CA Pratibha Goyal | Oct 10, 2024 |

GST Annual Return: Optional Table for GSTR-9 FY 2023-24

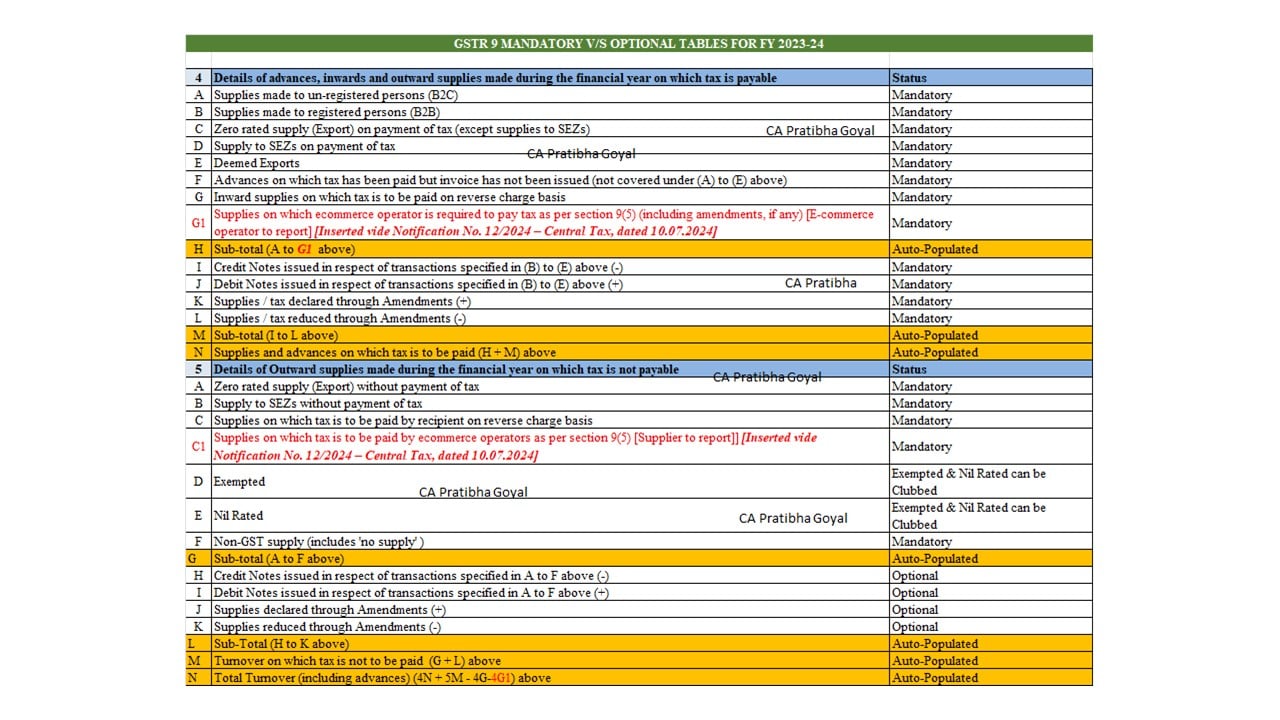

The GST Council has recommended that the relaxations provided in FY 2022-23 in respect of various tables of FORM GSTR-9 and FORM GSTR-9C be continued for FY 2023-24. Further, new rows have been inserted for the entries in respect of supplies made through E-Commerce operators.

Like last year, to ease the compliance burden on smaller taxpayers, exemption from filing of annual returns (in FORM GSTR-9/9A) for taxpayers having aggregate annual turnover upto two crore rupees, is to be continued for FY 2023-24 also.

GSTR-9 Optional Tables:

| GSTR 9 TABLES | |||||

| Table | Description | Reporting | |||

| FY 2020-21 | FY 2021-22 | FY 2022-23 | FY 2023-24 | ||

| 4I | Credit Notes in respect to Table 4B to Table 4E | Optional | Compulsory | Compulsory | Compulsory |

| 4J | Debit notes in respect to Table 4B to Table 4E | Optional | Compulsory | Compulsory | Compulsory |

| 4K & 4L | Amendments in respect to Table 4B to Table 4E | Optional | Compulsory | Compulsory | Compulsory |

| 5D | Exempted supplies | Option to report consolidated in 5D | Option to report consolidated in 5D | Option to report consolidated in 5D | Option to report consolidated in 5D |

