT | INTEREST SUBJECT TO TDS/TCS AMOUNT | PERIOD FOR WHICH INTEREST IS TO BE PAID |

| 201A | Non deduction of tax at source, either in whole or in part | 1% per month | From the date on which tax deductable to the date on which tax is actually deducted |

| After deduction of tax, non payment of tax either in whole or in part | 1.5% per month | From the date of deduction to the date of payment |

Under Section 201(1A) for late deposit of TDS after deduction, you have to pay interest. Interest is at the rate of 1.5% per month from the date at which TDS was deducted to the actual date of deposit. Note, that this is to be calculated on a monthly basis and not based on the number of days i.e. part of a month is considered as a full month.

For example, say that your payable TDS amount is Rs 5000 and the date of deduction is 11th January. Say you pay TDS on 25th May. Then the interest you owe is Rs 5000 x 1.5% p.m. x 5 months = Rs 375.

“Month” has not been defined in the Income Tax Act, 1961. However, in a number of High Court cases, it has been mentioned that it should be considered as a period of 30 days and not as an English calendar month.

This amount is to be paid from the date at which TDS was deducted, not from the date from which TDS was due.

For example, let the due date of TDS payment be 7th June and you have deducted TDS on 11th May. Say you have not deposited TDS by 7th June. Then you will be required to pay interest starting from 11th May and not 7th June.

Also consider the case in which you deposit tax one month after the due date. Say you have deducted TDS on 1st July. Then the due date is 7th august. Now say you deposit tax on 8th August (i.e. one day after the due date). Then interest is applicable from 1st July to 8th August i.e. for a period of 2 months. You now have to pay interest of 1.5% p.m. x 2 months = 3%

Penalty (Sec 234E): Deductor will be liable to pay way of fee Rs.200 per day till the failure to pay TDS continues. However penalty should not exceed the total amount of TDS deducted for which statement was required to be filed.

Penalty (Sec 271H): Assessing officer may direct a person who fails to file the statement of TDS within due date to pay penalty minimum of Rs.10,000 which may extended to Rs.1,00,000.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"