TDS Under Section 194Q | TDS on Purchase of Goods Please note that the Government of India inserted a new TDS Section 194Q which will be effective from 01-July-2021 as under

Navneet Jerath | Jun 16, 2021 |

TDS Under Section 194Q | TDS on Purchase of Goods

TDS under section 194Q | Section 194Q effective from 01.7.2021 | TDS on Purchase of Goods Exceeding Rs. 50 Lakhs

Please note that the Government of India inserted a new TDS Section 194Q which will be effective from 01-July-2021 as under:

Provision:-

“Any person, being a buyer who is responsible for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value or aggregate of such value exceeding fifty lakh rupees in any previous year, shall, at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1 percent. of such sum exceeding fifty lakh rupees as income-tax”.

Last year government implemented TCS provision for Seller to collect TCS @ 0.1% on Receipt of consideration after 1.10.2020 for amounts exceeding Rs. 50 Lakhs against Sales of Goods. The TCS is recoverable on the amount of receipt which is greater than 50 Lakhs and received after 1st. Oct. 2020. The rate of TCS is 0.1% but Due to COVID-19 Pandemic the Rate of TCS was reduced by 25 % until 31 March 2021 and its effective rate was 0.075%. Other Condition for its applicability was “seller” means a person whose total sales, gross receipts or turnover from the business carried on by him exceeds Rs. Ten crores during the financial year immediately preceding the financial year in which the sale of goods is carried out.

There were instances where Sellers Turnover is less than 10 Crore but his receipt from sales of goods to the particular buyer exceeded Rs.50 Lakhs. Therefore, there was no liability of TCS on seller. To handle this situation the Government came up with similar type of provision for Purchaser (Buyer) via TDS applicability.

Decoding of Provision:

“Buyer” means a person whose total sales, gross receipts or turnover from the business carried on by him exceed Rs. Ten crore during the financial year immediately preceding the financial year in which the purchase of goods is carried out.

RATE OF TDS TO BE DEDUCTED AND SOME OTHER CONDITIONS FOR DEDUCTION-

1. In case Seller provided PAN card details, Rate will be 0.1% otherwise it will deducted @5 % as per Sec206 AA.

2. TDS Amount will be deducted by buyer on amount exceeding Rs.50 Lakhs for purchase of goods in any previous year. TDS will be deducted on earlier of the Date of Payment or Credit of the amount of purchase to the account of the seller or any other account.

The provisions of this section shall not apply to a transaction in the following cases:

Tax is deductible under any other provisions of this Act; or tax is collectible under the provisions of section 206C other than a transaction to which subsection (1H) of section 206C applies (TCS).

As per Exclusion provision under Sec194Q, TCS and TDS both will applicable in case of exchange of amount between Seller and Buyer, exceeding Rs.50 Lakhs, in any previous year. But this has been covered under Sec206C (1H), which specify that

“Provided further that the provisions of this sub-section shall not apply, if the buyer is liable to deduct tax at source under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount”.

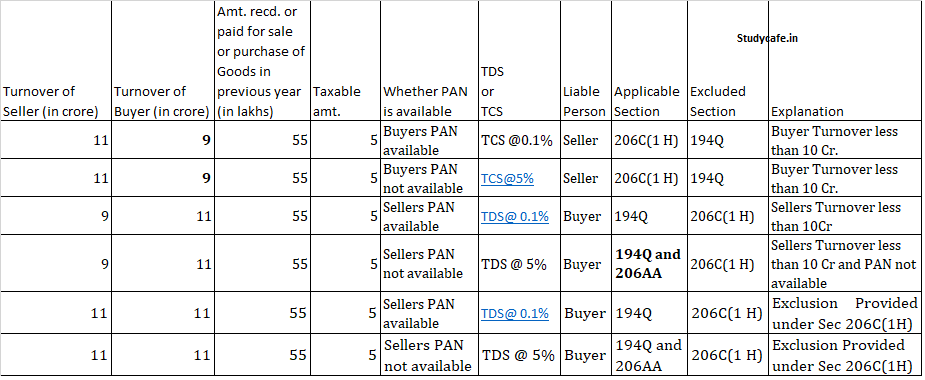

Illustration :-

| Turnover of Seller (in crore) | Turnover of Buyer (in crore) | Amt. recd. or paid for sale or purchase of Goods in previous year (in lakhs) | Taxable amt. | Whether PAN is available | TDS or TCS | Liable Person | Applicable Section | Excluded Section | Explanation |