| 5E | Nil Rated supplies | Option to report consolidated in 5D | Option to report consolidated in 5D | Option to report consolidated in 5D | Option to report consolidated in 5D |

| 5F | Non-GST supplies | Option to report consolidated in 5D | Compulsory | Compulsory | Compulsory |

| 5H | Credit Notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E and 5F | Optional | Optional | Optional | Optional |

| 5I | Debit Notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E and 5F | Optional | Optional | Optional | Optional |

| 5J & 5K | Amendments in respect to supplies declared in 5A, 5B, 5C, 5D, 5E and 5F | Optional | Optional | Optional | Optional |

| 6C | Aggregate value of input tax credit availed on all inward supplies received from unregistered persons (other than import of services) on which tax is payable on reverse charge basis shall be declared here | Option to report consolidated in 6D | Compulsory | Compulsory | Compulsory |

| 6D | Aggregate value of input tax credit availed on all inward supplies received from registered persons on which tax is payable on reverse charge basis shall be declared here | Option to report consolidated in 6D | Compulsory | Compulsory | Compulsory |

| 6E | Import of goods (including supplies from SEZ) | Compulsory | Compulsory | Compulsory | Compulsory |

| 6F | Import of services (excluding inward supplies from SEZs) | Compulsory | Compulsory | Compulsory | Compulsory |

| 6G | Input Tax credit received from ISD | Compulsory | Compulsory | Compulsory | Compulsory |

| 6H | Amount of ITC availed, reversed and reclaimed (other than B above) under the provisions of the Act | Compulsory | Compulsory | Compulsory | Compulsory |

| 6K | Transition Credit through TRAN-1 (including revisions if any) | Compulsory | Compulsory | Compulsory | Compulsory |

| 6L | Transition Credit through TRAN-2 | Compulsory | Compulsory | Compulsory | Compulsory |

| 6M | Any other ITC availed but not specified above (Form ITC-01 and ITC-02) | Compulsory | Compulsory | Compulsory | Compulsory |

| 7A, 7B, 7C, 7D, 7E, 7F, 7G and 7H | Details of ITC Reversed and Ineligible ITC for the financial year | Option to report consolidated in 7H. However, reversals on account of TRAN-1 credit (Table 7F) and TRAN-2 (Table 7G) are to be mandatorily reported. | Option to report consolidated in 7H. However, reversals on account of TRAN-1 credit (Table 7F) and TRAN-2 (Table 7G) are to be mandatorily reported. | Option to report consolidated in 7H. However, reversals on account of TRAN-1 credit (Table 7F) and TRAN-2 (Table 7G) are to be mandatorily reported. | Option to report consolidated in 7H. However, reversals on account of TRAN-1 credit (Table 7F) and TRAN-2 (Table 7G) are to be mandatorily reported. |

