ITR filing deadline is approaching soon and the income tax portal has now started showing technical glitches and errors to the taxpayers.

Reetu | Jun 20, 2024 |

ITR Filing AY 24-25: Technical issues started on Income tax e-filing Portal; Taxpayers facing major issues while filing

The Income tax return (ITR) filing deadline is nearly just a month away i.e. 31st July 2024. Taxpayers have started filing early this year just to avoid last-minute rush and consequences.

But now, they are facing various issues while filing their returns on the official income tax website. The Income tax portal has now started showing technical glitches and errors to the taxpayers. The portal is experiencing technical issues, causing problems with e-verification, pre-filling of data, and errors during ITR filing.

Tax filers and Users are frustrated with the portal not working properly at the time of filing and seeking assistance from the Income Tax Department which is replying by requesting the users to clean their browser cache and send their information via email for further assistance.

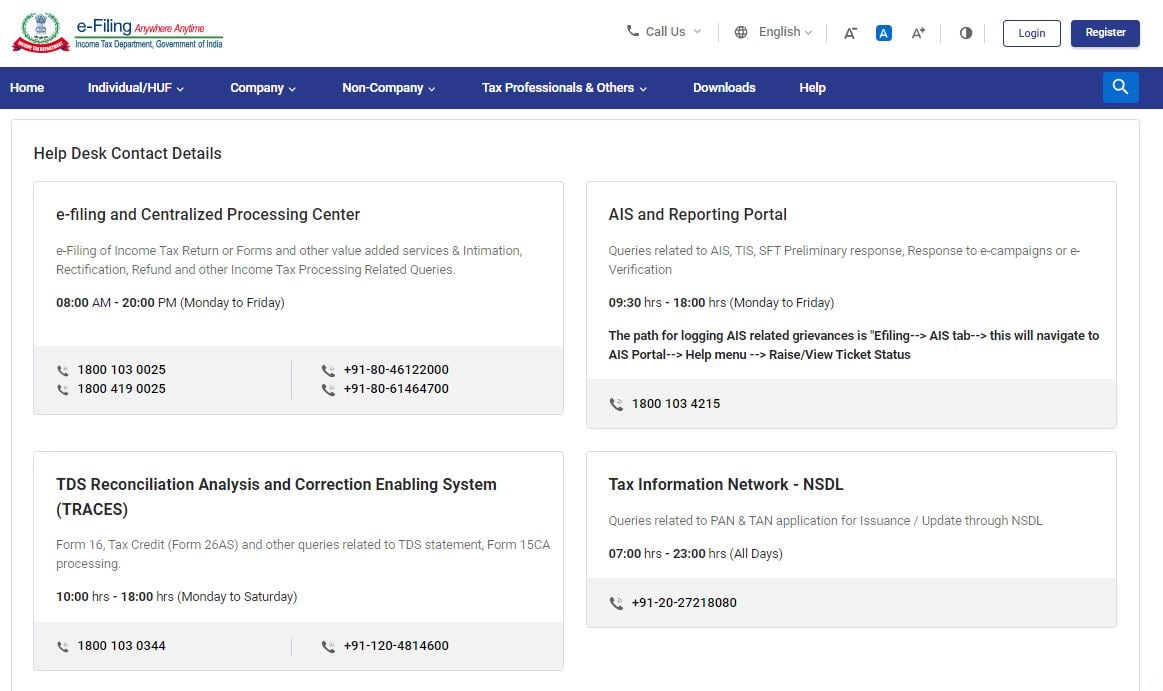

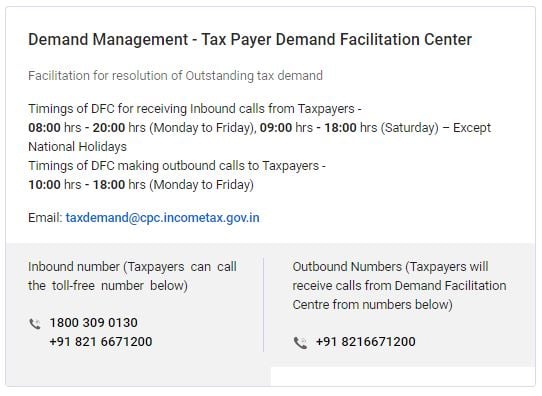

In case you are facing a problem with the ITR Filing, you may connect with the Income Tax Department at [email protected]. Other Contact details are given below:

Contact e-Filing Unit, Centralized Processing Centre, Income Tax Department, Bengaluru 560500

| Queries related to | Email id |

| Tax Audit report (Form 3CA-3CD, 3CB-3CD) | [email protected] |

| Income Tax return (For ITR 1 to ITR 7) | [email protected] |

| e-Pay Tax service | [email protected] |

| Any other issue | [email protected] |

The glitches are causing delays and inconvenience for taxpayers, particularly as the tax filing deadline approaches.

