Reetu | Feb 8, 2022 |

More than 71 lakh Subscribers Enrolled under Atal Pension Yojana upto 24.01.2022

According to data from the Pension Fund Regulatory and Development Authority (PFRDA), 71,06,743 subscribers have been enrolled in the Atal Pension Yojana (APY) up to January 24, 2022, for the fiscal year 2021-22. Dr Bhagwat Kisanrao Karad, Union Minister of State for Finance, declared this in a written reply to a Rajya Sabha question.

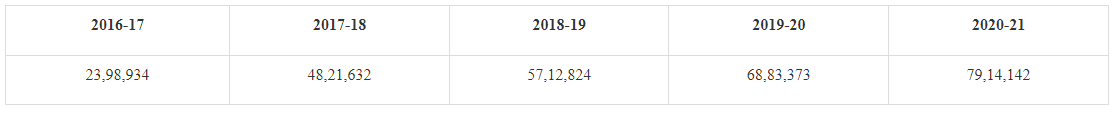

Giving more details, the Minister stated the number of subscribers enrolled under APY during last five years, given as under:

According to the Minister, the Atal Pension Yojana (APY) is a Government of India Scheme that was launched on May 9, 2015, with the goal of developing a universal social security system for all Indians, particularly the poor, underprivileged, and workers in the unorganised sector. The Scheme went into effect on June 1, 2015, and is administered by the PFRDA. It is open to all Indian nationals between the ages of 18 and 40 who have a savings bank account in a bank or post office.

The system provides five pension plan slabs, namely Rs 1000, Rs 2000, Rs 3000, Rs 4000, and Rs 5000, which are guaranteed by the Government of India to the subscriber at the age of 60. The Government of India guarantees the same pension to the subscriber’s spouse in the event of his or her death, according to the Minister.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"