Set-off and carry forward of Losses in Income Tax

CA Pratibha Goyal | Apr 11, 2023 |

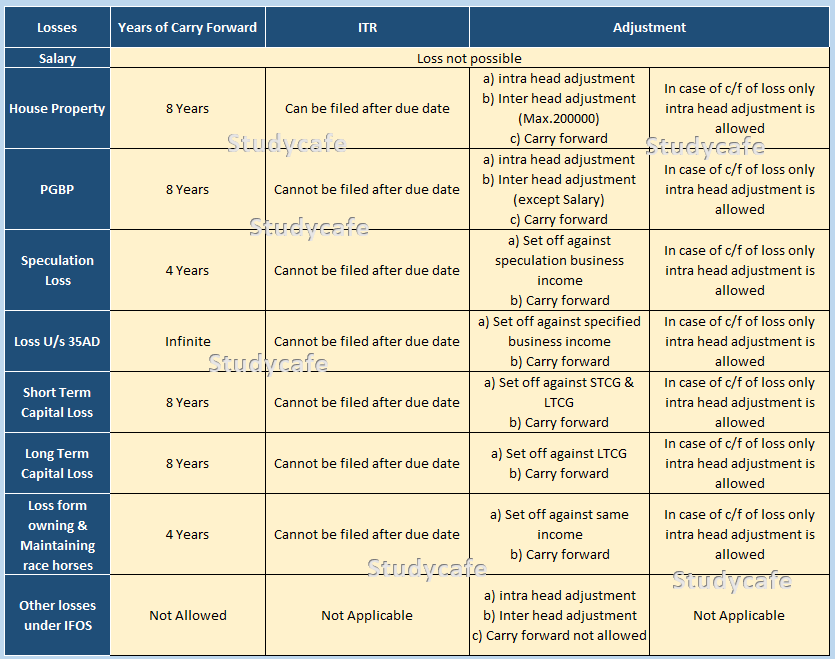

Set-off and carry forward of Losses in Income Tax

Some important points about Set-off and carry forward of Losses:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"