To give relief to small taxpayers from tedious job of maintenance of books of account and getting it audited, Income tax Act has framed Presumptive Taxation Scheme.

CA Pratibha Goyal | Sep 5, 2023 |

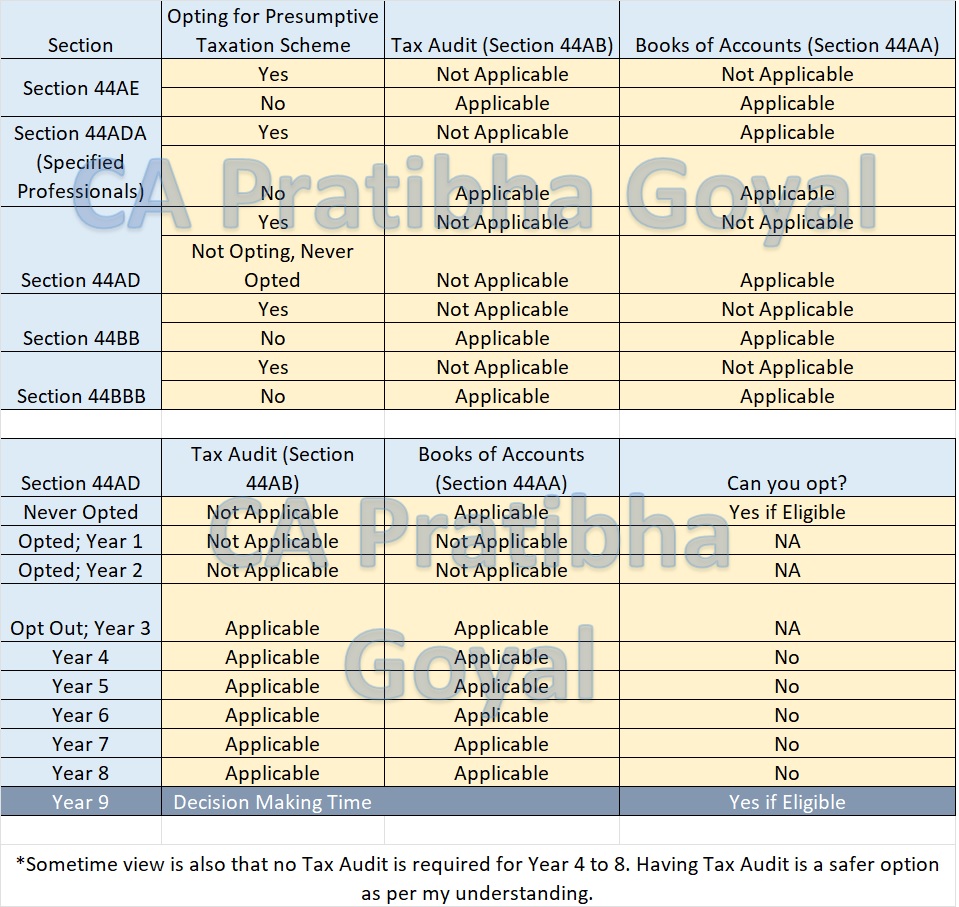

Interplay of Presumptive Taxation Scheme, Tax Audit and Maintaining Books of Accounts

Here is, the Interplay of the Presumptive Taxation Scheme (Section 44AD, Section 44ADA, Section 44BB, Section 44BBB, Section 44AE), Tax Audit Applicability (Section 44 AE), and Maintaining Books of Accounts (Section 44AA).

To give relief to small taxpayers from the tedious job of maintenance of books of account and getting the books of account audited, the Income tax Act has framed the Presumptive Taxation Scheme. The taxpayer adopting the Presumptive Taxation scheme can declare income at a prescribed rate instead.

However, the provisions are not as simple as it seems.

Please note that if the company is eligible for the Presumptive Taxation Scheme, the company will maintain Books of Accounts as per the Company Act 2013.

Category of assessees eligible for Presumptive Taxation u/s section 44AD:

An Individual, Hindu undivided family or a partnership firm, who is a resident, but not a limited liability partnership firm as defined under clause (n) of sub-section (1) of section 2 of the Limited Liability Partnership Act, 2008 (6 of 2009).

The eligible assessee must be carrying on any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE; and whose total turnover or gross receipts in the previous year does not exceed an amount of two crore rupees.

Category of Persons not eligible for Presumptive Taxation u/s 44AD.

Category of Persons Eligible for Presumptive Taxation u/s 44ADA

A person resident in India and engaged in the following professions-

whose gross receipts/turnover during the financial year does not exceed Rs. 50 Lakh.

Category of Persons eligible for Presumptive Taxation u/s 44AE

Any Person (i.e. an individual, HUF, firm, company, etc.) engaged in the business of plying, hiring, or leasing of goods carriages and who does not own more than 10 goods carriages at any time during the year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"