The AGFTC and ITBA write to Hon’ble Finance Minister about the IT Portal Glitches, Issue of Rebate u/s 87A and Extend Due date for Filing of ITRs.

Reetu | Jul 15, 2024 |

Extend Due Date of Filing Income Tax Return for AY 2024-25; Request due to IT Portal Glitches

The All Gujarat Federation of Tax Consultants and Income Tax Bar Association has written to Smt. Nirmala Sitharaman, Hon’ble Finance Minister about the Income Tax Portal Glitches, Issue of Rebate u/s 87A and Extend Due date for Filing of Income Tax Returns.

(a) Issue:

This is to bring to your kind notice that after an update in the ITR online utility post 5th July, the utility is not giving the benefit of rebate u/s 87A for the tax on short-term capital gain on shares u/s 111A and other special rate incomes. Before 5th July, the same utility and calculator were allowing rebate u/s 87A against the tax on short-term capital gain on shares u/s 111A and other special rate incomes other than long-term capital gain u/s 112A where such rebate is specifically barred by the sub-section (6) of the section 112A itself.

In our humble opinion and as per the intention of the law in providing the rebate u/s 87A, the behaviour of the system is incorrect and the same should be rectified at the earliest considering that it impacts a huge number of taxpayers especially when the exchequer needs to broaden the taxpayers base in India. During the last days of filing Income Tax Returns for which the due date is 31st July, such confusion adds fuel to the fire.

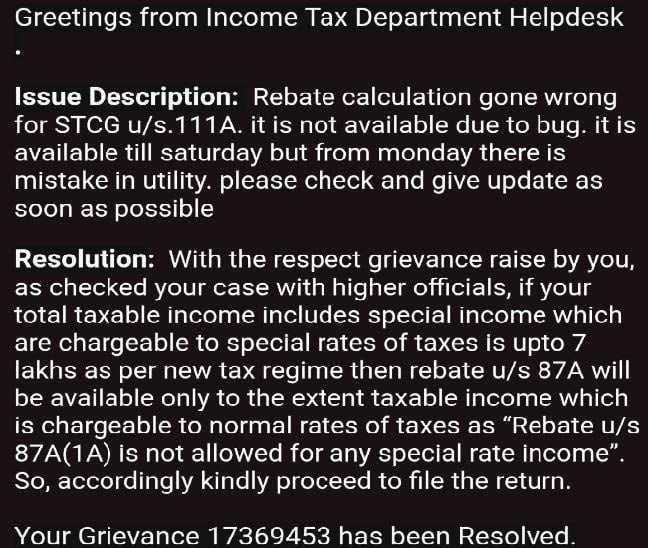

(b) Reasoning by Grievance Resolution of Income Tax Helpdesk:

There is one grievance resolution circulating on social media claimed to be from the Income Tax Helpdesk quoting higher officials, which says that the proviso to section 87A restricts the rebate on special rate income, hence not allowing for tax on short-term capital gain u/s 111A. A screenshot of the same is attached below.

(c) Analysis of such action in light of law & intention of law:

Budget Speech 2023:

During the budget speech of 2023, the Hon’ble Finance Minister declared an increase in the rebate u/s 87A from Rs.12,500 to Rs.25,000 in case of a new regime as a booster benefit for Taxpayers, without adding any additional restriction. Up to AY 2023-24, rebate u/s 87A was being allowed against tax on STCG u/s 111A and other special rate income (except LTCG u/s 112A).

The excerpts from the budget speech are as under:

Page No. 33, Point No. 146. read as under:

“146. – The first one concerns rebate. Currently, those with income up to Rs.5 lakh do not pay any income tax in both old and new tax regimes. I propose to increase the rebate limit to Rs.7 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to Rs.7 lakh will not have to pay any tax.”

Page No. 35 containing Annexure to Part B of the Budget Speech 2023-24, Amendments relating to Direct Taxes, Point No. A.5 read as under:

“A.5 – Resident individuals with total income up to Rs. 5,00,000 do not pay any tax due to rebate under both the old and new regimes. It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to Rs. 7,00,000.”

Intention of Law (Memorandum Explaining the Provisions in the Finance Bill, 2023)

Memorandum Page 12, Point IV. reads as under:

IV. Rebate under section 87A

Under the provisions of section 87A of the Act, an assessee, being an individual resident in India, having a total income not exceeding Rs 5 lakh, is provided a rebate of 100 per cent of the amount of income-tax payable i.e., an individual having income till Rs 5 lakh is not required to pay any income-tax.

From the assessment year 2024-25 onwards, an assessee, being an individual resident in India whose income is chargeable to tax under the proposed sub-section (1A) of section 115BAC, shall now be entitled to a rebate of 100 per cent of the amount of income-tax payable on a total income not exceeding Rs 7 lakh.

