Deepak Gupta | Apr 20, 2017 |

Why seeing Form 26AS is a must before filing tax return

Many times you might have wondered how much tax you have paid in aggregate to the government for the financial year in question To know answer of this question have A quick look at Form 26AS (from traces website ). Form 26AS will give you a clear picture of all the tax that has been deducted against your PAN number and paid to the government. Form 26AS is one of the crucial documents that a taxpayer must seebefore filing one’s tax returns for the year.

“One of the most important documents needed for filing income tax return is Form26AS. Just before filing of income tax returns, a taxpayer can know exactly how much tax has been deducted at source for the relevant financial year

The form contains details of all the taxes deducted and deposited by the deductor or paid by the taxpayer himself. It shows all tax payments like advance tax, self-assessment tax and tax deducted at source.

“In case the tax deducted shown in your TDS certificates (Form 16 or 16A) is not reflecting in your Form 26AS it means that the deductor has either not paid it to the government or it may be on account of an error or delay in filing TDS returns by the deductor. In such a case you can follow up with the deductor and get it corrected.

Besides being a single-source summarized document to trace your tax-related transactions, Form 26AS also contains the details of your other financial transactions reported by various agencies via AIR reporting. Thus, it helps you in preparing your returns quickly and in the most correct manner. “If there is any discrepancy in your TDS or other tax credit claims based on physical Form 16 or 16A or tax challans, which does not match with your 26AS credits, the tax department may deny those claims and will raise the tax demand,”

Also, any discrepancy between Form 26AS and claims by the taxpayer may result in refund claims being withheld. “In case of discrepancy, a demand notice may be issued by the Income Tax Department if such credit has been claimed by the taxpayer which did not reflect in Form 26AS. Unless the deductor correctly uploads the details of tax deductions, the deductee shall not be given the credit of such taxes.

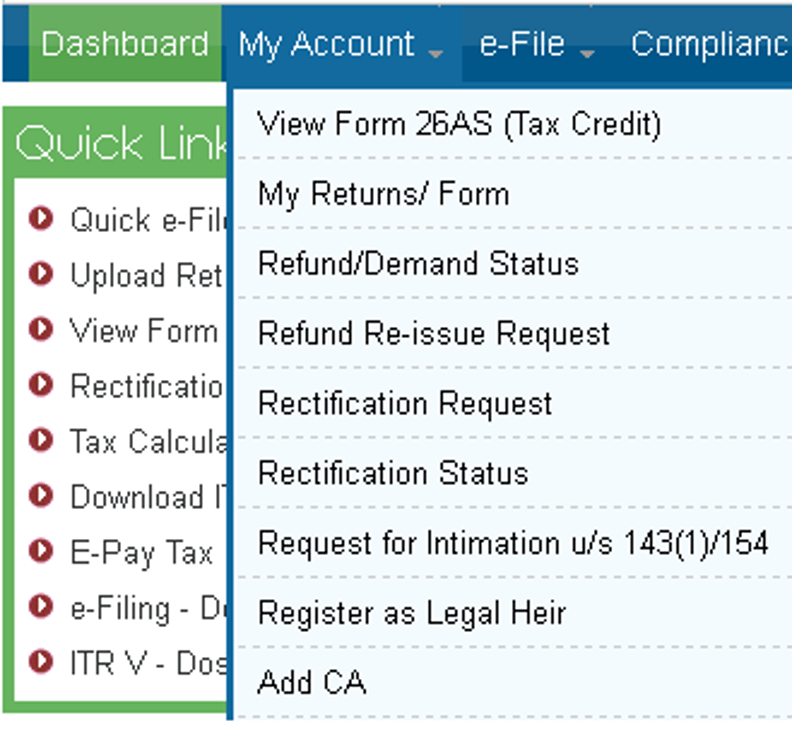

There are two ways to access Form26AS:

a)The more common way of doing so is by registering with TRACES (TDS Reconciliation Analysis and Correction Enabling System). Listed below are the steps to view the form;

b)The other way of viewing Form 26AS is through a net banking facility. However, Form 26AScan be viewed only if the PAN number is linked to the bank account. However, till now only select banks are authorized to provide Form26AS.

ITR forms in Excel Utility For F.Y 2016-17 (A.Y 2017-18) Released

Why seeing Form 26AS is a must before filing tax return, 26 as, 26as, itr, income tax return, income tax return filing

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"