CA Pratibha Goyal | Nov 23, 2022 |

GST Applicable on Health Insurance premium taken by Governmental authority for employees: AAAR

As per an advance ruling pronounced by the Appellate Authority, GST is Applicable on Health Insurance premium taken by Governmental authority for employees, pensioners and their family.

The applicant, M/s. Hyderabad Metropolitan Water Supply And Sewerage Board, 1, 4, HMWSSB Buildings Finance Wing, 1, Khairatabad, Hyderabad, Telangana – 500 004) (hereinafter referred to as M/s. Hyderabad Metropolitan Water Supply And Sewerage Board or the applicant). The applicant M/s. Hyderabad Metropolitan Water Supply and Sewerage Board have paid Medical insurance premium taken to provide health Insurance to the employees, pensioners and their family members and Vehicle insurance Policy taken to provide Insurance to the vehicles owned by the Board.

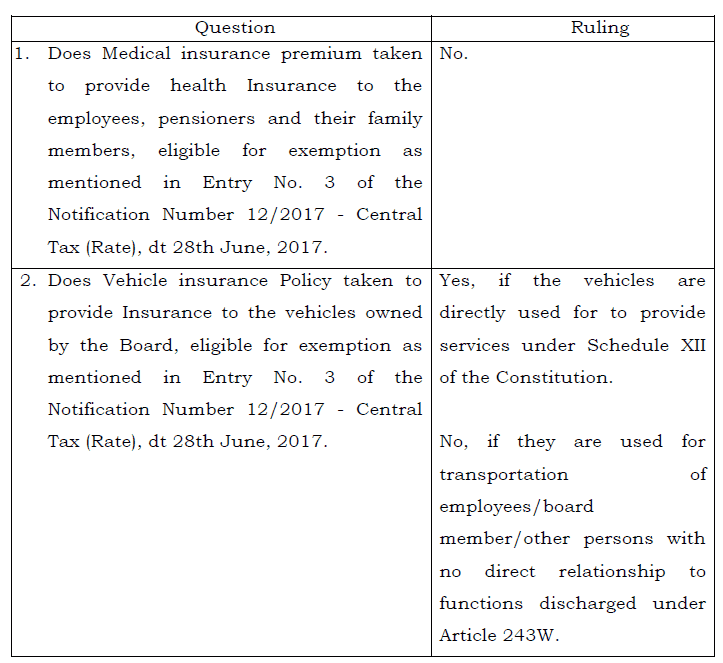

The applicant filed an appeal before the lower authority seeking advance ruling on the following questions.

(1) Does Medical insurance premium taken to provide health Insurance to the employees, pensioners and their family members, eligible for exemption as mentioned in Entry No. 3 of the Notification Number 12/2017 – Central Tax (Rate), dt 28th June, 2017.

(2) Does Vehicle insurance Policy taken to provide Insurance to the vehicles owned by the Board, eligible for exemption as mentioned in Entry No. 3 of the Notification Number 12/2017 – Central Tax (Rate), dt 28th June, 2017.

Aggrieved by above order, the applicant has seemed ruling from higher Authority.

