CA Pratibha Goyal | Apr 4, 2020 |

TDS Rate Chart For Assessment year 2021-22 or Financial Year 2020-21 & Threshold for no deduction of TDS

The Article contains TDS Rate Chart for Assessment year 2021-22 or Financial Year 2020-21. Refer TDS chart for AY 2021-22 in pdf download, TDS rate chart for FY 2020-21 pdf, TDS rate chart FY 2020-21, TDS rates for FY 2020-21, TDS rate chart pdf for your compliances.

In this article we shall discuss other compliances related to TDS like: TDS provisions Income Tax, Income tax Provision for TDS, RATE OF TAX DEDUCTION AT SOURCE (TDS), TIME OF DEPOSIT TDS, TDS Payment, TDS Return forms, DUE DATE OF SUBMISSION OF TDS RETURN, MODE OF FURNISHING RETURNS OF TDS, Certificate of TDS, Time limit for issuing TDS certificate, CONSEQUANCE ON DEFAULT IN TDS PROVISIONS

You May Also Refer: Corporate Compliance Calendar for the Month of April 2020

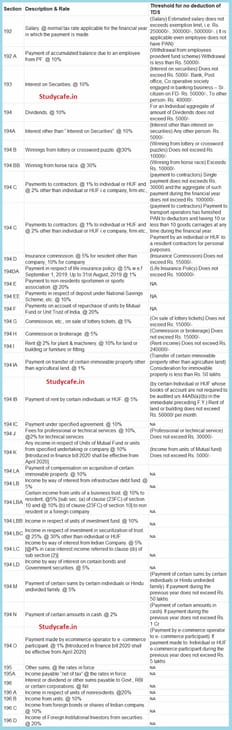

| Section | Nature of Income | Rate of TDS applicable for the period | Threshold Limit for deduction tax | |

| 01-04-2020 to 13-05-2020 | 14-05-2020 to 31-03-2021 | |||

| 193 | Interest on Securities | 10% | 7.50% | 0 |

| 194 | Dividend | 10% | 7.50% | Rs. 5,000 in case of Individual |

| 194A | Interest other than interest on Securities | 10% | 7.50% | Rs. 5,000 to Rs. 50,000 |

| 194C | Payment to Contractors | 1%: If deductee is an individual or HUF | 0.75%: If deductee is an individual or HUF | Single payment : Rs. 30,000 |

| 2%: In any other case | 1.50%: In any other case | Aggregate payment: Rs. 100,000 | ||

| 194D | Insurance Commission | 10%: If deductee is domestic Company | 7.50%: If deductee is domestic Company | 15,000 |

| 5%: In any other case | 3.75%: In any other case | |||

| 194G | Commission and other payments on sale of lottery tickets | 5% | 3.75% | 15,000 |

| 194H | Commission and Brokerage | 5% | 3.75% | 15,000 |

| 194-I | Rent | 10%: If rent pertains to hiring of immovable property | 7.50%: If rent pertains to hiring of immovable property | 2,40,000 |

| 2%: If rent pertains to hiring of plant and machinery | 1.50%: If rent pertains to hiring of plant and machinery | |||

| 194-IB | Payment of Rent by Certain Individuals or HUF | 5% | 3.75% | 50,000 |

| 194J | Royalty and Fees for Professional or Technical Services | 2%: If royalty is payable towards sale, distribution or exhibition of cinematographic films | 1.50%: If royalty is payable towards sale, distribution or exhibition of cinematographic films | Director’s fees: Nil |

| 2%: If recipient is engaged in business of operation of call Centre | 1.50%: If recipient is engaged in business of operation of call Centre | Others: Rs. 30,000 | ||

| 2%: If sum is payable towards fees for technical services (other than professional services) | 1.50%: If sum is payable towards fees for technical services (other than professional services) | |||

| 10%: In all other cases | 7.50%: In all other cases | |||

| 194M | Payment to contractor, commission agent, broker or professional by certain Individuals or HUF | 5% | 3.75% | 50 lakhs |

| 194N | Cash withdrawal | 2%: In general if cash withdrawn exceeds Rs. 1 crore | 1.50%: In general if cash withdrawn exceeds Rs. 1 crore | If a person defaults in filing of return: 20 lakhs If no default is made in filing of return: Rs 1 crore |

| 2%: If assessee has not furnished return for last 3 assessment years and cash withdrawn exceeds Rs. 20 lakhs but does not exceed Rs. 1 crore | 1.50%: If assessee has not furnished return for last 3 assessment years and cash withdrawn exceeds Rs. 20 lakhs but does not exceed Rs. 1 crore | |||

| 5%: If assessee has not furnished return for last 3 assessment years and cash withdrawn exceeds Rs. 1 crore | 3.75%: If assessee has not furnished return for last 3 assessment years and cash withdrawn exceeds Rs. 1 crore | |||

Following Amendements in TDS Provisions have been introduced by Finance Act 2020:

Amendment of Section 194 whereby TDS will now be deducted on complete dividend, as dividend distribution tax (DDT) has been abolished and dividend will now be taxed in the hands of shareholders/unit holders.

