TCS Rate of 5% is applicable upto 30th June 2023. TCS Rate of 20% is applicable w.e.f. 1st July 2023.

CA Pratibha Goyal | May 18, 2023 |

20% TCS on Credit Card Transactions: Understanding Key Points and Implications

As per FEMA Notification Number G.S.R. 369E dated 16th May 2023, International Credit Card spending outside India would come under the Liberalized Remittance Scheme (LRS).

Let’s understand how this is related to the Collection of TCS.

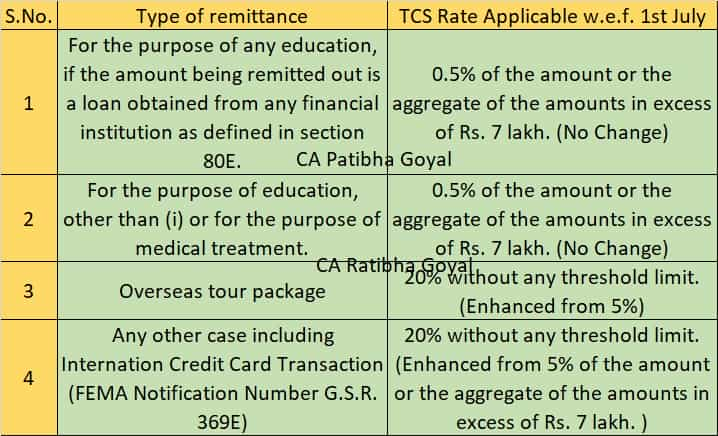

As per changes bought by Finance Act 2023 (Section 206C(1G)), TCS Rates on foreign remittance through the Liberalised Remittance Scheme and on the sale of overseas tour packages. was enhanced as follows:

Now before 16th May, 2023, Use of International Credit Card while outside India was not covered by Liberalised Remittance Scheme. But now same is covered by the Scheme, which means it is covered by Section 206C(1G) of Income Tax Act.

TCS Rate of 5% is applicable upto 30th June 2023. TCS Rate of 20% is applicable w.e.f. 1st July 2023.

This Section is applicable on:

(a) an authorized dealer, who receives an amount, for remittance from a buyer, being a person remitting such amount under the Liberalised Remittance Scheme of the Reserve Bank of India;

(b) Seller of an overseas tour program package, who receives any amount from a buyer, being the person who purchases such package.

Deductor:

In terms of Compliance, yes cost will be enhanced.

Deductee:

The deductee can claim credit of the TCS in his Income Tax Return (ITR). Deductee may face cashflow issues due to the collection of TCS.

The provisions of Section 206C(1G) shall not apply if the buyer is:

(i) liable to deduct tax at source under any other provision of this Act and has deducted such amount;

(ii) the Central Government, a State Government, an embassy, a High Commission, a legation, a commission, a consulate, the trade representation of a foreign State, a local authority as defined in the Explanation to clause (20) of section 10 or any other person as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"