| 11 | 9 | 55 | 5 | Buyers PAN available | TCS @0.1% | Seller | 206C(1 H) | 194Q | Buyer Turnover less than 10 Cr. |

| 11 | 9 | 55 | 5 | Buyers PAN not available | TCS@5% | Seller | 206C(1 H) | 194Q | Buyer Turnover less than 10 Cr. |

| 9 | 11 | 55 | 5 | Sellers PAN available | TDS@ 0.1% | Buyer | 194Q | 206C(1 H) | Sellers Turnover less than 10Cr |

| 9 | 11 | 55 | 5 | Sellers PAN not available | TDS @ 5% | Buyer | 194Q and 206AA | 206C(1 H) | Sellers Turnover less than 10 Cr and PAN not available |

| 11 | 11 | 55 | 5 | Sellers PAN available | TDS@ 0.1% | Buyer | 194Q | 206C(1 H) | Exclusion Provided under Sec 206C(1H) |

| 11 | 11 | 55 | 5 | Sellers PAN not available | TDS @ 5% | Buyer | 194Q and 206AA | 206C(1 H) | Exclusion Provided under Sec 206C(1H) |

| Particulars | 194Q | 206C(1H) |

| Purpose | Tax to be DEDUCTED | Tax to be COLLECTED |

| Applicable to | Buyer/Purchaser | Seller |

| With effect from | 01-07-2021 | 01-10-2020 |

| When Deducted or collected | Payment or credit, whichever is earlier | At the time of receipt |

| Advances | TDS shall be deducted on advance payments | TCS shall be collected on advance receipts |

| Rate of TDS/TCS | 0.10% | 0.1% (0.075% for FY 2020-21) |

| PAN not available | 5% | 1% |

| Triggering point | Turnover/Gross Receipts/Sales from the business of BUYER should exceed Rs.10crduring previous year (Excluding GST) Purchase of goods of aggregate value exceeding Rs.50Lakhs in P.Y. (The value of goods includes GST) | Turnover/Gross Receipts/Sales from the business of SELLER should exceed Rs.10cr during previous year (Excluding GST) Sale consideration received exceeds Rs.50Lakhs in P.Y.(The value of goods includes GST) |

| Exclusions | Yet to be notified by government | If Buyer is: Importer of goods Central/State Government, Local Authority An embassy, High Commission, legation, commission, consulate and trade representation of a foreign state. |

| When to deposit/collect | Tax so deducted shall be deposited with government by 7th day of subsequent month | Tax so collected shall be deposited with government by 7th day of subsequent month |

| Quarterly statement to be filed | 26Q | 27EQ |

| Certificate to be issued to seller/buyer | FORM 16A | FORM 27D |

The Finance Act, 2020, inserted Sub-Section (1H) in Section 206C to provide for the collection of tax by a seller from the amount received as consideration for the sale of goods if it exceeds Rs. 50 lakhs in any previous year.

On the similar lines, the Finance Bill, 2021, inserted a new Section 194Q to provide for deduction of tax by a buyer from the purchase of goods. As sale and purchase are the flip- side of a transaction, the applicability of two provisions on the same transaction may create a lot of doubts.

To resolve all these doubts we have prepared a list of the Frequently Asked Questions (FAQs) about the requirement to deduct TDS on purchase of goods with effect from 01-07-2021 with a distinction between the new Section 194Q and Section 206C(1H).

The tax shall be deducted under Section 194Q by a buyer carrying on a business whose total sales, gross receipts or turnover from the business exceeds Rs. 10 crores during the financial year immediately preceding the financial year in which such goods are purchased. This provision shall be applicable from 01-07-2021.

Thus, the liability to deduct tax under this provision in the financial year 2021-22 shall arise if the turnover of the purchaser was more than Rs. 10 crores in the financial year 2020-21.

The tax shall be deducted from the purchases made by a buyer if the following conditions are satisfied:

a. There is a purchase of goods from a resident person;

b. Goods are purchased for a value or aggregate of value exceeding Rs. 50 lakhs in any previous year; and

c. The buyer should not be in the list of persons excluded from the provision for deduction of tax. The tax shall not be deducted under this provision if the tax is deductible or collectible under any other provision except Section 206C(1H). Thus, if a transaction is subject to TCS under Section 206C(1H), the buyer shall have the first obligation to deduct the tax. If he does so, the seller will not have any obligation to collect the tax under Section 206C(1H). Also, refer to FAQ 5.