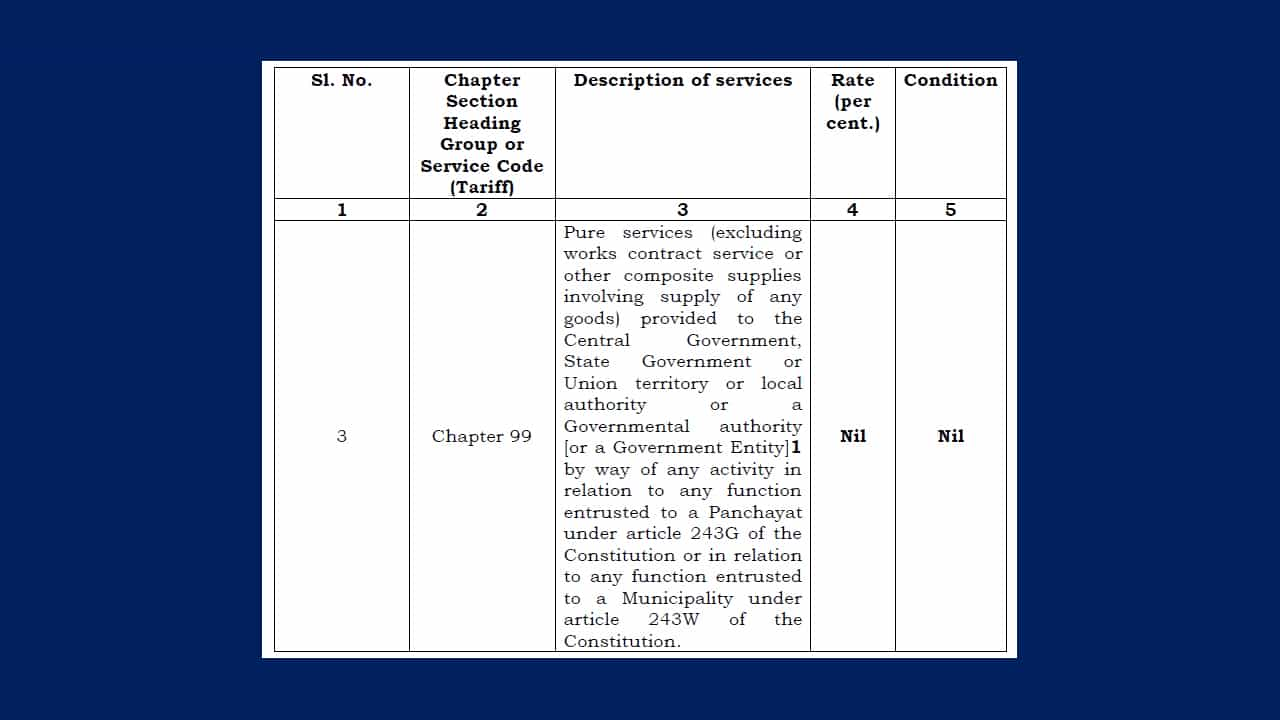

As per Sl.No 3 of Central Tax(Rate) notification no 12/2017 dated 28-06-2017 the rate of tax on supply of following services is Nil:

Since Hyderabad Metropolitan water supply and sewerage board is a board set up by act of state legislature to carry out any function entrusted to a Municipality under article 243 W, it is a ‘Governmental authority’ as per the above definition.

The applicant has contended that the following supply of services to them are eligible for exemption under Sl.No 3 mentioned above:

1) Insurance services provided to the board for insuring their employees and employee family members.

2) Insurance services provided to the vehicles of the board.

The Phrase ‘in relation to’ mentioned in Sl. No 3 of Central tax (rate) notification no 12/2017 is to be read as meaning a direct and proximate relationship to any function entrusted to a Municipality under article 243W of the Constitution in present case Water supply and sewerage.

The insurance services for employees and employees family members received by the applicant is not in direct and proximate relation to water supply and sewerage related function entrusted under Article 243W , hence the supply received by the applicant does not fall under Sl.No 3 of Central tax (rate) notification no 12/2017 and are not exempted.

The board also receives insurance services to vehicles which are used for transportation of water and sewerage management, since these vehicles are essential for performing the functions as entrusted in 243W of the constitution. The applicant is eligible for exemption under entry mentioned above. All other vehicles which are not used for performing the functions as entrusted in 243W of the constitution shall be taxable.

Also:

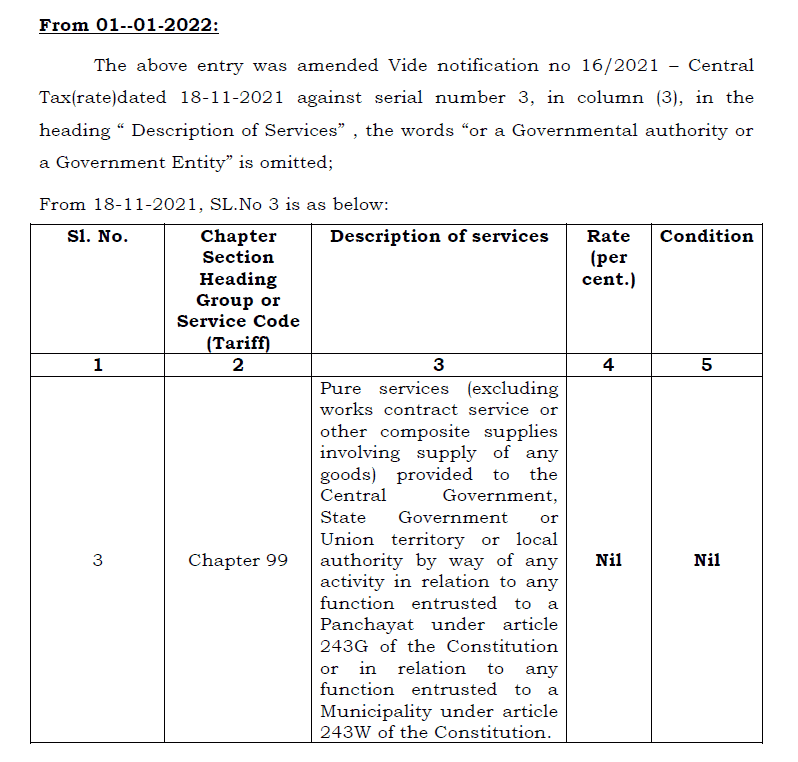

In view of the above from 18-11-2021, in view of the amendment mentioned above omitting the word ‘Government authority’, the services provided to the applicant are not eligible for exemption under Sl.No 3 of Notification no 12/2017 dated 28-06-2017.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"