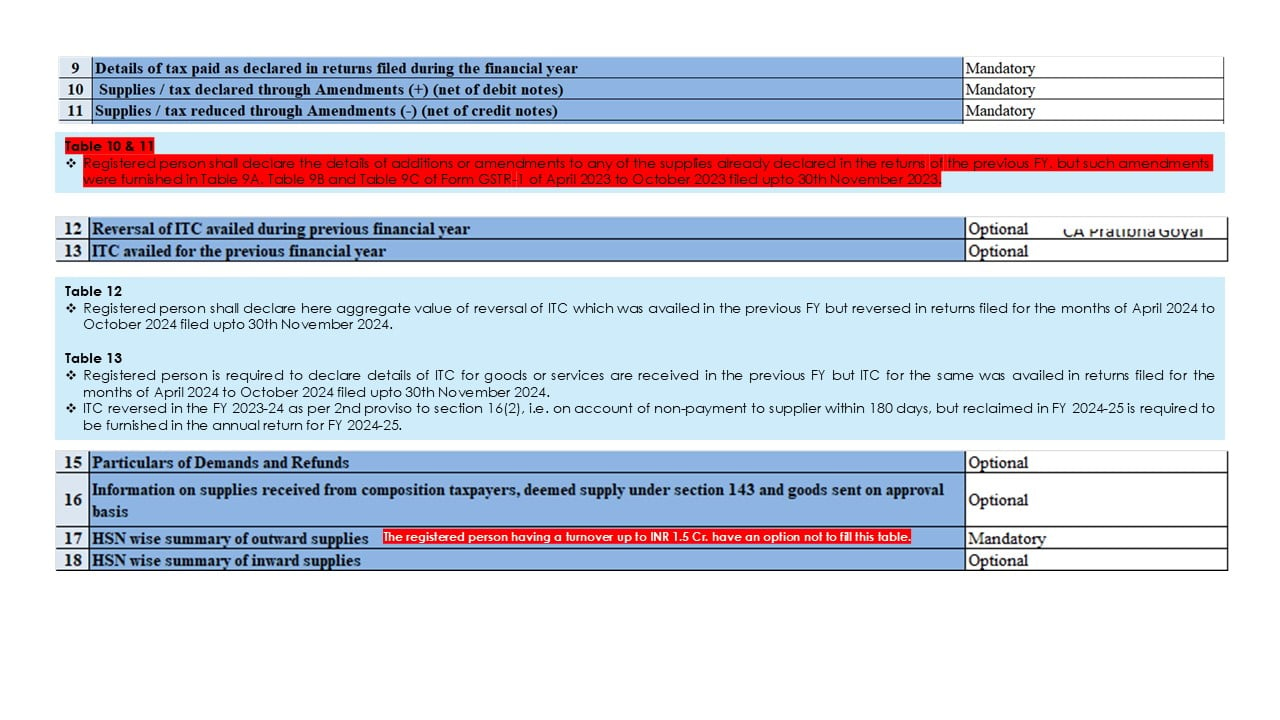

| 10 & 11 | Supplies / tax declared through Amendments (+) (net of debit notes) | Compulsory | Compulsory | Compulsory | Compulsory |

| 12 | Reversal of ITC availed during previous financial year | Optional | Optional | Optional | Optional |

| 13 | ITC availed for the previous financial year | Optional | Optional | Optional | Optional |

| 15A, 15B, 15C and 15D | Aggregate value of refunds claimed, sanctioned, rejected and pending for processing | Optional | Optional | Optional | Optional |

| 15E, 15F and 15G | Aggregate value of demands of taxes | Optional | Optional | Optional | Optional |

| 16A, 16B and 16C | Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on approval basis | Optional | Optional | Optional | Optional |

| 17 | HSN wise summary of outward supplies | Optional | Compulsory | Compulsory | Compulsory |

| 18 | HSN wise summary of inward supplies | Optional | Optional | Optional | Optional |

Details of Outward supplies made during the financial year:

