The Income Tax Department has launched the Demand Facilitation Centre (DFC) to facilitate the resolution of outstanding tax demand(s).

Reetu | Dec 23, 2023 |

Income Tax Helpline for resolving issue of Tax Refund being adjusted with old incorrect demands

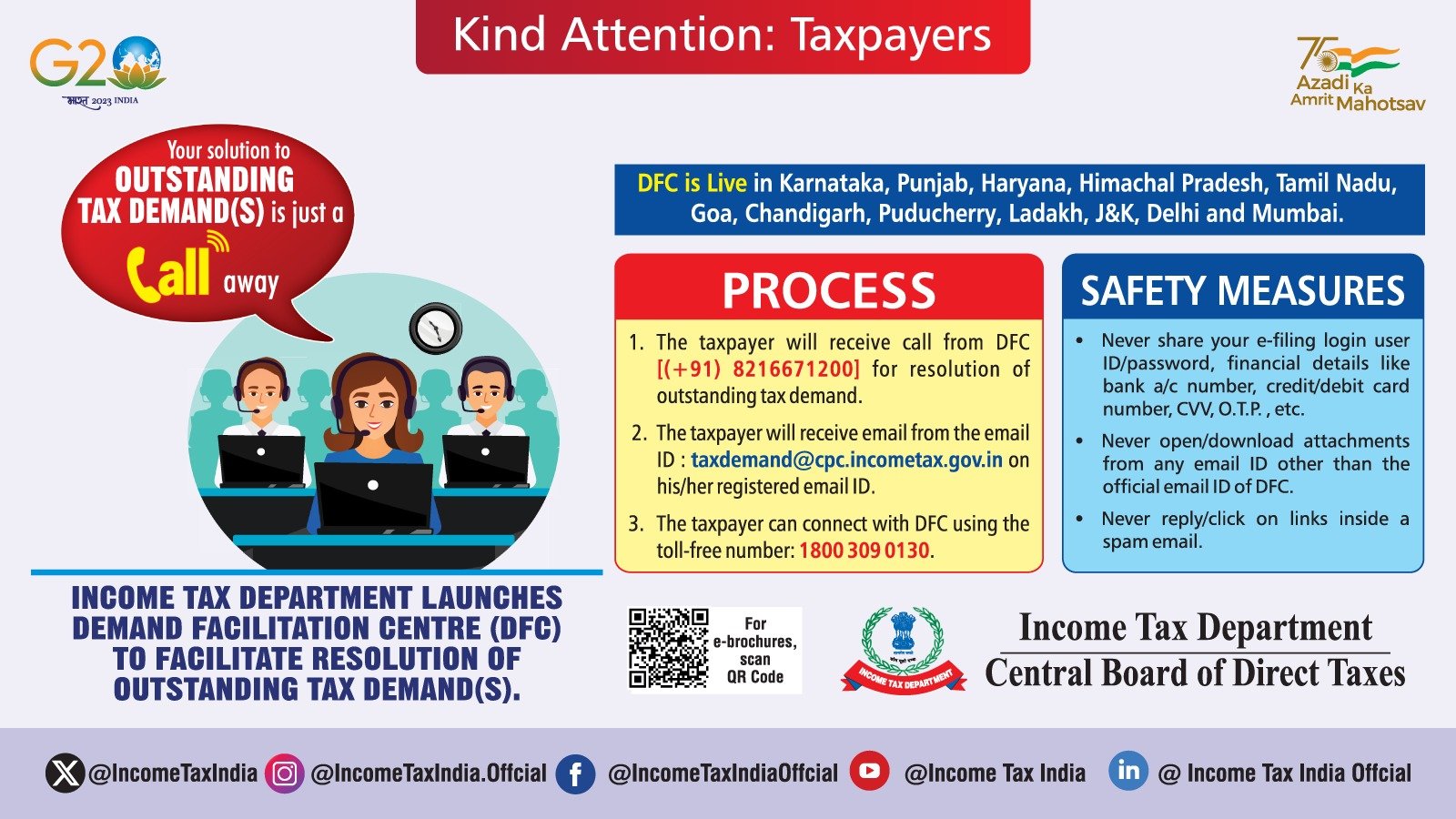

The Income Tax Department has launched the Demand Facilitation Centre (DFC) to facilitate the resolution of outstanding tax demand(s).

DFC is a solution to all Outstanding tax demands which is just a call away.

DFC is Live in Karnataka, Punjab. Haryana, Himachal Pradesh, Tamil Nadu, Goa, Chandigarh, Puducherry, Ladakh, Jammu and Kashmir, Delhi and Mumbai.

Pl note that the taxpayer/tax professional may receive:

1. Call from DFC from this number: +91 8216671200

2. Email from the email ID: [email protected] to facilitate resolution of outstanding demand.

1 The taxpayer will receive a call from DFC [(+91) 82166712001] for resolution of outstanding tax demand.

2. The taxpayer will receive an email from the email ID: [email protected] on his/her registered email ID.

3. The taxpayer can contact DFC by dialling 1800 309 0130, which is a toll-free number.

1. Never share your e-filing login user ID/password and financial details like bank a/c number, credit/debit card number, CW, O.T.P., etc.

2. Never open or download attachments from any email address other than DFC’s official email address.

3. Never reply/click on links inside a spam email.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"