CA Pratibha Goyal | Jun 17, 2023 |

All about new Income Tax Form 26AS

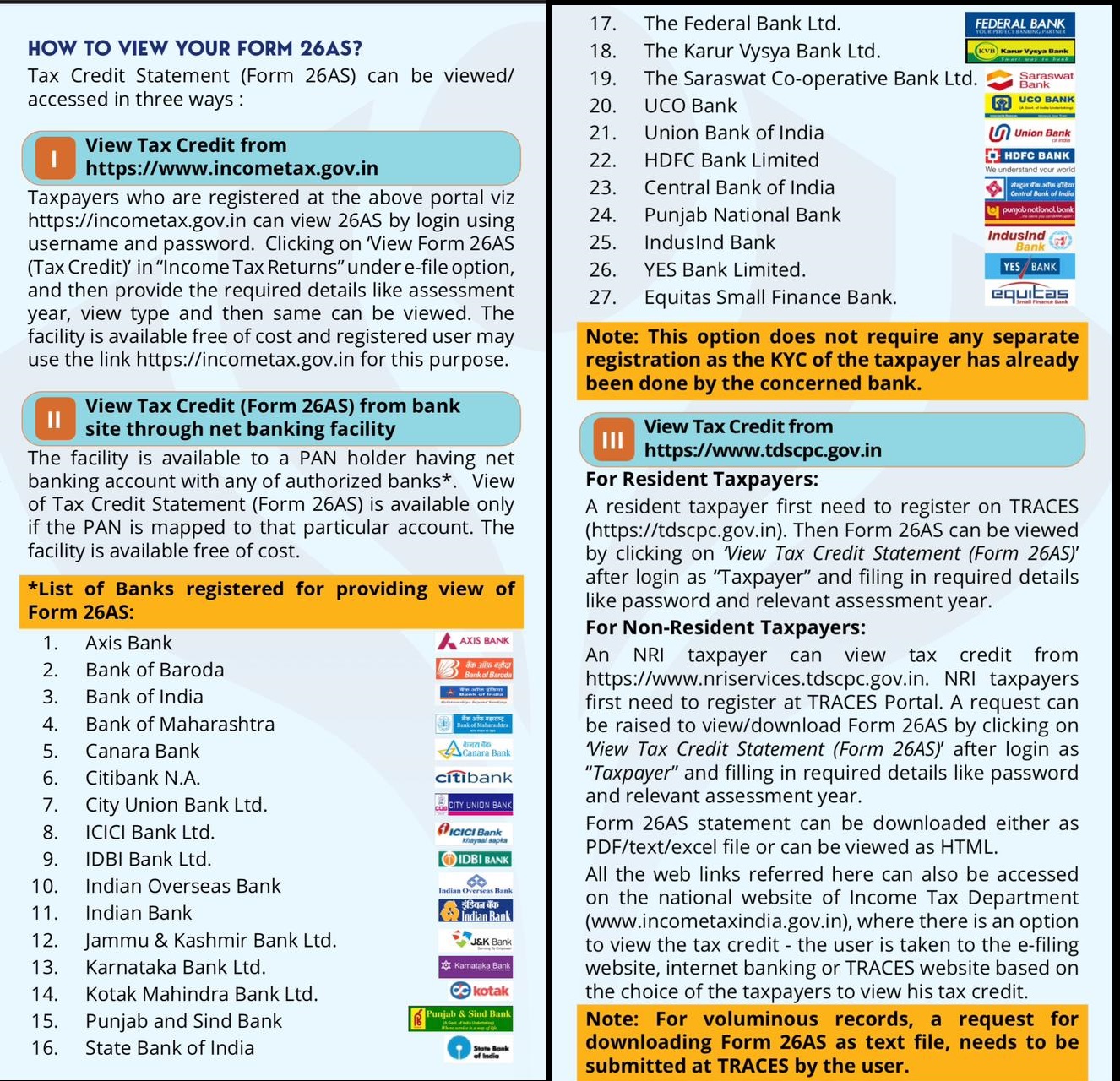

In order to promote transparency and simplifying the tax return filing process, CBDT vide Notification dated May 28, 2020 has amended Form 26AS vide Sec 285BB of Income Tax Act, 1961 r.w.r.114-I of Income Tax Rules, 1962 w.e.f. 01.06.2020. The new Form 26AS will provide a complete profile of the taxpayer for a particular year.

