ITR Online Utility has finally been updated for getting an Income Tax Rebate benefit u/s 87A

CA Pratibha Goyal | Jan 9, 2025 |

Income Tax Rebate u/s 87A: ITR Utility updated again

The income Tax Department has again updated the Income Tax Return (ITR) filing utility to give allow benefit of Rebate, as per the interim order of the Bombay High Court on 24th December 2024.

Bombay High Court Judgment

The Bombay High Court ordered the Central Board of Direct Taxes (CBDT) to issue the requisite notification under Section 119 of the Act extending the due date for e-filing of the ITR from December 31, 2024, at least to January 15, 2025, to ensure that all taxpayers eligible for the rebate under Section 87A are allowed to exercise their statutory rights without facing procedural impediments.

Due Date Extension

As a result, the ITR filing due date for filing belated/ Revised Return for Financial Year 2023-24 was extended by the CBDT from December 31, 2024, to January 15, 2025.

ITR Utility Update

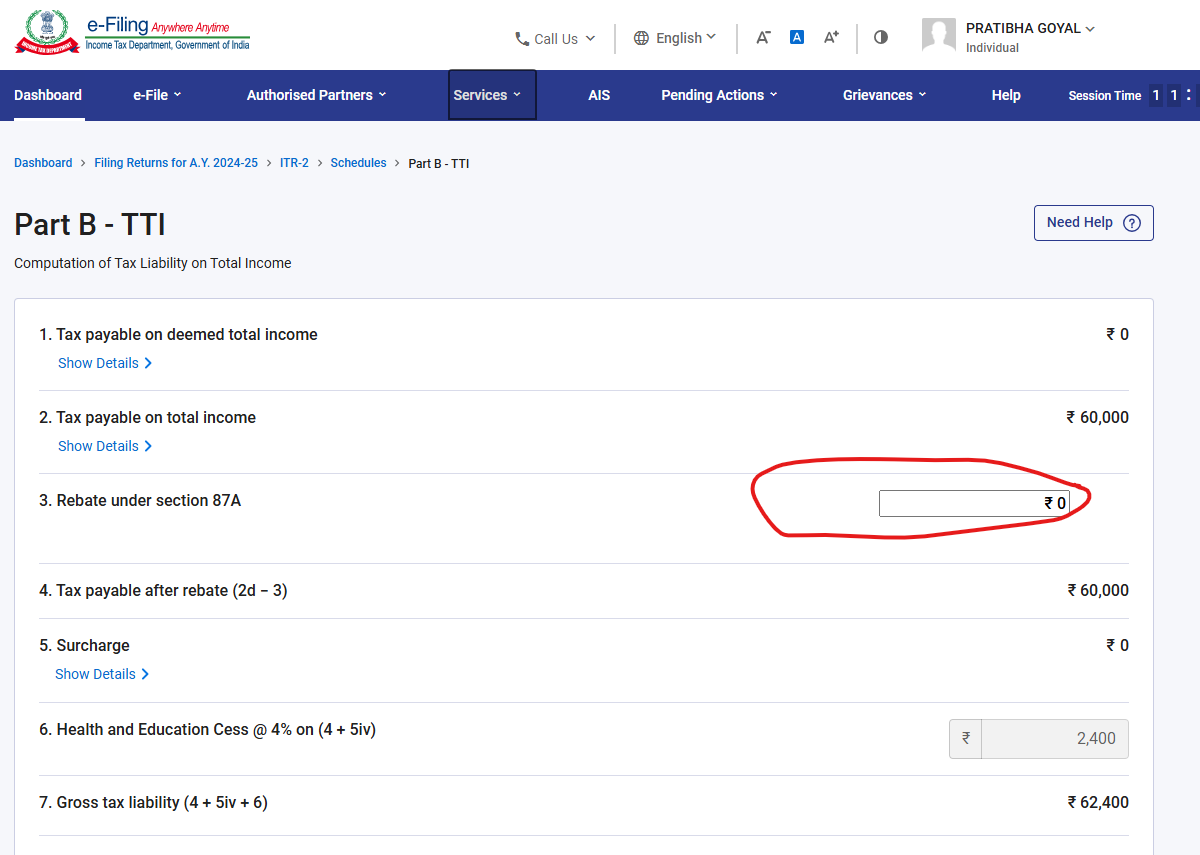

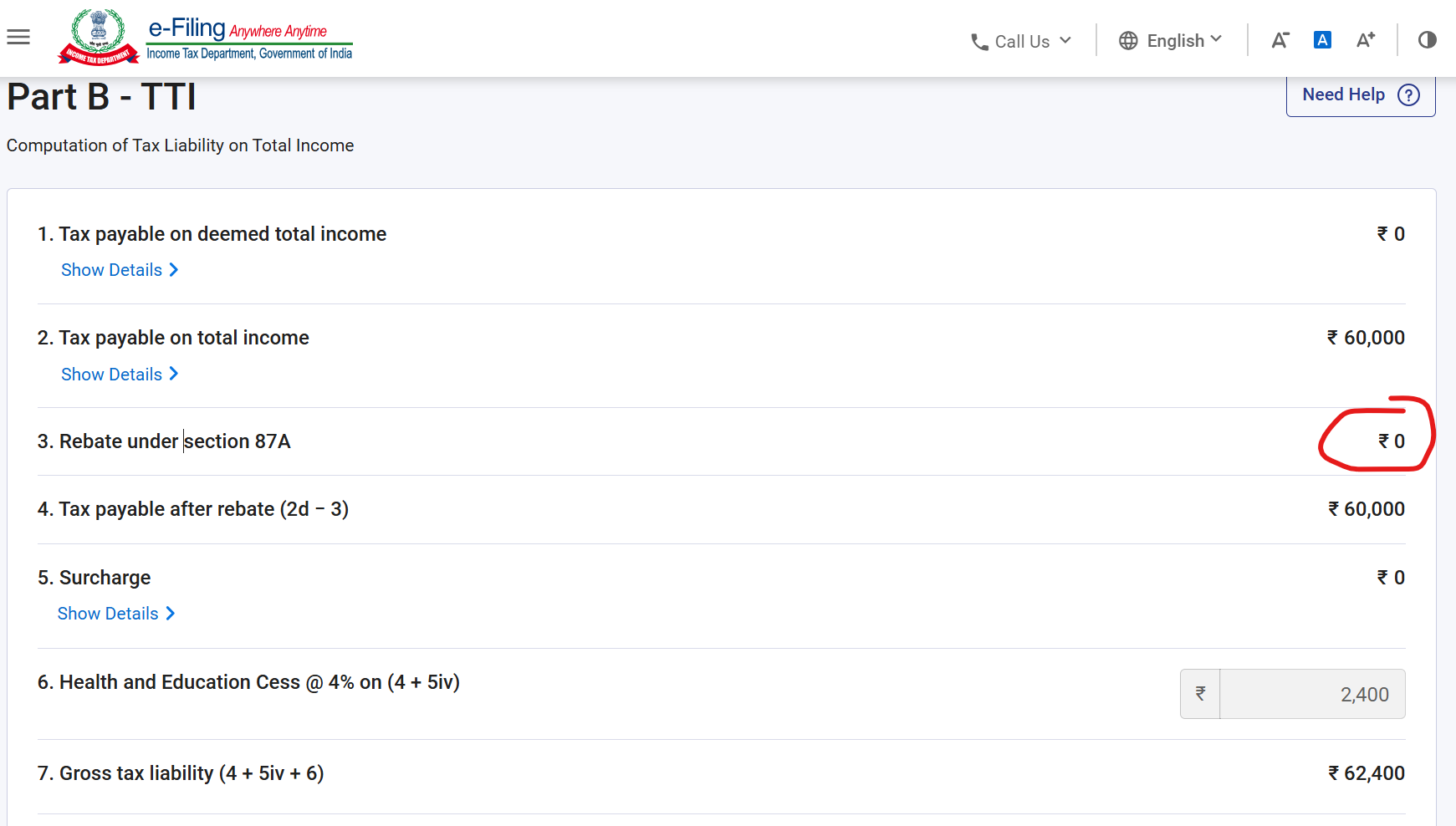

Now you have option to modify the Rebate Amount if you are revising the ITR via, Online mode.

