Studycafe | Dec 6, 2019 |

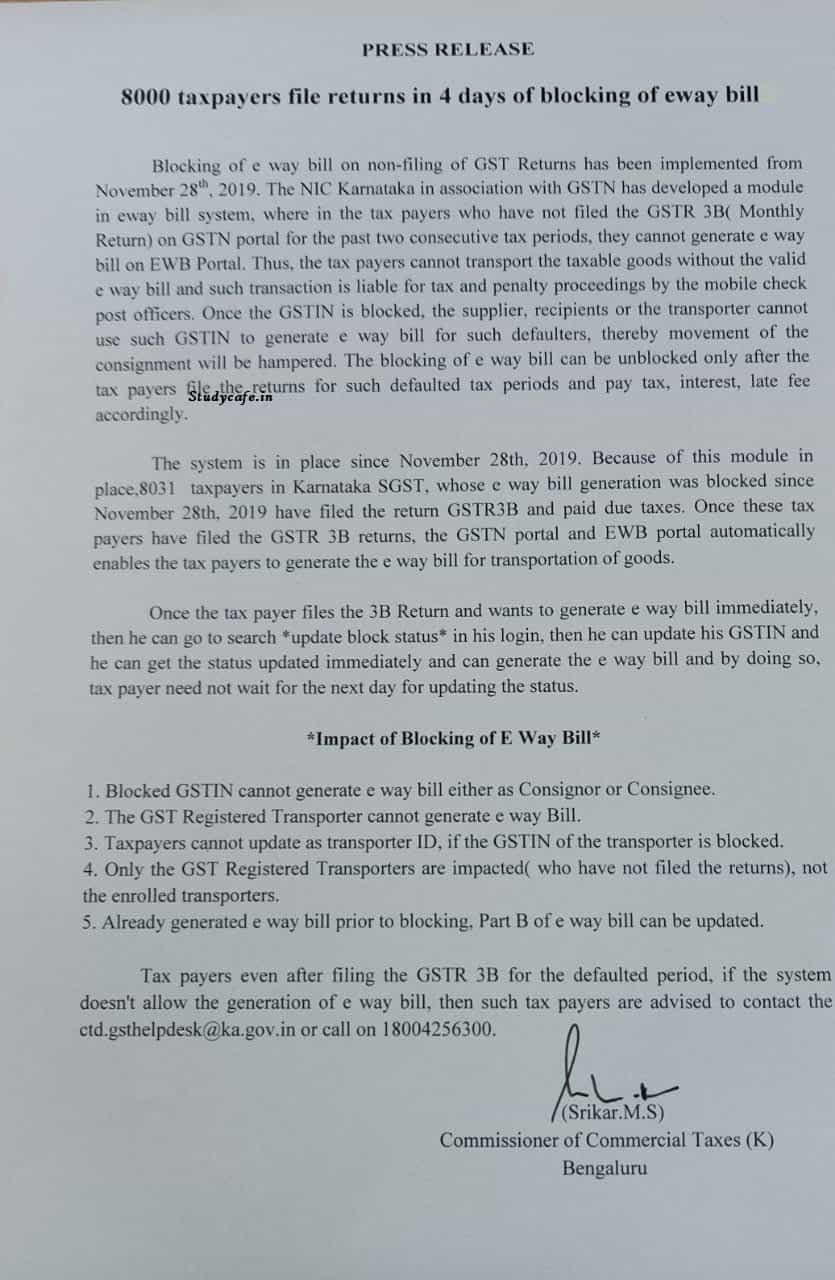

8000 taxpayers file returns in 4 days of blocking of Eway bill

Blocking or eway bill on non-filing of GST Returns has been implemented from November 28th. 2019. The NIC Karnataka in association with GSTN has developed a module in eway bill system. where in the tax payers who have not filed the GSTR 3B (Monthly Return) on GSTN portal for the past two consecutive tax periods. they cannot generate e way bill on EWB Portal. Thus the taxpayers cannot transport the taxable goods without the valid eway bill and such transaction is liable for tax and penalty proceedings by the mobile check post offices. Once the GSTIN is blocked, the supplier. recipients or the transporter cannot use such GSTIN to generate e way bill for such defaulters. thereby movement of the consignment ,will be hampered. The blocking of e way bill can be unblocked only after the taxpayers file the returns for such defaulted tax periods and pay tax, interest, late fee accordingly).

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"