Tax is required to be deducted at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier. The tax shall be deducted even if the sum is credited to the ‘Suspense Account’.

The tax shall be deducted by the buyer of goods at the rate of 0.1% of the purchase value exceeding Rs. 50 lakhs if the seller has furnished his PAN or Aadhaar, otherwise, the tax shall be deducted at the rate of 5%.

Second Provison to Section 206C(1H) provides that if the buyer is liable to deduct tax under any other provision on the goods purchased by him from the seller and has deducted such amount, no tax shall be collected on the same transaction. Section 194Q(5) provides that no tax is required to be deducted by a person under this provision if tax is deductible under any other provision or tax is collectable under section 206C [other than a transaction on which tax is collectable under Section 206C(1H)]. Though Section 206C(1H) excludes a transaction on which tax is actually deducted under any other provision (which will cover Section 194Q as well), but Section 194Q(5) does not create a similar exception for a transaction on which tax is collectible under Section 206C(1H). Thus, the buyer shall have the primary and foremost obligation to deduct the tax and no tax shall be collected on such transaction under Section 206C(1H). However, if the buyer makes a default, the liability to collect the tax gets shifted to the seller.

Section 194Q provides that any person, being a buyer who is responsible for paying any sum to any resident, being a seller, is required to deduct tax at source under this provision. Thus, the obligation to deduct tax under this provision arises only when the payment is made to a resident seller. As in the case of import, the seller is a non-resident, the buyer will not have any obligation to deduct tax under this provision. However, the TDS under Section 195 or payment of Equalisation Levy may be required in respect of such transaction.

Liability to deduct tax under this provision arises only when the payment is made to a resident seller. Residential status of the buyer, who is making payment, is not relevant under this provision. As in the transaction of export of goods, the seller is a resident but the buyer is a non-resident. Thus, the liability to deduct tax under this provision may arise on the non-resident buyer, which may not be practically possible. Thus, the Central Government may exempt such transactions in view of the powers given by the Explanation to Section 194Q.

As referred to above, ‘goods’ means every kind of movable property subject to certain exceptions and inclusions. Thus, the immovable property shall not be treated as ‘goods’. Consequently, the TDS shall not be deducted from the purchase of immovable property by a developer.

Section 194Q provides for the deduction of tax on the payment made for the purchase of goods. Customs Tariff Act has covered ‘Electricity’ under heading 2716 00 00, which also clarifies that Electricity is a good. Thus, it may be concluded that the tax should be deducted from the payment made in respect of the transaction in electricity. A transaction in electricity can be undertaken either by way of direct purchase from the company engaged in generation of electricity or through power exchanges. The CBDT has clarified that the transaction in electricity, renewable energy certificates and energy-saving certificates traded through power exchanges registered under Regulation 21 of the CERC shall be out of the scope of TCS under the provision of Section 206C(1H).

Applying the rationale behind such clarification, it is apprehended that the CBDT may allow a similar exemption from TDS under Section 194Q as well.

Tax is required to be deducted by a buyer carrying on business whose total sales, gross receipts or turnover from the business exceeds Rs. 10 crores during the financial year immediately preceding the financial year in which such goods are purchased. There is no

condition that the purchases should be connected with the business only. Thus, if a person is falling within the definition of the buyer, tax is required to be deducted even if such purchase is not connected with the business carried on by him. Jewellery, being a movable property, is covered within the term goods. There is no specific exclusion under Section 194Q for deduction of TDS on purchase of jewellery. Thus, the tax shall be deductible on purchase of jewellery if other conditions are also fulfilled.

It is imperative to accurately determine the purchase value as it is relevant both for the applicability of the provision and amount from which tax should be deducted. Additional, allied or out-of-pocket charges recovered from the customers may or may not form part of purchase value. Where these expenses have been reflected in the purchase invoice itself, it should form part of purchase value. If they are charged through a separate invoice, it should not form part of purchase value.

The Finance Bill, 2021, has inserted Section 194Q, with effect from 01-07-2021, to provide for the deduction of tax on certain purchases. The TDS has to be deducted if the value or aggregate purchase value exceeds Rs. 50 lakhs during the previous year. How this limit of Rs. 50 Lakh for deducting TDS shall be reckoned for the financial year 2021-22? Should it be from 01-04-2021 or 01-07-2021?

