Reetu | Jun 2, 2023 |

Upcoming Important GST Due Dates; Know Details

GST Taxpayers need to file GST Returns every month. Lots of GST Due Dates are approaching soon. Taxpayers who are Non-Filers of Annual Return, who have Turnover more than 5 crore, who are Composition Taxpayers etc., they are need to file their respective returns before the due date.

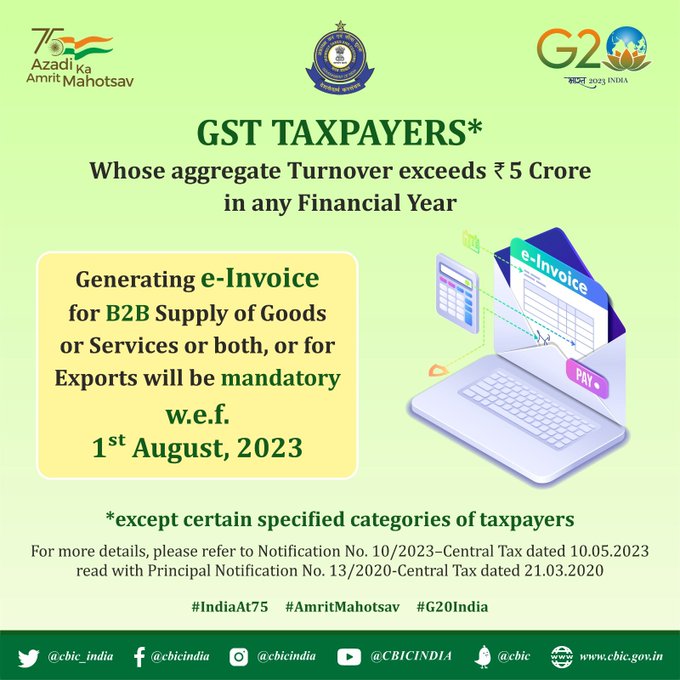

Attention, GST Taxpayers whose Aggregate Annual Turnover exceeds Rs.5 Crore in any Financial Year!. Generating E-Invoice for B2B Supply of Goods or Services or both, or for Exports will be mandatory w.e.f. 1st August, 2023.

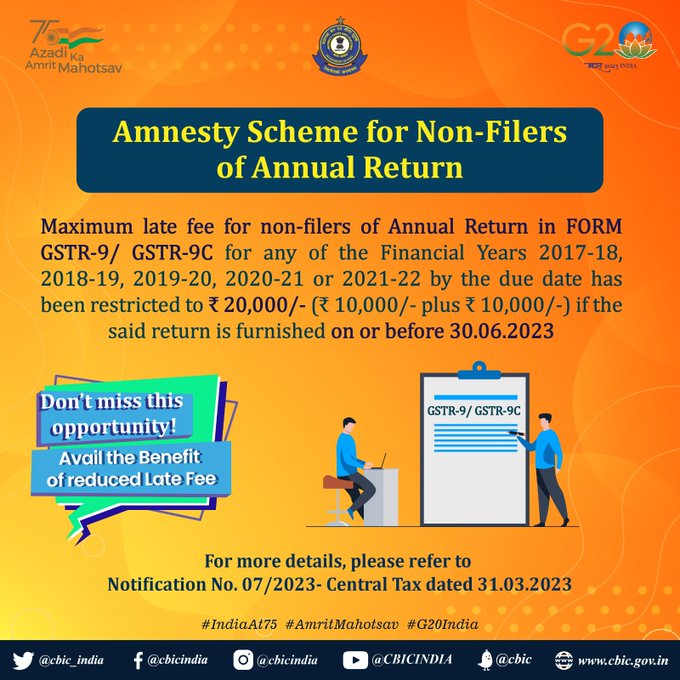

Amnesty Scheme, for non-filers of Annual Return GSTR 9/ GSTR 9C. Maximum late fee for non-filers of Annual Return in FORM GSTR-9/ GSTR-9C for any of the Financial Years 2017-18, 2018-19, 2019-20, 2020-21 or 2021-22 by the due date has been restricted to 20,000/- ( 10,000/- plus 10,000/-) if the said return is furnished on or before 30.06.2023.

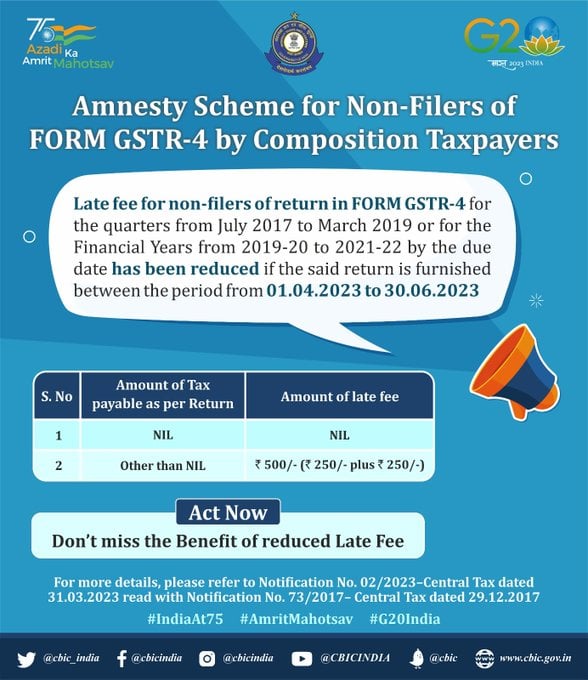

Amnesty Scheme, for non-filers of FORM GSTR-4 by Composition Taxpayers. Late fee for non-filers of return in FORM GSTR-4 for the quarters from July 2017 to March 2019 or for the Financial Years from 2019-20 to 2021-22 by the due date has been reduced if the said return is furnished between the period from 01.04.2023 to 30.06.2023. Don’t miss the benefit of reduced late fees.

