jay081767 | May 6, 2020 |

Time of Supply of goods under GST summary of GST Provisions | Point of Taxation

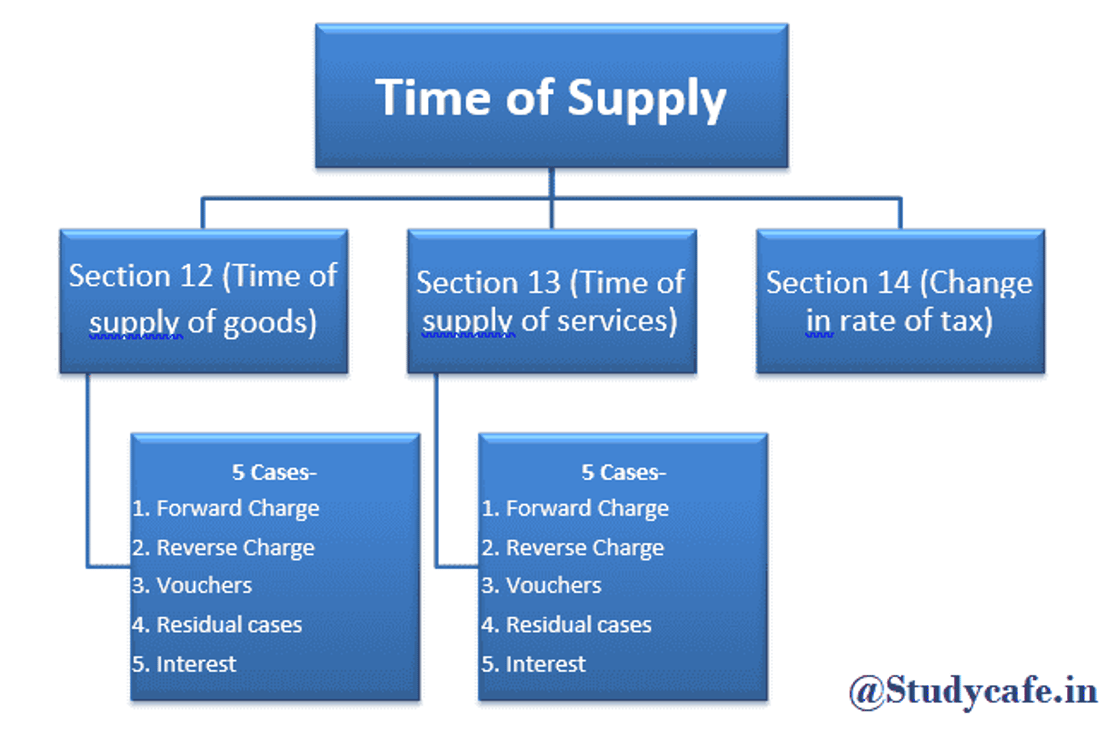

One of the most vital concepts that need to be understood for charge of GST is time of supply. After determining that a particular supply is taxable next thing that needs to be determined is its time of supply. Time of supply is the point of time when liability to pay tax arise. On this basis due date for tax payment is determined. Provisions pertaining to time of supply have been given as follows in CGST Act, 2017-

As given in above diagram time of supply can be studied in 5 cases which can be explained as follows.

a) Forward Charge(Section 12(2))- Where supplier is liable to pay tax, time of supply will be earlier of following-

• Date of issue of invoice or last date on which invoice ought to have been issued;

OR

• Date of receipt of payment by the supplier

But government vide notification no. 66/2017 specified that tax on outward supply need not to be paid on advance in relation to supply of goods.

“Date of receipt of payment” means earlier of following-

• Payment date recorded in the books of supplier; OR

• Date on which payment is credited in bank

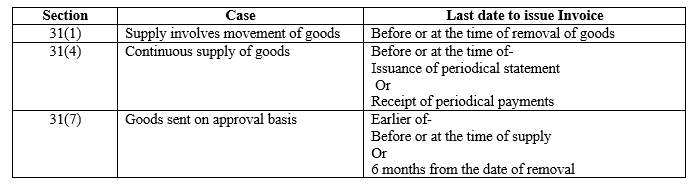

“Last date on which invoice ought to have been issued”

b) Reverse Charge (Section 12(3))- Where tax is payable by the recipient of supply, time of supply is earlier of following-