Similar confusion arose when Section 206C(1H) was introduced by the Finance Act, 2020, with effect from 01- 10-2020. In respect of which the CBDT vide Circular No. 17, dated 29- 09-2020, has clarified that since the threshold of Rs. 50 lakhs is with respect to the previous year, calculation of sale consideration for triggering TCS under this provision shall be computed from 01-04-2020. Hence, if a seller has already received Rs. 50 lakhs or more up to 30-09-2020 from a buyer, TCS under this provision shall apply on all receipts of sale consideration on or after 01-10-2020.

Applying the same principle it should be concluded that threshold of Rs. 50 lakhs shall be computed from 01-04-2021. Thus, if a buyer has already purchased goods of value Rs. 50 lakhs or more up to 30-06-2021 from a seller, TDS under this provision shall apply on all purchases on or after 01-07-2021.

A similar issue has been raised in respect of Section 194J, to which the CBDT vide Circular No. 23/2017, dated 19-7-2017, has clarified that wherever in terms of the agreement or contract between the payer and the payee, the component of ‘GST on services’ comprised in the amount payable to a resident is indicated separately, tax shall be deducted at source on the amount paid or payable without including such ‘GST on services’ component. However,

such clarification was issued in respect of GST on services only. No such clarification has been issued for GST on goods.

However, in respect of Section 206C(1H), the CBDT vide Circular No. 17, dated 29-09-2020, has clarified that since the collection is made with reference to receipt of the amount of sale consideration, no adjustment on account of indirect taxes including GST is required to be made for the collection of tax under this provision. Since deduction under Section 194Q is to be made with reference to the purchase value, applying the same principle it can be concluded that GST shall form part of the purchase value, therefore, the TDS is deductible on the purchase value inclusive of GST.

Section 194Q provides that tax is required to be deducted in the transaction relating to the purchase of goods. It does not mention whether such purchase needs to be effected immediately or at a future date. As the tax is required to be deducted at the time of payment or at the time of credit, whichever is earlier, it should be reasonable to conclude that the provision may get attracted even if such purchase happens in future. As long as the intention is to adjust the advance payment against the future purchase of goods, the tax should be deducted at the time of payment or credit, whichever is earlier. If the advance payment is not made with an intention to adjust it against future purchase (deposit or loan) but eventually it is adjusted against the future purchase, no tax is required to be deducted at the time of payment of such advance. In such case liability to deduct tax will arise the moment such advance is adjusted against the purchase value of goods.

The Finance Bill, 2021, has proposed to insert Section 194Q with effect from 01-07-2021. Thus, provisions of this Section shall not apply on any payment made or credit made in the books of accounts before 01-07-2021. Consequently, it would apply to all purchases made on or after 01-07-2021. In simple words, the tax should be deducted where the payment is made or amount is credited on or after 01- 07-2021. Thus, where any of the trigger events (i.e., payment or credit) has occurred before the date of applicability of provision, no liability to deduct tax will arise.

The requirement to deduct TDS under this provision arises if the purchase value exceeds the threshold limit during the previous years. The deduction is to be made at the earliest of payment or credit for the purchase of goods. Since the loan advanced by buyers is not a payment towards the purchase of goods, it shall remain outside the purview of this provision. Hence, there is no requirement to deduct TDS on loan advanced by the buyer. However, if at any future date, such loan amount is settled against purchased value, the liability to deduct TDS shall arise. The tax shall be deducted on the date on which parties agreed to adjust the loan amount against the outstanding liability.

The TDS under this section is required to be deducted by any person, being a buyer, responsible for making payment to the seller for the purchase of goods. Thus, the existence of two distinct parties as ‘seller’ and ‘buyer’ is a pre-requisite to construe a transaction as a purchase. The condition of purchase is not fulfilled in the context of branch transfer. Therefore, the provisions of this section shall not apply in the case of branch transfers.

As the tax has to be computed on the purchase value, the adjustment made to the ledger of the seller by issuing the debit note will not have an impact on the tax to be deducted. The position would remain the same if, after the deduction of tax, the seller repays some consideration to the buyer. In such a situation, the amount of purchase value shall not be reduced with the amount so refunded or the debit note so adjusted for calculation of TDS.

Where tax is required to be deducted at source, the deductee is required to furnish his PAN or Aadhaar number to the deductor failing which the tax is required to be deducted at higher rates. If the PAN or Aadhaar number is available, the threshold limit of Rs. 50 lakhs shall be computed in respect of each PAN or Aadhaar number. In other words, if different units of the seller are under the same PAN or Aadhaar number, the amount paid or payable to all such units shall be aggregated to compute the limit of Rs. 50 Lakhs.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"