This option was not present earlier.

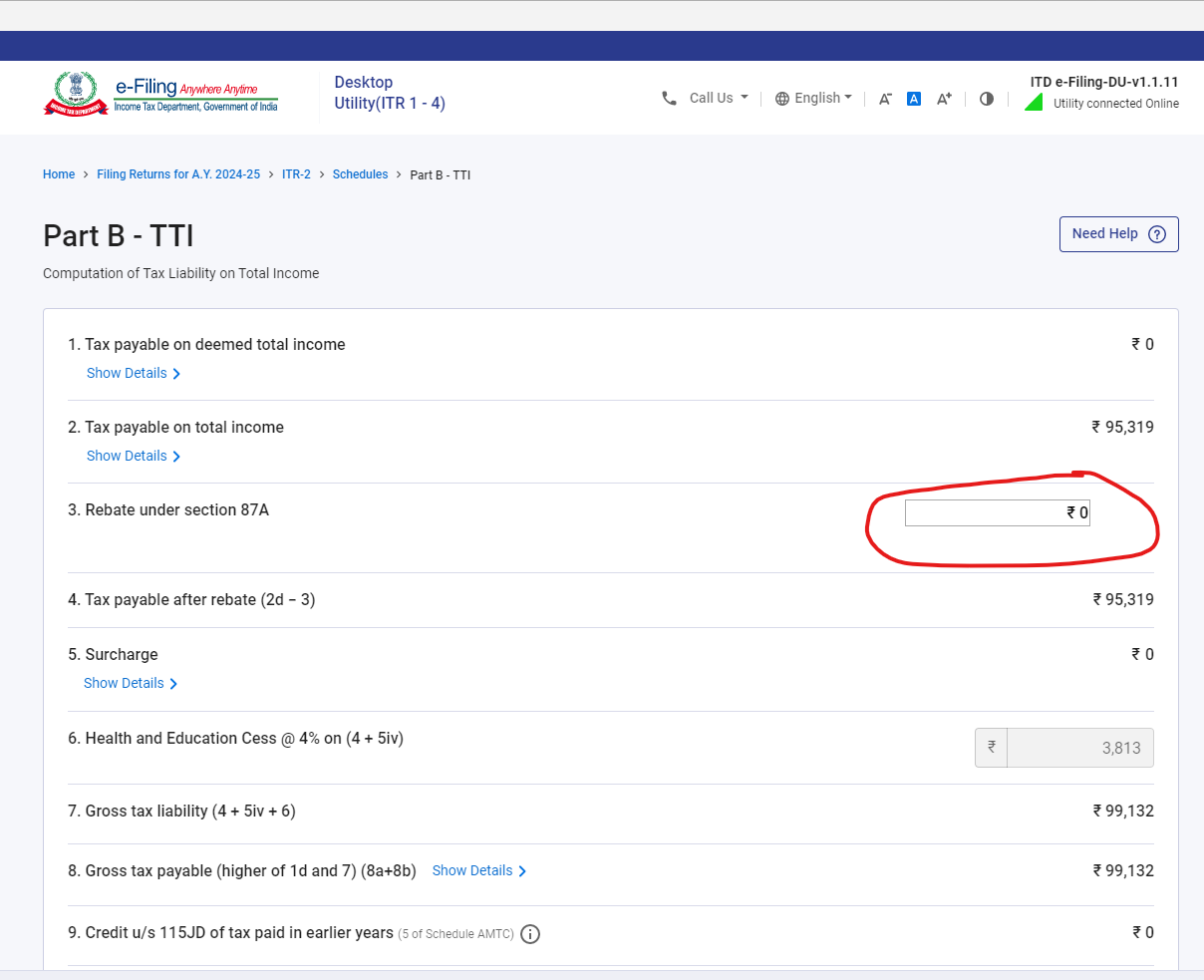

The same option is available on Common Offline Utility (ITR 1 to ITR 4) as well. Latest update of Common Offline Utility for filing Income-tax Returns ITR 1, ITR 2, ITR 3 and ITR 4 were released on 09-Jan-2025