Amnesty Scheme for revocation of cancellation of GST registration. Registered person whose registration was cancelled on or before 31.12.2022 on account of non filing of returns and who-

(a) failed to apply for revocation within the specified time period; or

(b) whose appeal against the order of cancellation of registration or the order rejecting application for revocation of cancellation of registration has been rejected on the ground of failure to adhere to the prescribed time limit.

May apply for REVOCATION OF CANCELLATION on or before 30.06.2023 after furnishing all returns, due upto the effective date of cancellation of registration, along with payment of tax with interest, penalty and late fees in respect of such returns.

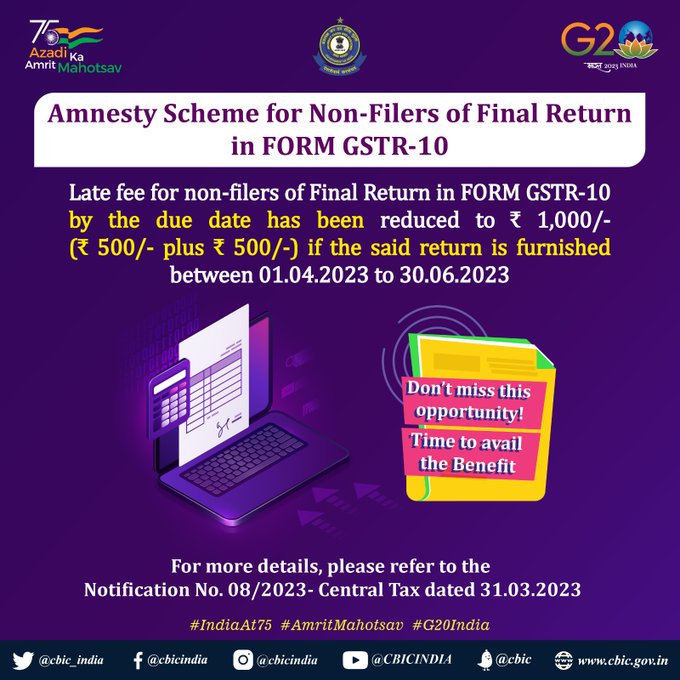

Amnesty Scheme for non filers of Final Return in FORM GSTR-10. Late fee for non-filers of Final Return in FORM GSTR-10 by the due date has been reduced to Rs.1,000 (Rs.500 plus Rs.500) if the said return is furnished between 01.04.2023 to 30.06.2023.

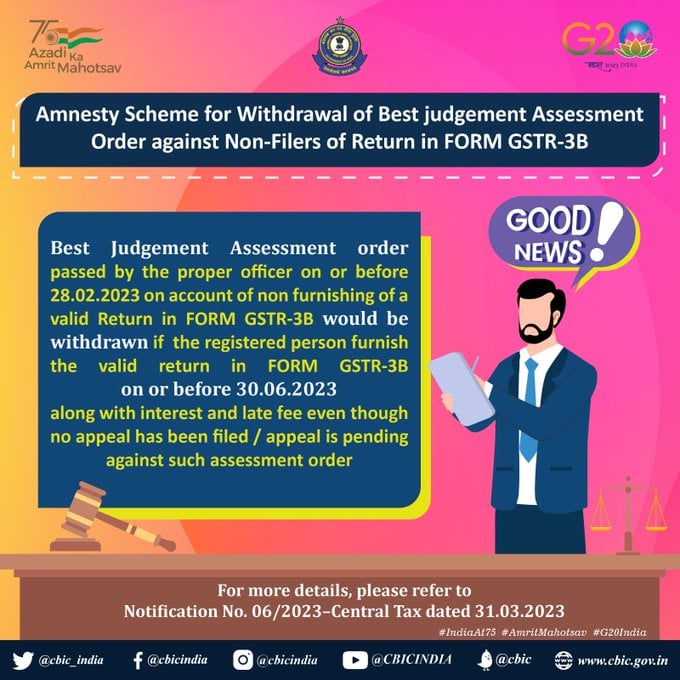

Amnesty Scheme for withdrawal of Best Judgment Assessment order against non filers of return in FORM GSTR-3B. Best Judgement Assessment order passed by the proper officer on or before 28.02.2023 on account of non furnishing of a valid Return in FORM GSTR-3B would be withdrawn if the registered person furnish the valid return in FORM GSTR-3B on or before 30.06.2023 along with interest and late fee even though no appeal has been filed / appeal is pending against such assessment order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"