Reetu | Dec 18, 2023 |

CBIC urges taxpayers to File GST Annual Returns on and before Due Date

The Central Board of Indirect Taxes and Customs (CBIC) has urged taxpayers to File GST Annual Returns on and before the Due Date.

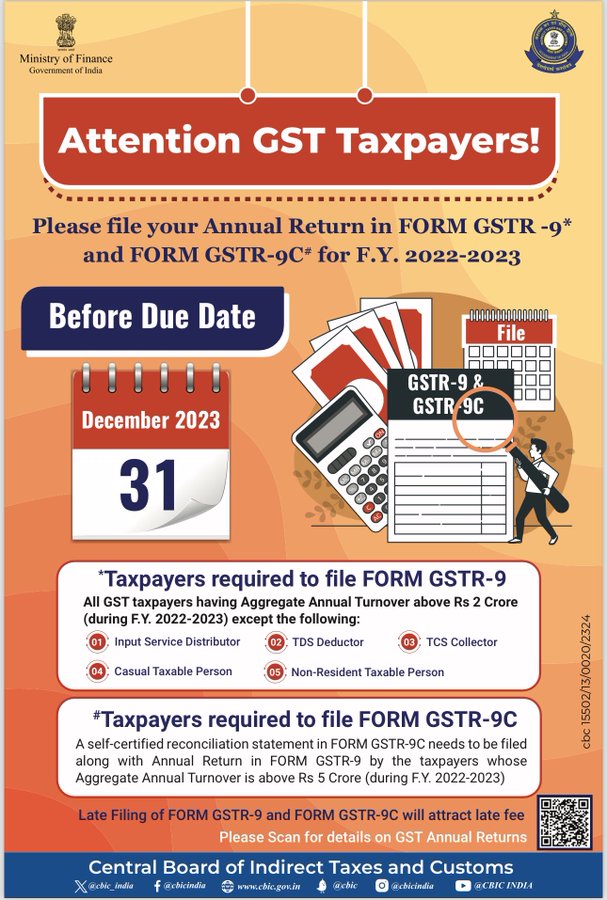

CBIC on his Twitter wrote, “File your Annual Return in Form GSTR-9 and Form GSTR-9C before the due date.”

Attention GST Taxpayer! Please file your Annual Return in FORM GSTR-9 and FORM GSTR-9C for FY 2022-23. The due date to File Form GSTR-9 and 9C is 31st December, 2023. Late Filing of FORM GSTR-9 and GSTR-9C will attract a late fee.

All GST Taxpayers having Aggregate Turnover above Rs.2 Crore (during F.Y. 2022-23) except the following:

1. Input Service Distributor

2. TDS Deductor

3. TCS Collector

4. Casual Taxable Person

5. Non-Resident Taxable Person

A self-certified reconciliation statement in FORM GSTR-9C needs to be filed along with the Annual Return in FORM GSTR-9 by the taxpayers whose Aggregate Annual Turnover is above Rs 5 Crore (during F.Y. 2022-2023).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"