[Clause 2, 43, 50, 52, 55, 56 & the First Schedule]

Though the language of the memorandum does not express clearly, the intention seems to provide the rebate in the same manner as it is available to individuals having an income of Rs. 5 lakhs (under the old regime).

Amendment in the Finance Bill 2023

Clause 43 of the Finance Bill 2023 reads as under:

inserted with effect from the 1st day of April 2024, namely:––

“Provided that where the income-tax payable on the total income of the assessee is computed under sub-section (1A) of section 115BAC, this section shall have the effect as if,––

(a) for the words “five hundred thousand rupees”, the words “seven hundred thousand rupees”;

(b) for the words “twelve thousand and five hundred rupees”, the words “twenty-five thousand rupees”

had been substituted.’.”

The wording in the bill is in line with the intention of the law i.e. increasing the monetary limit for rebate eligibility and rebate amount.

Amendments by the Finance Act 2023 & Introduction of the proviso

In the Finance Act, the proviso was introduced with different wordings (as mentioned below) but that seems to be inserted to give BENEFIT OF MARGINAL RELIEF which was not available till the preceding assessment years.

The proviso proposed in the Finance Bill was only modified while incorporating in the Act for giving Marginal relief benefits and actually correcting a long-time flaw in tax computations and not for restricting any benefit that is already available.

To wrongly interpret the new proviso for restricting rebates can only be termed as injustice towards lakhs of honest taxpayers.

Clause 44 of the Finance Act reads as under:

“44. In section 87A of the Income-tax Act, the following proviso shall be inserted with effect from the 1st day of April 2024, namely:—

”Provided that where the total income of the assessee is chargeable to tax under sub-section (1A) of section 115BAC, and the total income—

(a) does not exceed seven hundred thousand rupees, the assessee shall be entitled to a deduction from the amount of income tax (as computed before allowing for the deductions under this Chapter) on his total income with which he is chargeable for any assessment year, of an amount equal to one hundred per cent. of such income tax or an amount of twenty-five thousand rupees, whichever is less;

(b) exceeds seven hundred thousand rupees and the income tax payable on such total income exceeds the amount by which the total income is in excess of seven hundred thousand rupees, the assessee shall be entitled to a deduction from the amount of income tax (as computed before allowing the deductions under this Chapter) on his total income, of an amount equal to the amount by which the income-tax payable on such total income is in excess of the amount by which the total income exceeds seven hundred thousand rupees.”.”

Specific Provision in 112A

Rebate u/s 87A is not available on tax on LTCG u/s 112A and the same has been specifically mentioned in Section 112A(6). Nothing of that sort is mentioned in Section 111A or any other special rate section for that matter.

(d) Wordings of the sub-section (1A) of Section 115BAC

The sub-section (1A) of section 115BAC provides for the income tax payable in respect of the total income of a person, and NOT on the income of the person at a normal rate.

The total income is inseparable as it comes after inter-head adjustments. Also, the interpretation that is not in line with the general nature of the calculation of tax on the total income for such a long time, is grossly incorrect.

(e) Representation & Request:

In light of the above-mentioned points, we humbly request you to consider the facts and hardship to genuine and honest taxpayers and provide clarification and immediate amendments in the utility on the Income Tax Portal.

We Also, request you to issue an immediate circular to the effect that, the processing of income tax returns shall be done in accordance with the intention of the law in providing rebate u/s 87A in the new regime in all special rate incomes including u/s 111A.

When the new portal was introduced, it had many glitches but last year, it functioned smoothly and gave satisfactory results. The Tax Professionals & Taxpayers community admired it.

Technical Glitches on the Portal:

It is also to bring to your attention that once again the Income Tax Portal has not functioning properly for almost a month by now. There are many glitches like –

are being faced constantly by the taxpayers.

The department addresses the issues through the grievances redressal mechanism and also by providing many answers to the queries raised on the official handle on X (formerly known as Twitter) through its handle @IncomeTaxIndia.

There are so many issues where this handle has given standard replies stating There seem to be some intermittent issues. We have flagged them to the team concerned. The technical team is working to resolve the issues. However, please share your details (with PAN and mobile no.) at [email protected] for our team to assist.

The smooth functioning of the e-filing portal is critical to the filing of Income Tax Returns. Nowadays, professionals need to engage with data from the portal multiple times before filing an Income Tax Return. Verification time has been reduced to 30 days and Aadhar OTP is one of the most preferred mediums for e-verification of returns. From the current year, the need for DSC is removed even in the case of audited individuals, where Aadhar OTP is required.

Till the time the portal doesn’t function smoothly, the extension of the due date or any other gesture by the government related to relief in late fees or interest is going to be in vain.

In light of the portal not functioning properly and heavy reporting requirements, you are kindly requested to:

(a) Instruct the technical team, the vendor and officials responsible for maintenance of the portal to ensure that it functions smoothly just like last year which can cater for the increasing taxpayer base.

and

(b) Extend the due date for Assessment Year 2024-25 from 31st July 2024 to 31st August 2024.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"