The Minister of State has answered questions asked in Lok Sabha that 2,16,217 Individuals reported income of more than Rs.1 Cr in ITR.

Reetu | Feb 7, 2024 |

2,16,217 Individuals reported income of more than Rs.1 Cr in ITR

The Minister of State in the Ministry of Finance Shri Pankaj Chaudhary has answered to questions asked in Lok Sabha that 2,16,217 Individuals reported income of more than Rs.1 Cr in ITR.

The Minister Smt. Phulo Devi Netam asked the following questions in Lok Sabha:

(a) the number of persons having annual income exceeding rupees one crore in the country, the details thereof for the last five years;

(b) the number of professional taxpayers out of such people, the details thereof for the last five years; and

(c) the details of efforts being made by the Government to increase the number of taxpayers?

The Minister of State in the Ministry of Finance Shri Pankaj Chaudhary replied:

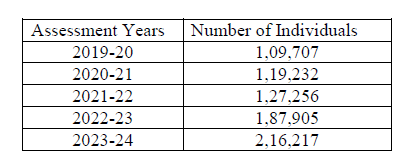

(a) The assessment-year-wise number of individuals submitting an e-Return with returned income of more than Rs. 1 crore is as under:

Note: The e-Returns of AY 2019-20 and AY 2020-21 have been taken up to 31 May 2021 and the e-Returns of AY 2021-22, 2022-23 and 2023-24 have been taken up to 31-Dec-2023.

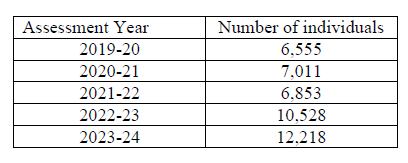

(b) Total number of individuals reporting ‘Profession’ as one of their nature of business is as under:

Note: (i) ITR-1 and ITR-2 do not have an option for specifying the nature of business in these ITRs.

(ii) Annual income includes both professional and other sources of income.

(c) Efforts made by the Government to increase the number of taxpayers are as under –

(i) New Form 26AS – This new form comprises all information related to tax deduction or collection at the source, specified financial transactions (SFT), tax payment, demand and refund, and so on. Furthermore, Form 26AS includes specifics of SFT data, which informs taxpayers about their transactions in advance and encourages them to reveal their genuine income.

(ii) Pre-filling of Income-tax Returns – Individual taxpayers have been issued with pre-filled Income Tax Returns (ITR) to facilitate tax compliance. Salary income, bank interest, dividends, and other financial information are among the items covered by the pre-filing requirements.

(iii) Updated Return – Section 139(8A) of the Income-tax Act of 1961 (the Act) allows the taxpayer to alter his return at any time within two years of the end of the relevant assessment by voluntarily acknowledging omissions or mistakes and paying any additional tax that may be applicable. Furthermore, an e-verification programme was introduced to allow taxpayers to disclose any unreported or under-reported income in the amended ITR.

(iv) Reduction in the Corporate tax rate – Corporate tax rates have been gradually cut since the Finance Act of 2016, while exemptions and incentives for corporations have been phased out in order to grow the tax base.

(v) Simplification of the Personal Income Tax – Individual taxpayers who do not qualify for specific exemptions and incentives can now pay income tax at lower slab rates under the Finance Act of 2020.

(vi) Expansion of scope of TDS/ TCS – To bring additional taxpayers into the income-tax net, the scope of TDS/TCS was broadened to include large cash withdrawals, international remittances, the purchase of a luxury car, e-commerce participants, the sale of products, the acquisition of immovable property, the purchase of an overseas tour programme package, and so on.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"