Reetu | Mar 25, 2025 |

List of Services Notified Under RCM for GST

Typically, the taxes on the supply of services is collected and paid by the supplier. The reverse charge mechanism compels the recipient of goods or services to pay the tax, essentially reversing the chargeability.

The goal of moving GST payments to the recipient is to cover unorganized industries, exempt some groups of suppliers, and charge for services imported from outside India.

Only some sorts of businesses are subject to the reverse charge mechanism.

The reverse charge scenarios for intrastate transactions are governed by Sections 9(3), 9(4), and 9(5) of the Central GST and State/Union Territories GST Acts. Sections 5(3), 5(4), and 5(5) of the Integrated GST Act govern reverse charge scenarios for interstate transactions.

The provisions of Section 9(4) of the CGST Act, 2017, will not be applicable to supplies made to a TDS deductor in terms of notification no.9/2017-Central Tax (Rate) dated 28.06.2017. Thus, government entities that are TDS deductors under Section 51 of the CGST Act, 2015, need not pay GST under reverse charge in cases of procurements from unregistered suppliers.

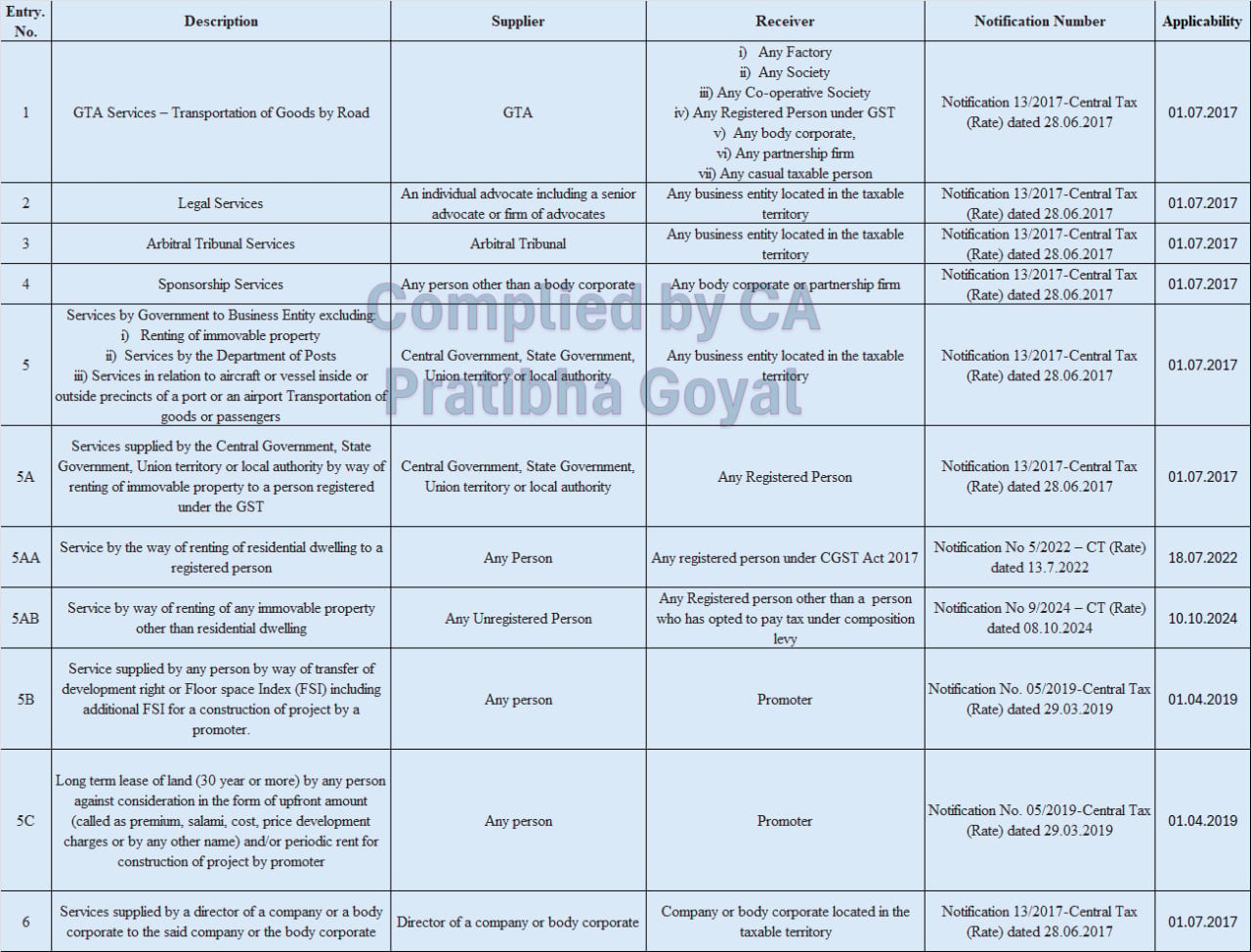

1. GTA Services -Transportation of Goods by Road [Entry Number 1]

The RCM levied on GTA Services -Transportation of Goods by Road, when the supplier is an “GTA” and the receiver is “i) Any Factory, ii) Any Society, iii) Any Co-operative Society, iv) Any Registered Person under GST, v) Any body corporate, vi) Any partnership firm vii) Any casual taxable person.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

