Deepak Gupta | Nov 18, 2018 |

GSTR 9:Understanding Annual Return and GST Audit, gst annual return format, GSTR 9C: Reconciliation Statement & Certification, gstr 9c pdf, gstr 9c notification, form gstr 9c format in excel, form gstr-9c pdf, gst audit form 9c in excel, gstr 9c format pdf, form gstr 9c in excel, gst audit format in excel, gst annual return format, gst annual return format in excel, gst annual return pdf, gst annual return format pdf, annual return under gst, gstr 9 annual return, annual return under gst pdf, gstr 9 annual return format in excel, gst annual return format in excel, gst annual return format pdf, gst annual return pdf, annual return under gst, gst annual return due date, gst annual return notification, gstr 9 format, Is there any annual return in GST, What is the due date for filing the GST returns, What is Gstr 9c, What is procedure of GST, Can I pay GST annually, difference between Annual Return and GST Audit, Complete Analysis of Annual Return and GST Audit,Can GST annual returns be revised,Can GST returns be revised

GSTR 9: Understanding Annual Return and GST Audit :

The implementation of GST has brought a major shift in structure of Indirect Taxes. One of the very important compliance in GST regime is Filling of Annual Return and Conducting GST Audit. Although Annual Return and GST Audit has givenan opportunity to the professionals but they are responsibility as well which are required to be deliberated very carefully.

Understanding Annual Return and GST Audit

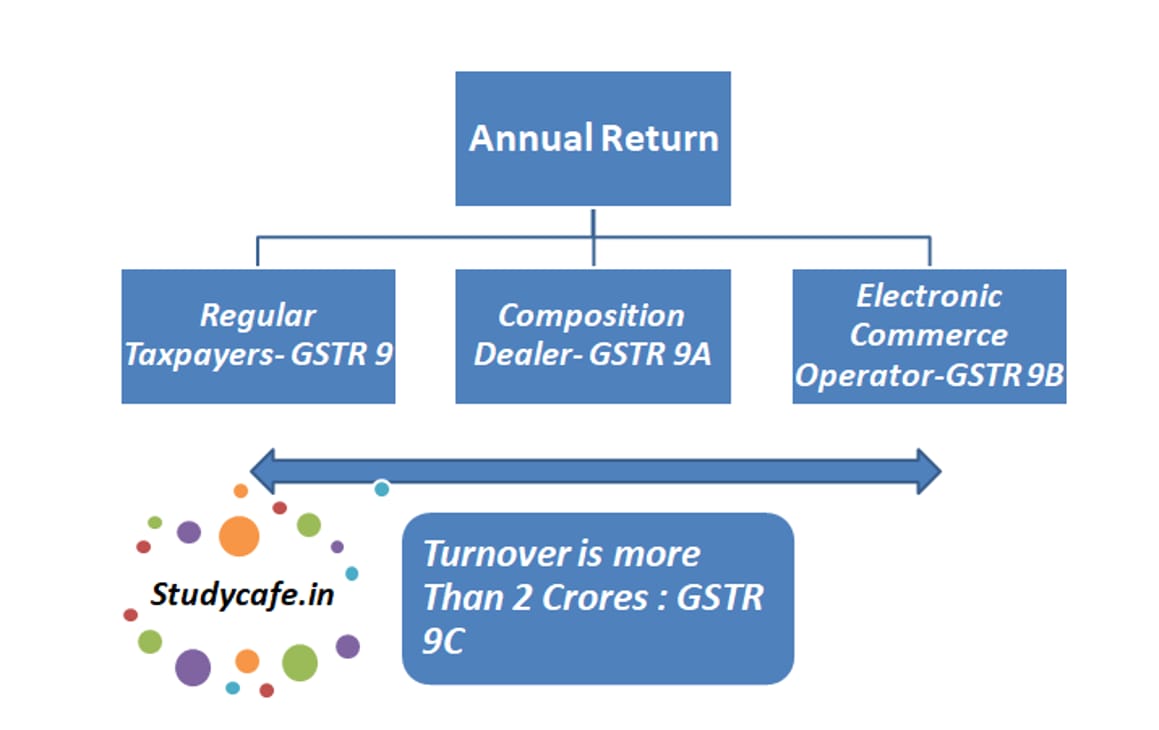

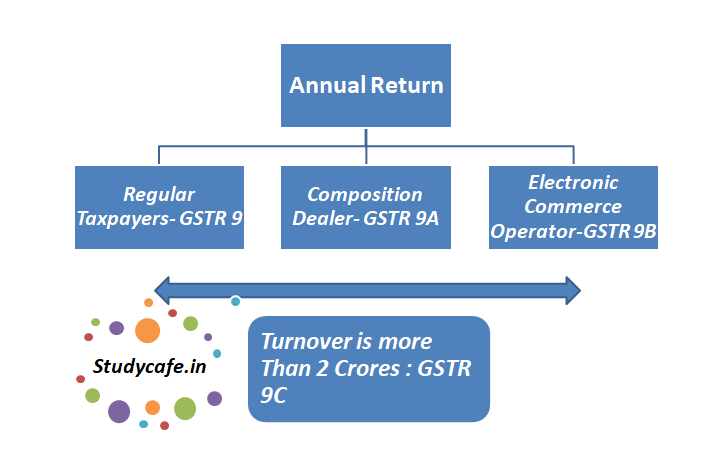

Before Filing Annual Return or Conducting GST Audit, professionals are required to carefully study the New Forms GSTR9 /GSTR9A /GSTR9Band GSTR9C. Through this article we have tried to draw a comparison between Annual Return and GST Audit for simple and quick Understanding.

| Kindly note that For FY 17-18 GST annual return for electronic commerce operator or GSTR 9B has not been notified. Also the provisions of TDS and TCS were notified after March 2018, so it is quite clear that no GST 9B is required to be filed for FY 17-18 |

| Annual Return or GSTR9/GSTR9A/GSTR9B | Form GSTR9C* for GST Audit |

| Prescribed in terms of section 44 CGST Act read with Rule 80 | Prescribed in terms of Section 35(5) read with section 44 CGST Act and Rule 80(3) |

| GSTR9 is divided into Six Parts and GSTR9A is divided into Five Parts | Form GSTR9C is divided in to two parts Part A is Reconciliation Statement which is divided into Five Parts Part B is Certification by the professional. Professional certifying the Reconciliation Statement may or may not be the one who has Audited Accounts of the Assessee. |

| Annual return is kind of consolidation of previous returns filed by the Taxpayer | FORM GSTR9C involves reconciliation, audit and certification. |

| To be filed by all registered Persons except : Casual Taxable Person Input service distributors Non-resident taxable persons Persons paying TDSunder section 51 of CGST Act Person Collecting TCS under Section 52 of CGST Act | Tax payers who are required to file Annual Return and there aggregate turnover in a financial year exceeds Rs 2 Crores require to file Form GSTR9C |

| No need to annex financials | Financials to be annexed |

*Reader may please note thatForm GSTR9C is also a specific kind of annual return only.

GSTR9 is filled before the GSTR9C and thesereturns can only be filed once for a financial year. There is no option to revise this return.

The Due date of submitting Annual Return and GST Audit is 30th June 2019.Professionals should take due care of this date and do this compliance on time to avoid any penalty or litigation.

(The Author of this Article can be reached at [email protected])

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information.In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information. Please refer your consultant before relying on the provisions of this article.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"