Amendment of Section 194J, whereby TDS Rate on Technical services to be reduced to 2% from current 10%.

Introduction of Section 194 O where by TDS to be deducted by E-Commerce operator for sale of goods or provision of service facilitated by it through its digital or electronic facility or platform.

Introduction of Section 194K where by person responsible for paying to a resident any income in respect of units of a Mutual Fund would deduct TDS.

Kindly Refer: TDS Rate Chart for FY 2020-21 or TDS Rates for AY 2021-22

If recipient not furnish his/its PAN Tax shall be deducted at the normal rate or at the rate of 20% , whichever is higher.

| Taxpayer | Date of Deposit |

| Is office of the Govt. and tax is paid without production of income tax challan. | On the same day on which tax is deducted |

| Is office of the Govt. and tax is paid with production of income tax challan. | On or before 7 days from the end of month in which tax is deducted |

| Tax is deducted by a person other than office of Government | On or before 7 days from the end of month in which tax is deducted Income paid or credited in the month of March: Tax should be deposited by April 30. |

| Tax is deducted by a person other than office of Govt. and The AO has permitted quarterly deposit of tax deducted u/s 192, 194A, 194D and 194H | Tax Quarter ending: June 30: By July 7 |

| Tax is deducted by a person u/s 194-IA (Challan – 26QB) Tax is deducted u/s 194-IB (Challan- 26QC) | Within 30 days from the last date of month in which tax is deducted |

How to make TDS Payment

You May Also Refer: TCS Rate Chart For Assessment year 2021-22 or Financial Year 2020-21

| Situation | Form |

| Tax deduction from Salary under section 192 | In form No. 24Q |

| Tax deduction when deductees are non-resident, foreign company, and persons who are resident but not ordinarily resident | In form No. 27Q |

| Tax deduction under section 194-IA | In form no. 26QB |

| Tax deduction under section 194-IB | In form no. 26QC |

| Tax deduction in any other case | In form no. 26QC |

| Quarter ending | Due date of TDS Return |

| Jun-30 | Jul-31 |

| Sep-30 | Oct-31 |

| Dec-31 | Jan-31 |

| Mar-31 | May-31 |

| Form No. of Certificate | Type of Certificate | Time-limit for issue of certificate |

| 16 | From Salary | Annual, on or before 15 June |

| 16B | U/S 194-IA | Within 15 days of furnishing challan 26QB |

| 16C | U/S 194-IB | Within 15 days of furnishing challan 26QC |

| 16A | Other than Salary | Within 15 days from the due date of furnishing quarterly TDS return |

| For the Quarter ending | Form No 16A |

| Jun-30 | Aug-15 |

| Sep-30 | Nov-15 |

| Dec-31 | Feb-15 |

| Mar-31 | Jun-15 |

| Default | Penalty |

| Failure to deduct and pay tax deducted at source under section 192 to 196C [Sec 201(1A)] | Tax with interest shall be payable @ 1% from the date on which actually deductible and to the date on which actually deducted. |

| @ 1.5% from the date on which tax was actually deducted and to the date on which tax is actually paid. | |

| Failure in furnish TDS return within stipulated time [U/S 234E] | Rs. 200 per day and shall not exceed the amount of tax deducted |

| Penalty for failure to furnish quarterly TDS return [271H] | Rs. 10000/- to Rs. 100000/- |

U/S 40(a)(i):- 100% expenditure shall be not allowed to deduct from income chargeable under the “profits and gains from business or profession”, if any assessee fail to deduct tax at source or fail to deposit TDS deducted from interest, royalty, fee for technical services payable outside India, or in India to a non-resident, not being a company or a foreign company.

U/S 40(a)(ia):- 30% expenditure shall be not allowed to deduct from income chargeable under the “profits and gains from business or profession”, if any assessee fail to deduct tax at source or fail to deposit TDS deducted to a resident

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"