2. Legal Services [Entry Number 2]

The RCM levied on Legal Services, when the supplier is an “An individual advocate including a senior advocate or firm of advocates” and the receiver is “Any business entity located in the taxable territory.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

3. Arbitral Tribunal Services [Entry Number 3]

In the case of Arbitral Tribunal Services, the RCM is levied when the supplier is an “Arbitral Tribunal” and the receiver is “Any business entity located in the taxable territory.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

4. Sponsorship Services [Entry Number 4]

The supply of services mentioned above attract RCM when the supplier is “Any person other than body corporate” and the receiver is “Any body corporate or partnership firm.”[Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

5. Services by Govt to Business Entity excluding: [Entry Number 5]

i) Renting of immovable property

ii) Services by the Department of Posts

iii) Services in relation to aircraft or vessel inside or outside precincts of a port or an airport Transportation of goods or passengers

In the case of above mentioned Services, the RCM is levied when the supplier is “Central Government, State Government, Union territory or local authority” and the receiver is “Any business entity located in the taxable territory.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

6. Services supplied by Government by the way of renting of immovable property to a person registered under the Central Goods and Services Tax Act, 2017 [Entry Number 5A]

The RCM is imposed on specified sevices mentioned above, when the supplier is “Central Government, State Government, Union territory or local authority” and the receiver is “Any Registered Person.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

7. Service by the way of renting of residential dwelling to a registered person [Entry Number 5AA]

In case of above mentioned supply of services, the RCM is levied when the supplier is “Any Person” and the receiver is “Any registered person under CGST Act 2017.” [Notification No 5/2022-CT (Rate) dated 13.7.2022]

8. Service by way of renting of any immovable property other than residential dwelling [Entry Number 5AB]

The RCM is levied on above mentioned supply of services, when the supplier is “Any Unregistered Person” and the receiver is “Any Registered person other than a person who has opted to pay tax under composition levy.” [Notification No 9/2024 – CT (Rate) dated 08.10.2024]

9. Service supplied by any person by way of transfer of development right or Floor space Index (FSI) including additional FSI for a construction of project by a promoter [Entry Number 5B]

The above mentioned supply of services attract RCM when the supplier is “Any person” and the receiver is “Promoter.” [Notification No. 05/2019-Central Tax (Rate) dated 29.03.2019]

10. Long term lease of land (30year or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price development charges or by any other name) and/or periodic rent for construction of project by promoter [Entry Number 5C]

In case of the above mentioned supply of services, the RCM is imposed when the supplier is “Any person” and the receiver is “Promoter.” [Notification No. 05/2019-Central Tax (Rate) dated 29.03.2019]

11. Services supplied by a director of a company or a body corporate to the said company or the body corporate [Entry Number 6]

The RCM is imposed on the above mentioned supply of services, when the supplier is “Director of a company or body corporate” and the receiver is “Company or body corporate located in the taxable territory.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