The new Form 26AS will provide the following information about the Tax payer:

1. Mobile no., e-mail id, date of birth/incorporation and Aadhaar no.

2. Information relating to tax deducted or collected at source.

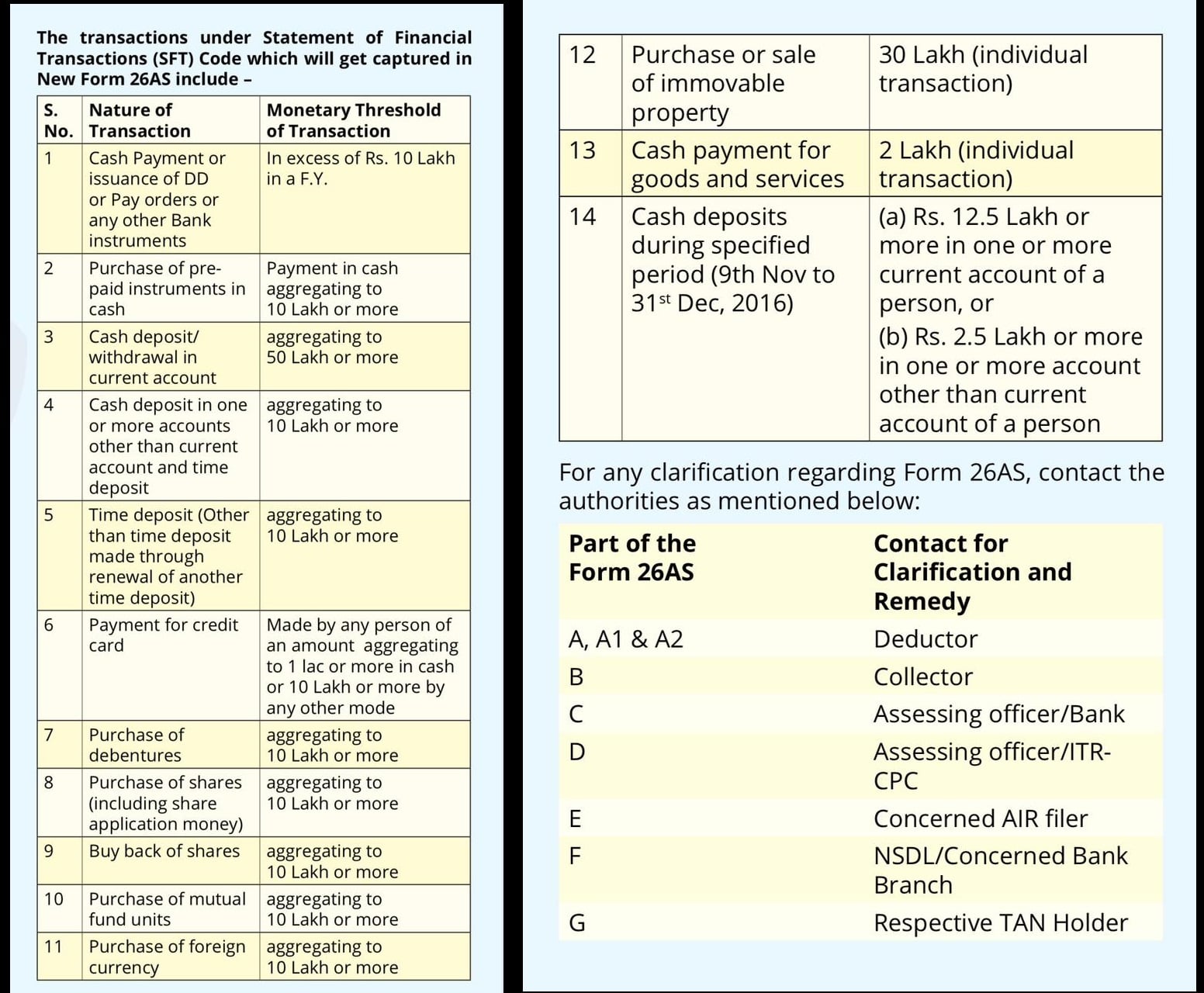

3. Information relating to specified financial transaction (Information of property and share transactions etc.)

4. Information relating to payment of taxes

5. Information relating to demand and refund.

6. Information relating to pending proceedings.

7. Information relating to completed proceedings.

8. Information received by Income Tax Department from any other country under the treaty/ exchange of information about income or assets of the taxpayer located outside India.

9. Further an enabling provision has been notified empowering the CBDT to authorize DG Systems or any other officer to upload in this form, information received from any other officer, authority under any law. Thus any adverse action initiated or taken or found or order passed under any other law such as custom, GST, Benami Law etc. including information about Turnover, import, export etc. may be made a part of Form 26AS.

Note: Form 26AS can be viewed from assessment year 2009–10 onwards. Form 26AS also shows current status of PAN (active/inactive/deleted).

USEFULNESS OF TAX CREDIT STATEMENT (FORM 26AS):

Following information is available in Form 26AS of a taxpayer which is helpful for him in furnishing his ITR and ensuring other tax compliances.

THE REASONS FOR NOT FINDING YOUR TAX-CREDITS IN 26AS CAN BE:

1. Tax collected by deductor not deposited in govt account.

2. TDS Return not filed by deductor.

3. Statement of tax deduction not filed with TDS Return.

4. Statement of tax deduction filed with wrong PAN which is not yours.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"