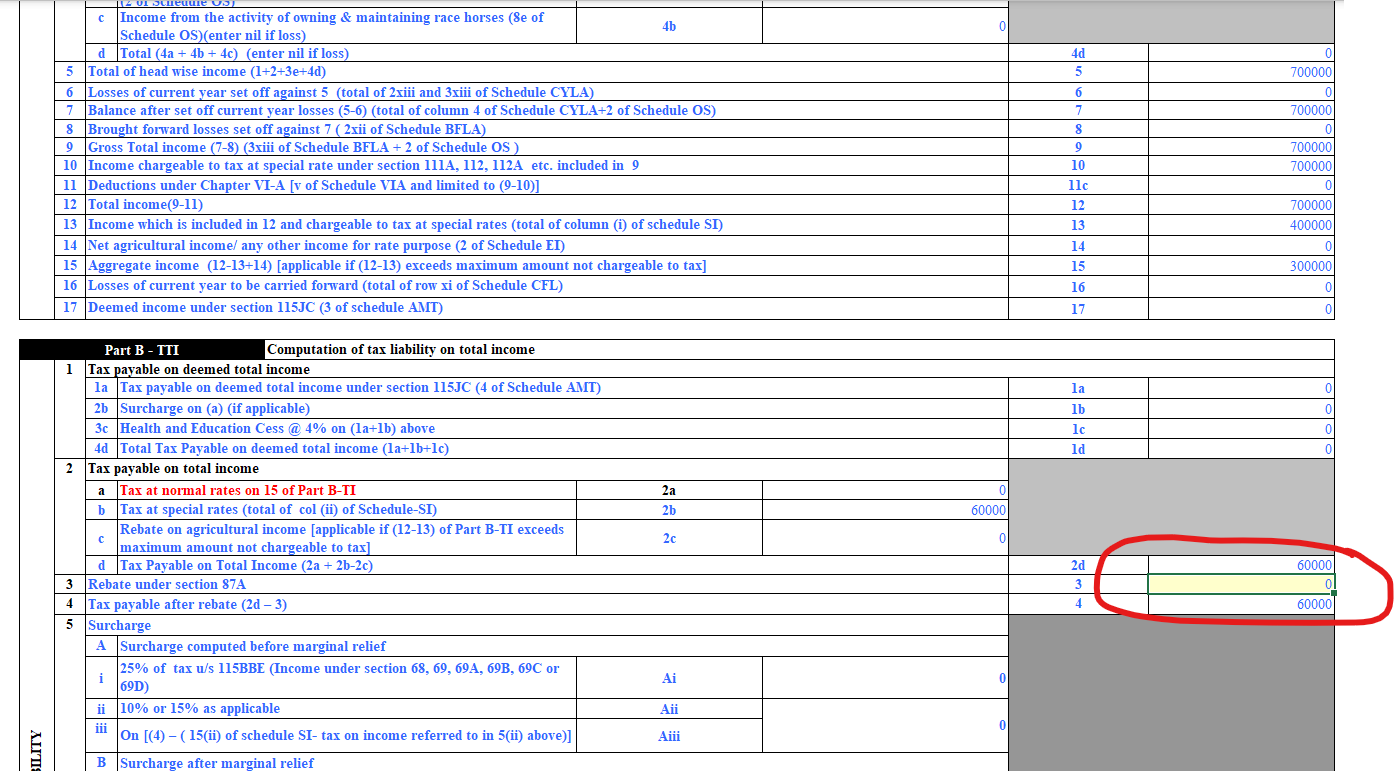

Latest update of Excel Utility for ITR-1 and ITR-4 were released on 01-Jan-2025

Latest update of Excel Utility for ITR-2 and ITR-3 were released on 04-Jan-2025

The latest version of the Excel utility now allows users to modify and update the rebate under Section 87A. However, the default tax calculation still does not provide the rebate on special rate income.

Users can manually modify the relevant field to avail of the Section 87A rebate on such income. This field was un-editable in earlier version of excel utility.

All those revising returns and taking benefit of the Income Tax Rebate should watch out for the final Judgement. The hearing for Final Disposal of the case has been adjourned to 10th Jan 25,as counsel for both the parties agreed to the same.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"