CA Pratibha Goyal | Jan 9, 2025 |

Did Panipuri Vala get Tax Notice for Rs. 40L: Let’s know the whole Truth

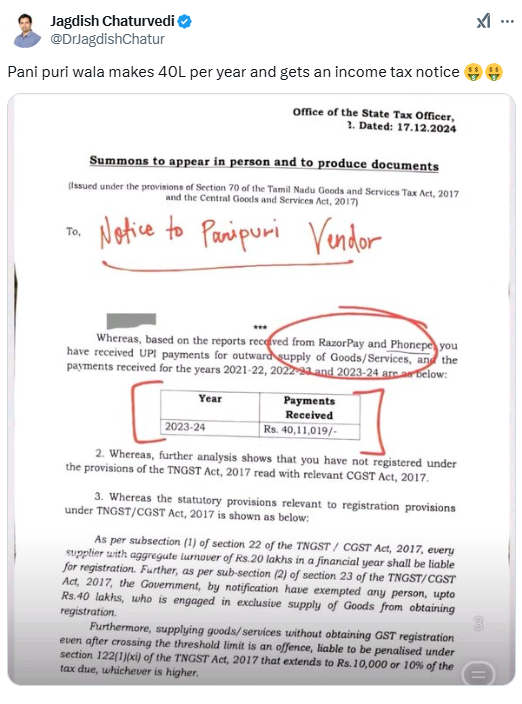

A few days ago, there was news on social media where a panipuri vendor in Tamil Nadu who makes an earning of Rs. 40 lakh per year gets a tax notice. It was claim on social media, that the vendor had received an Income Tax notice for earning Rs. 40 Lakhs.

As per the notice, “Based on the reports received from Razor Pay and Phonepe, you have received UPI payments for the outward supply of goods/services, and the payments received for the years 2021-22, 2022-23, and 2023-24 are Rs.40,11,019 in total,”.

First, it was an GST Notice, and not a Income Tax Notice. As per news sources, the notice was issued to a hotel vendor in Kanniyakumari. A source in the Tamil Nadu GST department said the notice was misrepresented and was to inform the vendor to get a GST registration certificate and come under the GST purview by getting a GST number to register his business. The source also said that the vendor agreed to the same.

Taking GST Registration is compulsory when your annual aggregate turnover (AATO) or yearly turnover exceeds Rs. 20 lakhs. In case you are exclusively dealing in goods, the yearly turnover limit for taking GST Number is Rs. 40Lakhs.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"