• Date on which goods are received; or

• Date on which payment is recorded in the books of recipient of goods;

• Date of debit of payment in bank account of recipient of goods;

• 31st day from the issue of invoice by the supplier

If above dates are not available and determination of time of supply is not possible from above then time of supply will be date on which goods are recorded in the books of recipient of supply.

c) Supply of vouchers (Section 12(4))- Time of supply of vouchers will be-

• If supply is identifiable at the time of issue of voucher- Date of issue of voucher;

• If supply is not identifiable at the time of issue of voucher- Date of redemption

d) Residual Cases (Section 12(5))- If situation does not fall in any of the above cases then time of supply will be-

• Where a periodical return is filed- Date on which return is required to be filed;

• Other Cases- Date on which GST is filed

e) Interest on delayed payment of consideration (Section 12(6))- In case where interest or late fees is paid with the consideration of supply then time of supply for that interest/fees will be the date of payment of such interest or fees.

Like in case of services also following 5 cases are there for time of supply.

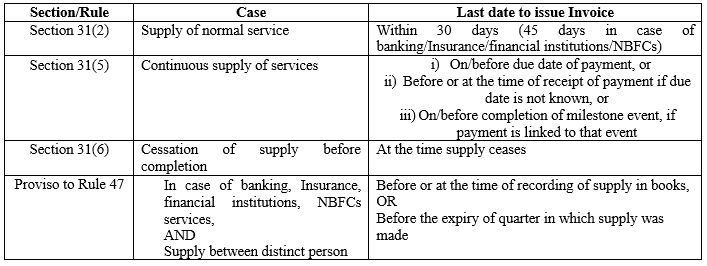

a) Forward Charge (Section 13(2))- Time of supply where tax needs to be paid by the supplier of services will be earliest of following-

i. If invoice is issued within prescribed time- Earlier of following- Date of issue of invoice;

OR

Date of receipt of payment

ii. If invoice is not issued within prescribed time- Earlier of following- Date of provision of services;

OR

Date of receipt of payment

iii. The date on which recipient shows receipt of service in his books of accounts, in a case where the provisions of (i) and (ii) do not apply.

“Date of receipt of payment” means earlier of following- Payment date recorded in the books of supplier;

OR

Date on which payment is credited in bank

Time limit to issue invoice-

Services from associated enterprise located outside India: Time of supply will be earlier of following-

• Date of payment; OR

• Date of recording of supply in the books of accounts of recipient

b) Reverse Charge (Section 13(3))- Time of supply will be earlier of the following-

• “Date of payment”

• 61st day from the date of issue of invoice

If not possible to determine from above clauses then time of supply will be date on which supply was recorded in the books of recipient.

“Date of payment” will be the earlier of the following-

• Date on which payment is recorded in the books of recipient of service; OR

• Date on amount is debited in the bank

c) Supply of vouchers (Section 13(4))- Time of supply of vouchers will be-

• If supply is identifiable at the time of issue of voucher- Date of issue of voucher;

• If supply is not identifiable at the time of issue of voucher- Date of redemption

d) Residual Cases (Section 13(5))- If situation does not fall in any of the above cases then time of supply will be-

• Where a periodical return is filed- Date on which return is required to be filed;

• Other Cases- Date on which GST is filed

e) Interest on delayed payment of consideration (Section 13(6))- In case where interest or late fees is paid with the consideration of supply then time of supply for that interest/fees will be the date of payment of such interest or fees.

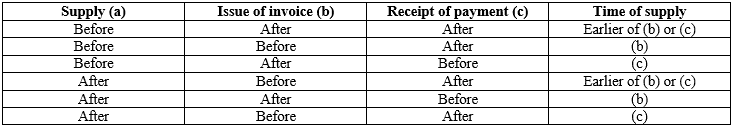

Time of supply in this case will depend on whether following 3 factors occurred before or after change in rate of tax-

• Supply of goods or services

• Issue of invoice

• Date of receipt of payment

“Date of receipt of payment” means earlier of following-

• Payment date recorded in the books of supplier; OR

• Date on which payment is credited in bank

If payment is credited in banks after 4 working days from the date of change in rate of tax, date of credit in bank will be the date of receipt of payment.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"