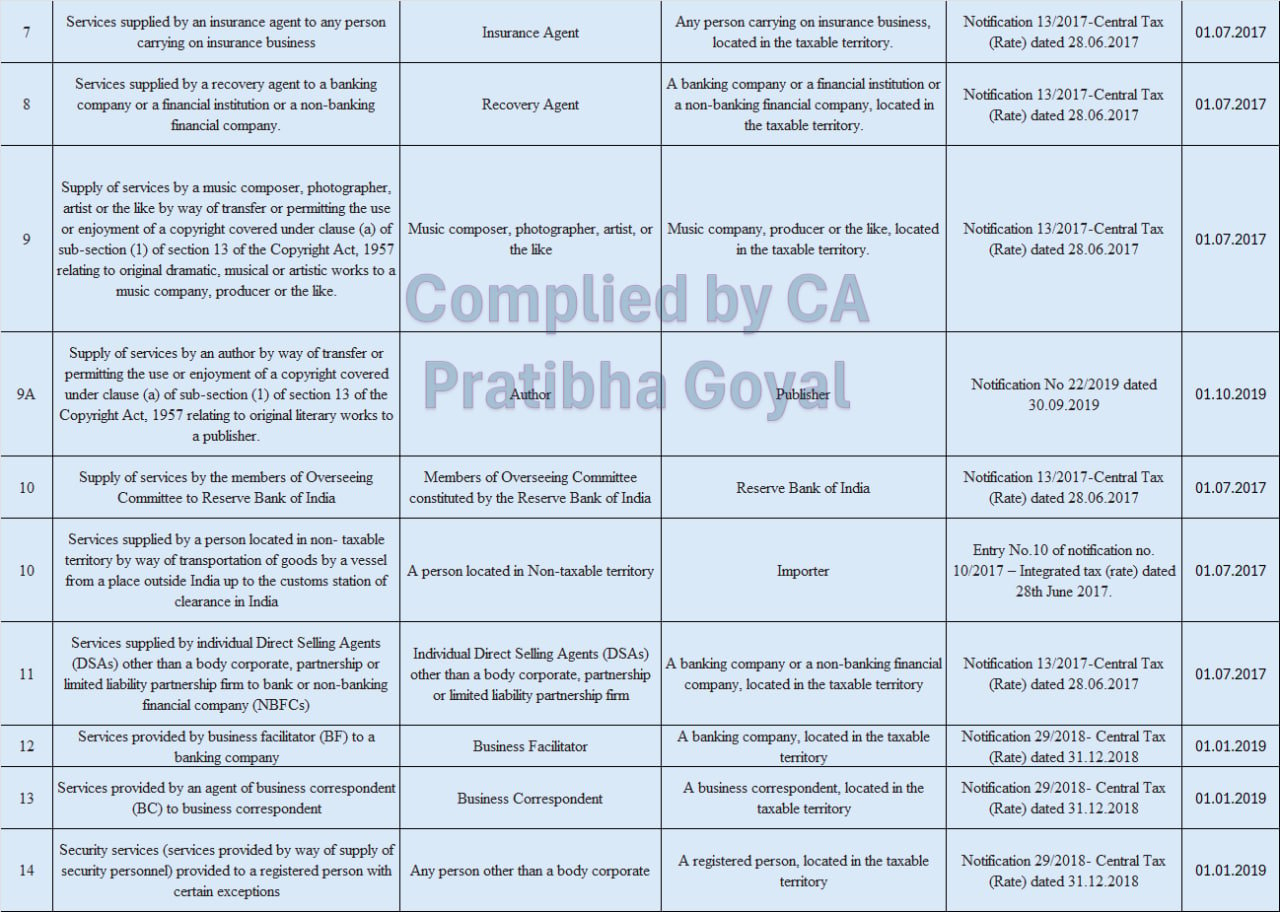

12. Services supplied by an insurance agent to any person carrying on insurance business [Entry Number 7]

The RCM is levied on the above mentioned supply of services, when the supplier is “Insurance Agent” and the receiver is “Any person carrying on insurance business.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

13. Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company [Entry Number 8]

The above mentioned supply of services attract RCM when the supplier is “Recovery Agent” and the receiver is “A banking company or a financial institution or a non-banking financial company, located in the taxable territory.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

14. Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright [Entry Number 9]

In case of the above mentioned supply of services, RCM is imposed when the supplier is “Author or music composer, photographer, artist, or the like” and the receiver is “Publisher, music company, producer or the like, located in the taxable territory.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

15. Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of subsection (1) of section 13. of the Copyright Act, 1957 relating to original literary works to a publisher [Entry Number 9A]

The supply that mentioned above attract RCM when the supplier is “Author” and the receiver is “Publisher.” [Notification No 22/2019 dated 30.09.2019]

16. Supply of services by the members of Overseeing Committee to Reserve Bank of India [Entry Number 10]

The RCM is imposed on the supply mentioned above, when the supplier is “Members of Overseeing Committee constituted by the Reserve Bank of India” and the receiver is “Reserve Bank of India.” [Notification 13/2017-Central Tax (Rate) dated 28.06.2017]

17. Services supplied by a person located in non-taxable territory by way of transportation of goods by a vessel non-taxable territory from a place outside India up to the custom [Entry Number 10]

In the case of above mentioned supply of services, the RCM is levied when the supplier is “A person located in Non-taxable territory” and the receiver is “Importer.” [Notification no. 10/2017-Integrated Tax (Rate) dated 28th June 2017]

18. Services supplied by individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm to bank or non-banking financial company (NBFCs) [Entry Number 11]

