Reetu | Apr 10, 2024 |

GST Portal Enhanced Capacity Struggles: Even after more than 5 years of GST

The Goods and Services Tax (GST) portal has been experiencing significant technical issues for nearly 7 years, with the most recent glitches causing irritation among taxpayers attempting to file their tax returns.

The portal, overburdened by excessive demand, has been unable to handle the load, resulting in login difficulties, the returns module not working, and the site not working properly.

Despite repeated complaints and concerns made by taxpayers, the government has yet to solve this reoccurring issue, prompting a call for immediate action to ensure a seamless filing procedure.

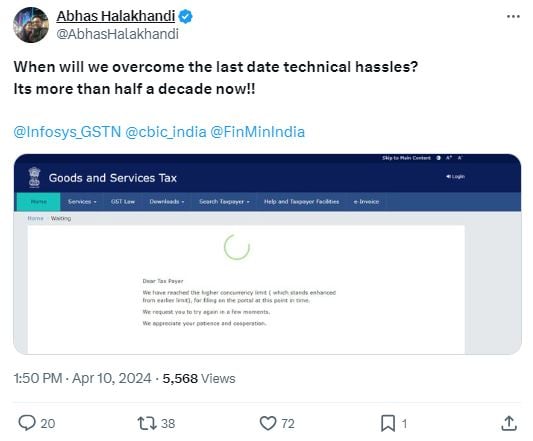

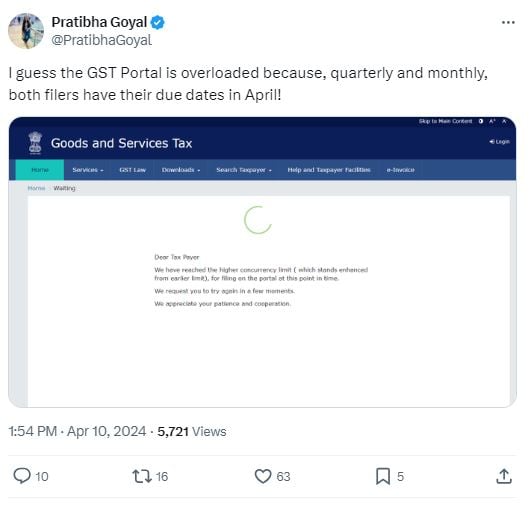

Various taxpayers are not happy with the functioning of the GST portal and continuously tweeting about this issue.

One post read, “When will we overcome the last date technical hassles? Its more than half a decade now!! @Infosys_GSTN @cbic_india @FinMinIndia”

CA AK Mittal wrote, “Its been almost 6 Years to GST & @Infosys_GSTN is unable to provide a glitch free Portal. Raising a severe doubt on capacity of Infosys Handling Portals. Even after almost 6 Years of GST the govt is unable to give us a smooth portal then what’s the point of spending so much money? @cbic_india”

Taxology India said in a tweet, “GST Portal is down @Infosys_GSTN, PS: What’s the use of mentioning that you’ve enhanced your limit if it still can’t handle the load? Hilarious.”

CA Pratibha Goyal Shared, “This calls for a Due Date Extension. Non-filing of GSTR-1 on time will block the ITC of the vendor, creating cash crunch issues.”

Another post read, “The returns module of the GST Portal is not working. @cbic_india”

In this scenario, the GSTR-1 due date should be extended. What is your opinion?

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"