Deepak Gupta | Jan 26, 2022 |

5% GST applicable on supply of pressure/non pressure tight cables for use in submarine supplied to Ministry of Defense

M/s. Radiant Corporation private Limited are supplying pressure tight cables and non-pressure tight cables and special cables for use in the S4 submarine by the Defense Machinery Design Establishment(DMDE), Ministry of Defense, Government of India. The applicant is desirous to clarify the goods supplied by them are eligible for a concessional rate of tax under Sl.No.252 read with Sl.No.250 of Schedule I in Notification No. 01/2017 dated: 28.06.2017.

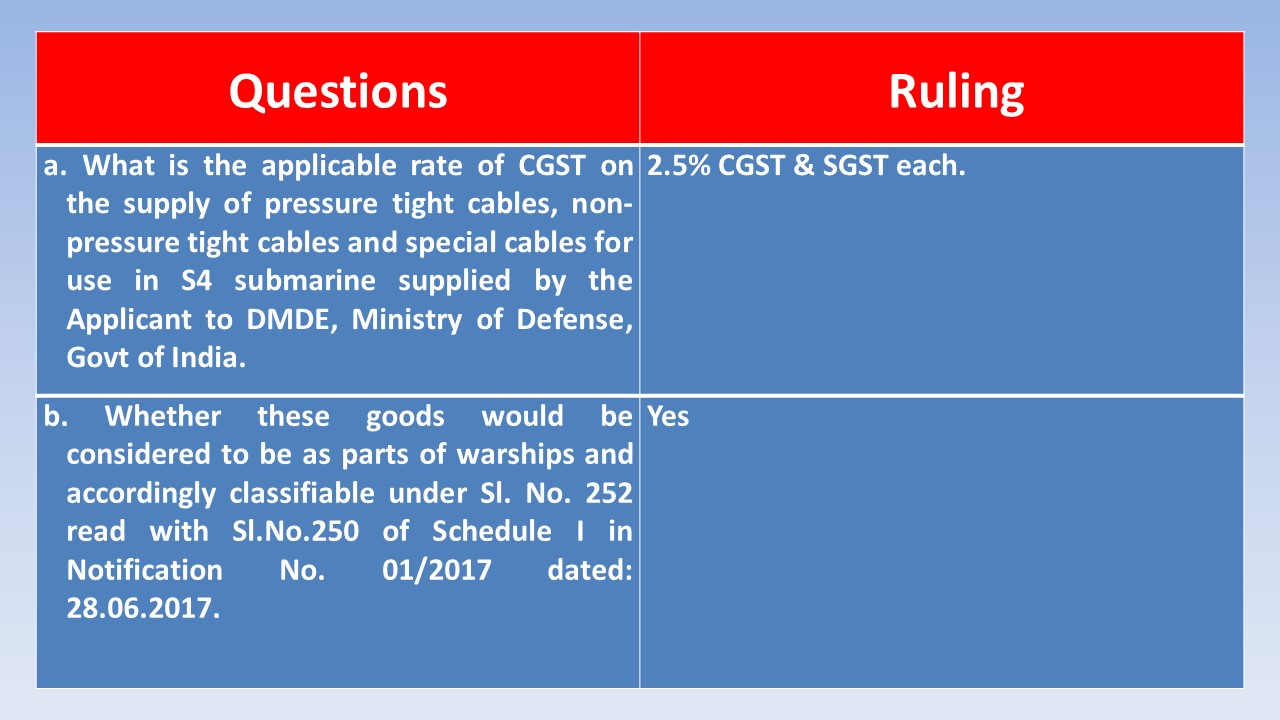

a. What is the applicable rate of CGST on the supply of pressure tight cables, non-pressure tight cables and special cables for use in S4 submarine supplied by the Applicant to DMDE, Ministry of Defense, Govt of India.

b. Whether these goods would be considered to be as parts of warships and accordingly classifiable under Sl.No.252 read with Sl.No.250 of Schedule I in Notification No. 01/2017 dated: 28.06.2017.

In the present case, the applicant has submitted certain utilization certificates from the Naval authorities. The certificates categorically state that the goods supplied are used “as stores for consumption onboard of Indian Navy Ship” (Certificate dated: 29.08.2016 & 08.11.2016). Similarly, in the certificate dated: 24.02.2017 it is stated that they are exclusively for use onboard Indian Naval Ships. In the certificate dated: 30.03.2017 it is stated that these goods are required for ATV program.

When the above (2) evidences are read in tandem, it is clear that the appellant is supplying special types of cables to the Naval authorities.

Therefore the supplies made by the applicant to Defence Machinery Design Establishment (DMD) for the purpose of use in warship building of Indian Navy will qualify for the concessional rate of tax of 5% under CGST & SGST.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"