The above mentioned supply of services attract RCM when the supplier is “Individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm” and the receiver is “A banking company or a non-banking financial company, located in the taxable territory.” [Notification 13/2017-Central Tax (Rate)]

19. Services provided by business facilitator (BF) to a banking company [Entry Number 12]

In the case of supply of services mentioned above, the RCM is imposed when the supplier is “Business Facilitator” and the receiver is “A banking company, located in the taxable territory.” This is notified by Master Notification 13/2017-Central Tax (Rate). [Notification 29/2018- Central Tax (Rate) dated 31.12.2018]

20. Services provided by an agent of business correspondent (BC) to business correspondent [Entry Number 13]

The RCM is levied on the above mentioned supply services when the supplier is “Business Correspondent” and the receiver is “A business correspondent, located in the taxable territory.” This is notified by Master Notification 13/2017-Central Tax (Rate). [Notification 29/2018- Central Tax (Rate) dated 31.12.2018]

21. Security services (services provided by way of supply of security personnel) provided to a registered person with certain exceptions [Entry Number 14]

The supply of services that mentioned above attract RCM when the supplier is “Any person other than a body corporate” and the receiver is “A registered person, located in the taxable territory.” This is notified by Master Notification 13/2017-Central Tax (Rate). [Notification 29/2018- Central Tax (Rate) dated 31.12.2018]

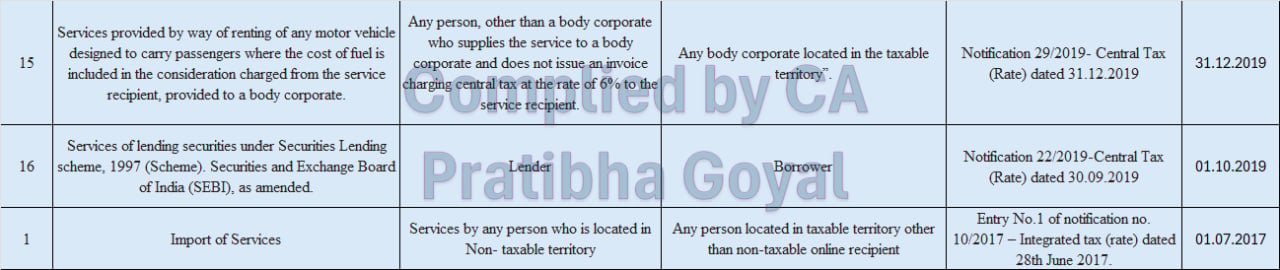

22. Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate [Entry Number 15]

The RCM is imposed on the supply of services mentioned above, when the supplier is “Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6% to the service recipient” and the receiver is “Any body corporate located in the taxable territory.” [Notification 29/2019-Central Tax (Rate) dated 13.12.2019]

23. Services of lending securities under Securities Lending scheme, 1997 (Scheme). Securities and Exchange Board of India (SEBI), as amended [Entry Number 16]

The above mentioned supply of services attract RCM when the supplier is “Lender” and the receiver is “Borrower.” [Notification 22/2019-Central Tax (Rate) dated 30.09.2019]

24. Import of Services [Entry Number 1]

The supply of services mentioned above attract RCM when the supplier is “Services by any person who is located in Non-taxable territory” and the receiver is “Any person located in taxable territory other than non-taxable online recipient.” [Notification no. 10/2017 Integrated tax (rate) dated 28th June 2017]

S. No. 1 to 6

S. No. 12 to 21

S. No. 22 to 24

| Entry. No. | Description | Supplier | Receiver | Notification Number | Applicability |

| 1 | GTA Services – Transportation of Goods by Road | GTA | i) Any Factory ii) Any Society iii) Any Co-operative Society iv) Any Registered Person under GST v) Any body corporate, vi) Any partnership firm vii) Any casual taxable person | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 2 | Legal Services | An individual advocate including a senior advocate or firm of advocates | Any business entity located in the taxable territory | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 3 | Arbitral Tribunal Services | Arbitral Tribunal | Any business entity located in the taxable territory | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 4 | Sponsorship Services | Any person other than a body corporate | Any body corporate or partnership firm | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 5 | Services by Government to Business Entity excluding: i) Renting of immovable property ii) Services by the Department of Posts iii) Services in relation to aircraft or vessel inside or outside precincts of a port or an airport Transportation of goods or passengers | Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 5A | Services supplied by the Central Government, State Government, Union territory or local authority by way of renting of immovable property to a person registered under the GST | Central Government, State Government, Union territory or local authority | Any Registered Person | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 5AA | Service by the way of renting of residential dwelling to a registered person | Any Person | Any registered person under CGST Act 2017 | Notification No 5/2022 – CT (Rate) dated 13.7.2022 | 18.07.2022 |

