Term Insurance offers financial coverage to family members or nominees in the event of an unfortunate death. Selecting the best Term Insurance provider is essential if you want to protect your family's finances.

AASHISH KUMAR JHA | Sep 17, 2023 |

Top 10 Term Insurance Companies in India: Know about their Details, Annual Premiums, and Other Details

Top Ten Term Insurance Companies in India: No one knows about the future and no one can predict life with certainty. This uncertainty about life poses brings out fear in a person’s life for their loved ones. They start thinking about who will care for their loved ones when they are not in this world. So there is a very famous saying, it is always better to get insured. Insurance is assurance, as it assures you that your loved ones will be taken care of financially and they won’t have to be at the pity of anyone. One such insurance that will secure the future of your loved ones is Term Insurance.

Term life insurance is a form of life insurance policy that offers protection for a predetermined “term” of years, or a certain amount of time. A death benefit will be paid if the insured passes away within the time frame stated and the policy is “in force,” or active. Term insurance is a pure financial protection strategy that provides for the needs of the family financially in the event of the policyholder’s untimely passing. In the event of unfavourable circumstances, the term insurance plan’s designated beneficiary will receive a lump sum payment called the death benefit. If the policyholder lives past the insured period, they can choose to keep their coverage in place or forego it totally.

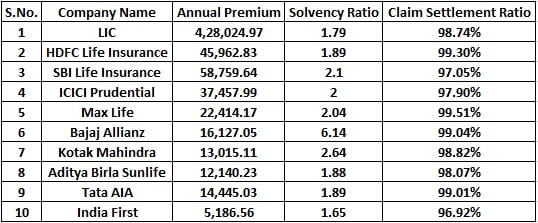

While making such a big decision, it is plausible to be cautious. You can’t just simply invest money anywhere without knowing its credibility and reliability. Selecting the top-term insurance provider is essential if you want to protect your family’s finances. So, in this article, we will walk you through the top 10 best Term Insurance Companies in India. We will also let you know about their annual premiums, claim settlement ratio, and solvency ratio.

Top 10 Term Insurance Companies in India

1) Life Insurance Corporation of India (LIC)

The oldest insurer in our nation’s insurance market is Life Insurance Corporation of India (LIC). One of the biggest insurance groups in India and a state-owned investment company, it was founded in 1956 and provides a variety of insurance products to its clients. The organization has a sizable workforce that works in numerous cities and towns across the nation.

2) HDFC Life Insurance

A joint venture between Standard Life Plus and Housing Development Financial Corporation Ltd. is HDFC Life Insurance Company India. It was established in 2000. Currently, the company’s portfolio includes 38 individual goods and 13 group products. The company offers a variety of individual and group insurance options, including pension plans, saving and health plans, protection plans, child plans, and women’s plans, in order to fulfil the diverse demands of its customers.

3) SBI Life Insurance

The State Bank of India (SBI), the country’s largest bank, and BNP Paribas Cardif, a French international bank and financial services provider, have joined forces to create SBI Life Insurance Company. SBI Life was first established as a bancassurance company and has now grown to include other distribution channels. The business has consistently experienced year-over-year growth because of a winning combination of top-notch customer service and cutting-edge products.

4) ICICI Prudential

A partnership between Prudential Plus and ICICI Bank Ltd. has resulted in the creation of ICICI Prudential Life Insurance Company of India. The business started operating in December 2000 as India’s first private provider of life insurance. The company has held the top spot among private life insurers in the nation for more than ten years. ICICI Prudential Life Insurance offers a variety of solutions to meet the needs of customers at various life stages, enabling them to accomplish their long-term objectives.

5) Max life

Max Life Insurance Company is one of the top insurance companies in India. It was founded in the year 2000. The main objective of this life insurance firm is to provide its customers with adequate financial stability. As a result, the insurance provider offers a number of life insurance plans, including ones for children, retirement savings, protection, and investments, in addition to other group solutions. All of the insurance options provided by Max Life are jam-packed with benefits and useful features tailored to each customer’s needs.

6) Bajaj Allianz

A joint venture between Bajaj Finserv Limited and the European financial services firm Allianz SE produced Bajaj Allianz Life Insurance. This life insurance firm, which was established in 2001, offers a one-stop shop for customers’ insurance needs and aids them in accomplishing their financial objectives by offering them a wide choice of products, from term insurance to group insurance. The business offers a wide variety of products that are specially made to meet the needs of the clients and offers them cutting-edge services.

7) Kotak Mahindra

One of the top and fastest-growing life insurance businesses in India is Kotak Mahindra Life Insurance Company Limited. One of the best insurance providers in India is this one. It is a partnership between Kotak Mahindra Bank Limited and Old Mutual Limited, a pan-African investing, savings insurance, and banking company. To meet the needs of business and individual investors, it provides a variety of financial solutions.

8) Aditya Birla Sunlife

Aditya Birla Capital Limited’s subsidiary, the Aditya Birla Sun Life Insurance Company, was founded in 2000. The Aditya Birla Sun Life Insurance Company was created as a result of the combination of the Aditya Birla Group and Sun Life Financial, a well-known provider of financial services in Canada. This insurer, known as Birla Sun Life, stands out among India’s top insurance providers by providing a broad range of insurance solutions that cover protection, pension, savings, and cutting-edge goods.

9) Tata AIA

The AIA Group and TATA Sons joined together to create and introduce the TATA AIA Life Insurance Company. The business offers a wide variety of insurance products to individuals, groups, and corporate insurance purchasers using a consumer services strategy. The company offers a variety of plans in a number of market categories, including group plans, kid plans, wealth plans, protection plans, saving plans, and microinsurance plans.

10) India First

Since its founding in 2009, IndiaFirst Life Insurance Company has been dedicated to providing excellent customer service. The collaboration between the Bank of Baroda, Andhra Bank, and the UK investment brand (Legal & General Group) resulted in the formation of the youngest life insurance firm.

After getting the brief information about the top ten best-term insurance companies, Let us have a look into their financial aspects. The annual premiums, claim settlement ratio, and solvency ratio of the above-mentioned term insurance companies are depicted hereunder:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"