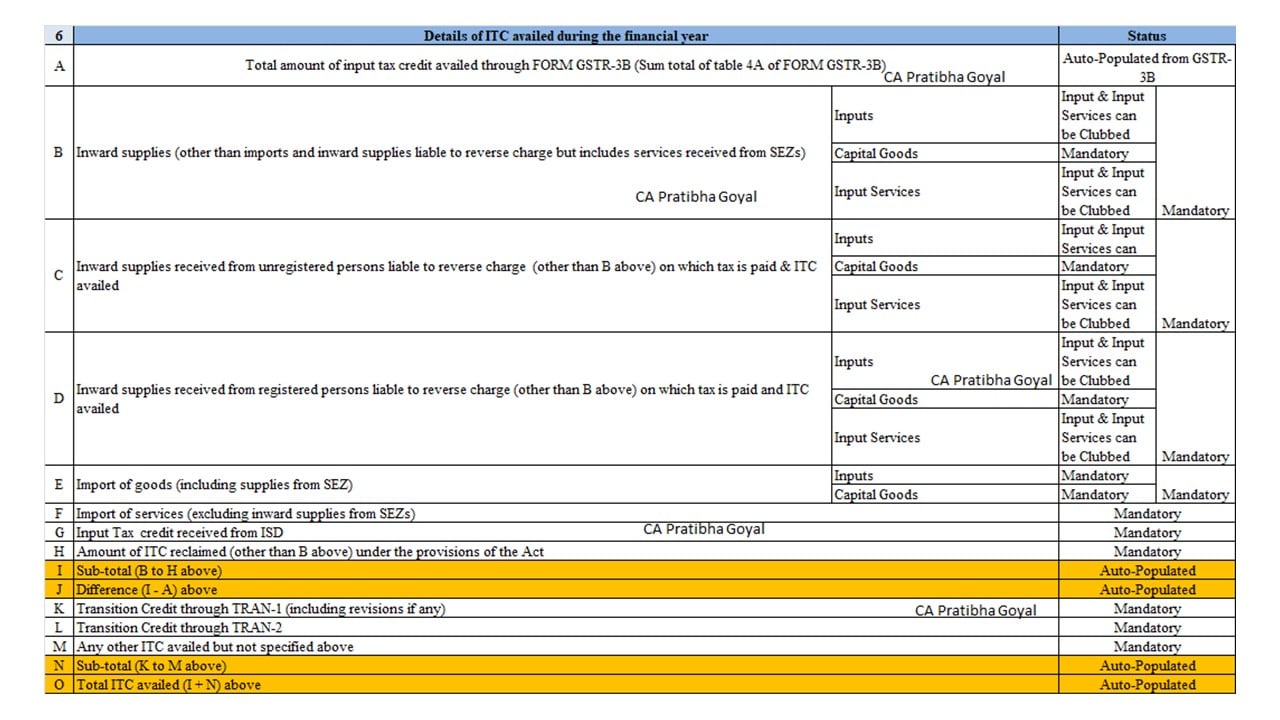

Details of ITC availed during the financial year:

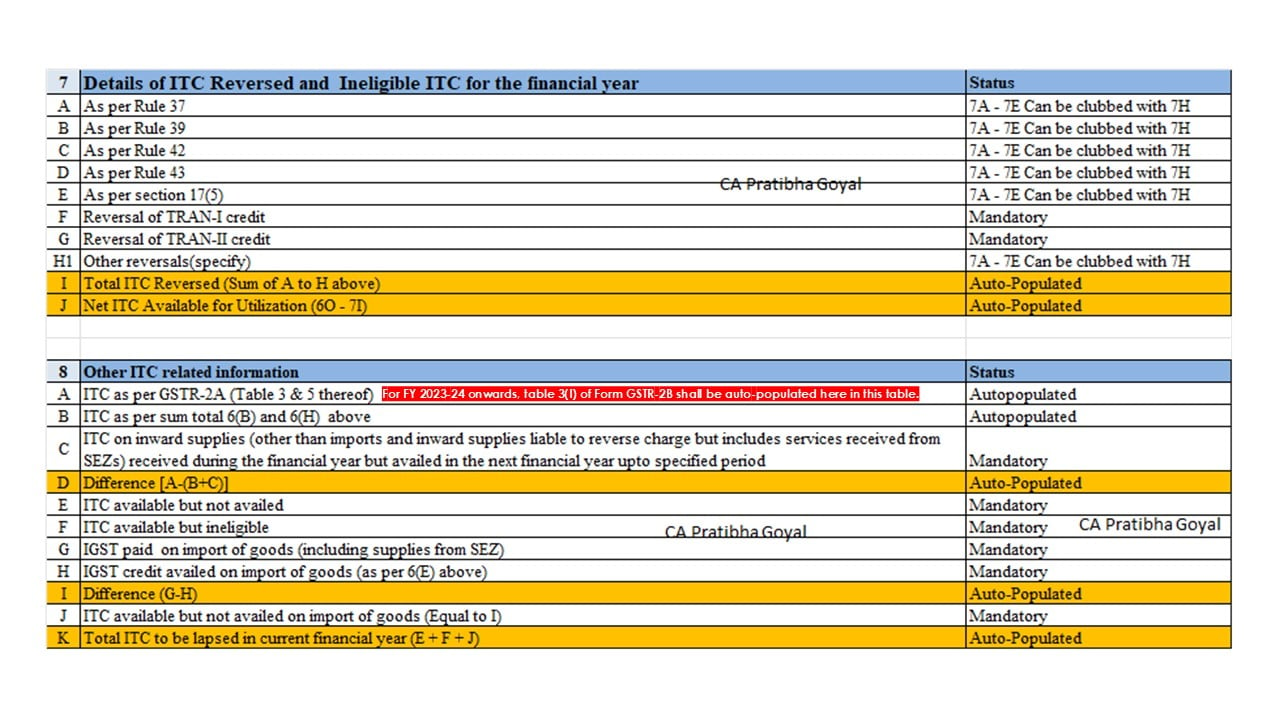

ITC Reversed and Other ITC-related information:

Other Tables:

These changes were notified by Notification No. 12/2024-Central Tax, Dated 10-07-2024.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"