| 5AB | Service by way of renting of any immovable property other than residential dwelling | Any Unregistered Person | Any Registered person other than a person who has opted to pay tax under composition levy | Notification No 9/2024 – CT (Rate) dated 08.10.2024 | 10.10.2024 |

| 5B | Service supplied by any person by way of transfer of development right or Floor space Index (FSI) including additional FSI for a construction of project by a promoter. | Any person | Promoter | Notification No. 05/2019-Central Tax (Rate) dated 29.03.2019 | 01.04.2019 |

| 5C | Long term lease of land (30 year or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price development charges or by any other name) and/or periodic rent for construction of project by promoter | Any person | Promoter | Notification No. 05/2019-Central Tax (Rate) dated 29.03.2019 | 01.04.2019 |

| 6 | Services supplied by a director of a company or a body corporate to the said company or the body corporate | Director of a company or body corporate | Company or body corporate located in the taxable territory | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 7 | Services supplied by an insurance agent to any person carrying on insurance business | Insurance Agent | Any person carrying on insurance business, located in the taxable territory. | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 8 | Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company. | Recovery Agent | A banking company or a financial institution or a non-banking financial company, located in the taxable territory. | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 9 | Supply of services by a music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original dramatic, musical or artistic works to a music company, producer or the like. | Music composer, photographer, artist, or the like | Music company, producer or the like, located in the taxable territory. | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 9A | Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary works to a publisher. | Author | Publisher | Notification No 22/2019 dated 30.09.2019 | 01.10.2019 |

| 10 | Supply of services by the members of Overseeing Committee to Reserve Bank of India | Members of Overseeing Committee constituted by the Reserve Bank of India | Reserve Bank of India | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 10 | Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India | A person located in Non-taxable territory | Importer | Entry No.10 of notification no. 10/2017 – Integrated tax (rate) dated 28th June 2017. | 01.07.2017 |

| 11 | Services supplied by individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm to bank or non-banking financial company (NBFCs) | Individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm | A banking company or a non-banking financial company, located in the taxable territory | Notification 13/2017-Central Tax (Rate) dated 28.06.2017 | 01.07.2017 |

| 12 | Services provided by business facilitator (BF) to a banking company | Business Facilitator | A banking company, located in the taxable territory | Notification 29/2018- Central Tax (Rate) dated 31.12.2018 | 01.01.2019 |

| 13 | Services provided by an agent of business correspondent (BC) to business correspondent | Business Correspondent | A business correspondent, located in the taxable territory | Notification 29/2018- Central Tax (Rate) dated 31.12.2018 | 01.01.2019 |

| 14 | Security services (services provided by way of supply of security personnel) provided to a registered person with certain exceptions | Any person other than a body corporate | A registered person, located in the taxable territory | Notification 29/2018- Central Tax (Rate) dated 31.12.2018 | 01.01.2019 |

| 15 | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate. | Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6% to the service recipient. | Any body corporate located in the taxable territory”. | Notification 29/2019- Central Tax (Rate) dated 31.12.2019 | 31.12.2019 |

| 16 | Services of lending securities under Securities Lending scheme, 1997 (Scheme). Securities and Exchange Board of India (SEBI), as amended. | Lender | Borrower | Notification 22/2019-Central Tax (Rate) dated 30.09.2019 | 01.10.2019 |

| 1 | Import of Services | Services by any person who is located in Non- taxable territory | Any person located in taxable territory other than non-taxable online recipient | Entry No.1 of notification no. 10/2017 – Integrated tax (rate) dated 28th June 2017. | 01.07.2017 |

Notification 13/2017 – Central Tax (Rate) and Notification 10/2017 – Integrated Tax (Rate) is the master notification for Reverse Charge Applicability in case of supply of services.

1.) If purchases/services are availed within the state (Intra State)

Purchase / Expense A/c. ———10,000

Input CGST A/c. ——————- 900

Input SGST A/c. ——————- 900

To Creditors A/c. or Cash/Bank Ac —— 10,000

To CGST A/c Payable ———————–900

To SGST A/c Payable ———————–900

2.) If purchases / services are availed from other state (Inter State)

Purchase / Expense A/c. ———10,000

Input IGST A/c. ——————– 1,800

To Creditors A/c. or Cash/Bank A/c. —— 10,000

To IGST A/c Payable ———————–1,800

3.) If purchases / services are availed from other Country (Import)

Purchase / Expense A/c. ———10,000

Input IGST A/c. ——————– 1,800

To Creditors A/c. or Cash/Bank A/c. —— 10,000

To IGST A/c Payable ———————–1,800

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"