The Income Tax Department has released the key Highlights of the Finance Bill, 2024.

Reetu | Feb 3, 2024 |

IT Department released Key Highlights of Finance Bill 2024

The Income Tax Department has released the key Highlights of the Finance Bill, 2024.

The Highlights are:

No changes in tax rates are proposed by Finance Bill, 2024.

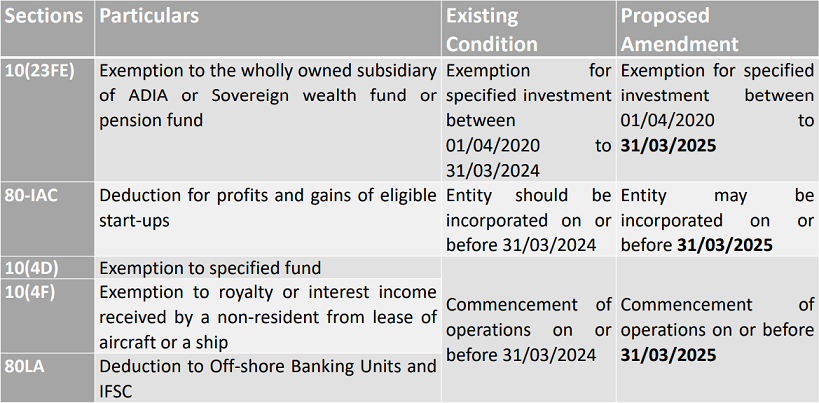

The following amendments are proposed for deductions/ exemptions:

To implement the faceless regime in Section 92CA, Section 144C, Section 253 and Section 255, it was provided that the CBDT shall issue the necessary directions by 31/03/2024.

It is proposed to amend the aforesaid Sections to allow the issue of necessary directions by 31/03/2025.

The following faceless schemes are covered in the above sections:

The Finance Bill proposes the necessary amendments to Section 206C(1G) to restore the threshold of INR. 7 lakhs per financial year for TCS on all categories (except the sale of overseas tour program packages) of foreign remittances made under the Liberalised Remittance Scheme (LRS) w.e.f. 01-10-2023.

In the case of ‘sale of overseas tour program package’, the TCS rate shall be 5% for remittances up to INR 7 lakh, and 20% for remittances exceeding INR 7 lakhs.

The Finance Bill, 2024 proposes to insert the sixth proviso to provide that the collection of tax at source during the period 01-07-2023 to 30-09-2023 shall be in accordance with provisions of Section 206C(1G) as they stood on 01-04-2023.

In the budget speech, Hon’ble Finance Minister proposed to withdraw or waive off the small, unresolved, unverified, or disputed direct tax demands pertaining to the financial years up to 2014-15.

The proposal aims to waive off the recovery of the old outstanding demands up to INR 25,000 for the period up to financial year 2009-10 and up to INR 10,000 for financial years 2010-11 to 2014-15

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"