Tax Audit for AY 2022-23 Extension Update | Tax Audit Extension Update for FY 2021-22

Deepak Gupta | Sep 23, 2022 |

A person covered by section 44AB should get his accounts audited and should obtain the audit report on or before 30th September of the relevant assessment year, e.g., a Tax audit report for the financial year 2021-22 corresponding to the assessment year 2022-23 should be obtained on or before 30th September 2022.

The tax audit report is to be electronically filed by the chartered accountant to the Income-tax Department. After filing of the report by the chartered accountant, the taxpayer has to approve the report from his e-fling account with Income-tax Department

How Much Tax Audit Work Have You Completed?

— CAStudycafe (@castudycafe) September 23, 2022

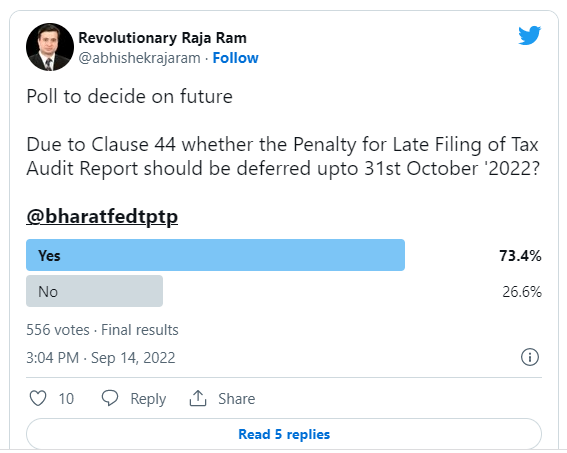

The due date for Tax Audit for FY 2021-22 (AY 2022-23) is 30/09/2022. Now, professionals all over India are requesting that this due date should be extended by at least one month.

One of the reasons for the demand for an extension of the due date is the newly applicable clause 44.

The reporting under clause 44 requires the break up of total expenditure both for entities registered and not registered under GST.

This clause is required to be reported by all the reporting assessees whether the assessee is registered under GST or not. Thus, even if a person is not registered under GST, a break-up of total expenditure in the prescribed table is required to be furnished. This makes the work of Data compilation under this clause all the more difficult.

Some professionals also believe that this clause cannot be filled without filing GSTR-9/9C and the due date for filing the same is 31st December and accordingly due date for Tax Audit should be extended.

@PMOIndia @FinMinIndia @nsitharaman @narendramodi

Please declare tomorrow in Mumbai extension of TAX Audit Report due date from 30-09-2022 to 31-12-2022 as clause 44 of Form 3CD can not be filled up without GST Audit. GST Audit date extended till 31-12-2022.— Ashok Furia (@AshokFuria) September 14, 2022

Also, Professionals are demanding either to scrap clause 44 or to restructure it.

Need of the hour

Clause 44 of form 3 CD

It is very difficult for the assessee to compile data.

Extremely difficult to verify the authenticity of the data submitted .

Please #Scrap_clause_44 or restructure clause 44 of form 3CD. @IncomeTaxIndia @FinMinIndia— Karandeep Singh (@karandeep1991) August 18, 2022

Chartered Accountants Association, Surat has already given a representation demanding scraping clause 44.

As a follow up of our earlier representation on "Inapt Amendments in TAR" (full text https://t.co/8WE4xDXJOv), @caas_org hereby represents with respect to Clause 44 of Tax Audit Report once again.

Read Full text here: https://t.co/eJmUnfdRHu pic.twitter.com/dO8Vak7XPU

— Chartered Accountants Association, Surat (@caas_org) August 24, 2022

This time there are very less glitches in Income Tax Portal. It was seen earlier also that Government is in no mood for an extension of the due date, as seen in the month of July 2022.

According to section 271B, if any person who is required to comply with section 44AB fails to get his accounts audited in respect of any year or years as required under section 44AB or furnish such report as required under section 44AB, the Assessing Officer may impose a penalty. The penalty shall be lower of the following amounts:

(a) 0.5% of the total sales, turnover or gross receipts, as the case may be, in business, or of the gross receipts in the profession, in such year or years.

(b) Rs. 1,50,000.

However, according to section 271B, no penalty shall be imposed if reasonable cause for such failure is proved.

A question may arise whether a tax auditor appointed under section 44AB can be held responsible if he does not complete the audit and if the tax audit report is not uploaded before the specified date. The answer to this question will depend on the facts and circumstances of the case.

Normally, it is the professional duty of the chartered accountant to ensure that the audit accepted by him is completed before the due date. If there is any unreasonable delay on his part, he is answerable to the Institute if a complaint is made by the client. However, if the delay in the completion of the audit is attributable to his client, the tax auditor cannot be held responsible.

Tax Audit Due Date for AY 2022-2023 Extended by CBDT

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"