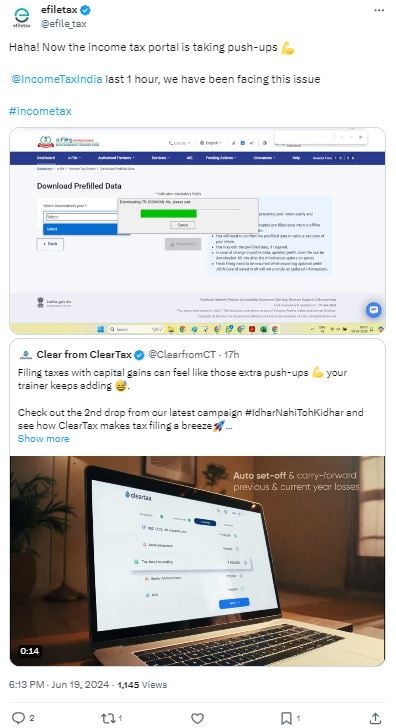

Many tax filers and users are tweeting on social media to show their anger and frustration and in the hope that the income tax department will see it and take some action in order to solve this issue.

A third party tax filing website wrote, “Haha! Now the income tax portal is taking push-ups 💪 @IncomeTaxIndia last 1 hour, we have been facing this issue #incometax”

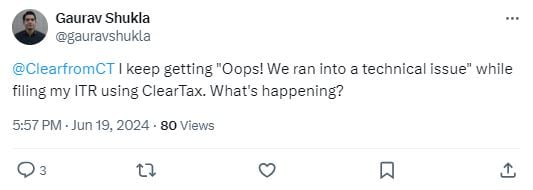

One user tweeted who is using a third party website for filing tax, “@ClearfromCT I keep getting “Oops! We ran into a technical issue” while filing my ITR using ClearTax. What’s happening?”

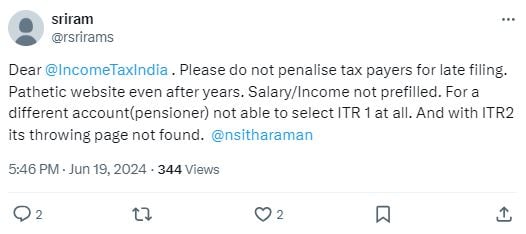

Other user wrote who is filing a return on the IT portal, “Dear @IncomeTaxIndia. Please do not penalise taxpayers for late filing. Pathetic website even after years. Salary/Income not prefilled. For a different account(pensioner) not able to select ITR 1 at all. And with ITR2 its throwing page not found. @nsitharaman”

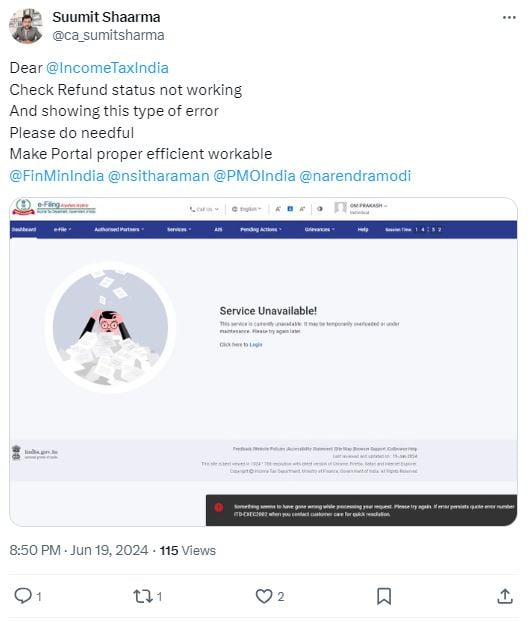

One taxpayer tweeted, “Dear @IncomeTaxIndia Check Refund status not working And showing this type of error. Please do needful. Make Portal proper efficient workable @FinMinIndia @nsitharaman @PMOIndia @narendramodi”

Another taxpayer said via tweet, “Pre-filled data is not working since evening, please resolve the issue. @IncomeTaxIndia #incometax”

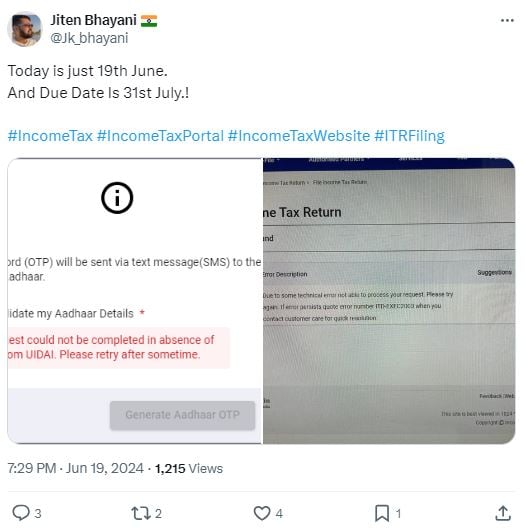

Another user tweeted in a sarcastic way, “Today is just 19th June. And Due Date Is 31st July.! #IncomeTax #IncomeTaxPortal #IncomeTaxWebsite #ITRFiling”

How is your ITR filing experience going? Do comment.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"