Income Tax Form 10BD required to be filed for Donations Received is now live: Read Instructions

Reetu | Apr 26, 2022 |

Income Tax Form 10BD required to be filed for Donations Received is now live: Read Instructions

Form 10BD is a Statement or Income Tax Form required to be filed towards particulars of donations received for a particular FY. It is required to be filed by a Charitable or religious Trust. It is to be furnished on or before 31st May of the FY immediately following the FY in which the donation is received

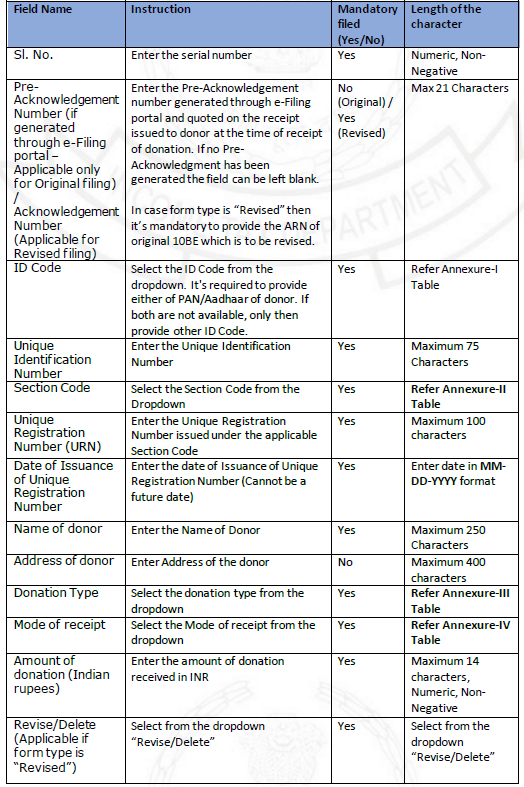

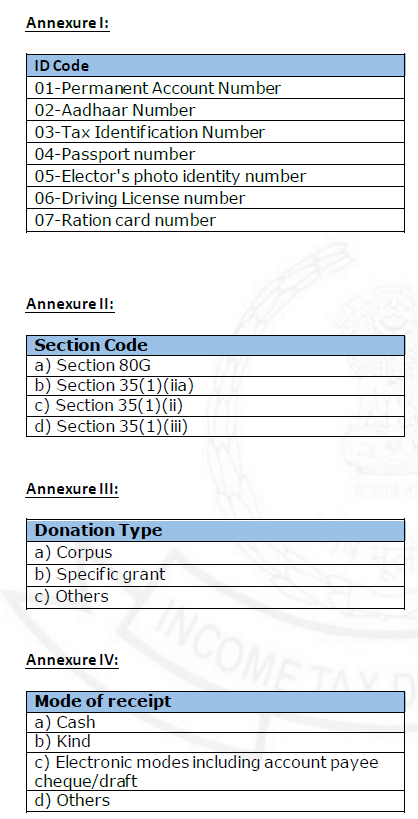

These instructions are guidelines to help the taxpayers for filling the particulars in CSV template in Part-B Details of donors and donation relevant to the Financial Year. Ensure to provide the data as per below instructions and in the correct schema only to avoid rejections during processing. The instructions are to be read in conjunction with the set of instructions provided in the Form 10BD “Statement of particulars to be filed by reporting person u/s 80G(5)/35(1A)(i)” instruction page.

In case of any doubt, please refer to relevant provisions of the Income-Tax Act, 1961 and Income Tax Rules, 1962.

Start by downloading a fresh CSV Template for uploading transaction-wise “Part-B Details of donors and donation”. Please note that the file size cannot be more than 50 MB.

*If anyone field is entered then all other fields of that row shall be mandatory.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"