CA Pratibha Goyal | May 31, 2023 |

5 Important Due dates today: Click here to know

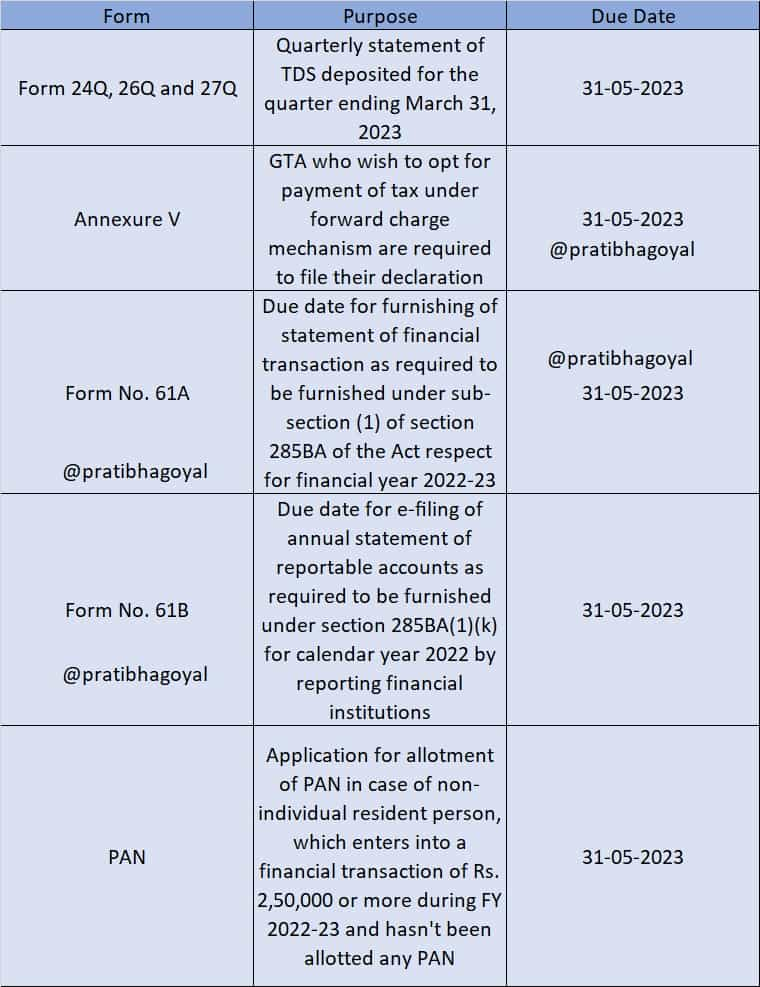

Below are the Due Dates for 31st May 2023.

Form 24Q, 26Q and 27Q

Quarterly statement of TDS deposited for the quarter ending March 31, 2023

Annexure V

GTA who wish to opt for payment of tax under forward charge mechanism are required to file their declaration

Form No. 61A

Due date for furnishing of statement of financial transaction as required to be furnished under sub-section (1) of section 285BA of the Act respect for financial year 2022-23

Form No. 61B

Due date for e-filing of annual statement of reportable accounts as required to be furnished under section 285BA(1)(k) for calendar year 2022 by reporting financial institutions

PAN Application

Application for allotment of PAN in case of non-individual resident person, which enters into a financial transaction of Rs. 2,50,000 or more during FY 2022-23 and hasn’t been allotted any PAN

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"