The city intimation slip for the CSIR UGC NET 2024 June Exam has been released on the official website, download now

Maahiya Saini | Jul 17, 2024 |

CSIR UGC NET 2024 June Exam: CSIR UGC NET 2024 June Exam City Intimation Slip Released; Check Download Procedure

CSIR UGC NET 2024 June Exam: The National Testing Agency (NTA) is going to conduct the CSIR UGC NET 2024 June Exam. The CSIR UGC NET 2024 June Exam will be held from July 25, 2024, to July 27, 2024. The exam is to find out the eligibility of Indian nationals for Junior Research Fellowship (JRF) and Lectureship (LS) or Assistant Professor in Indian Universities and Colleges.

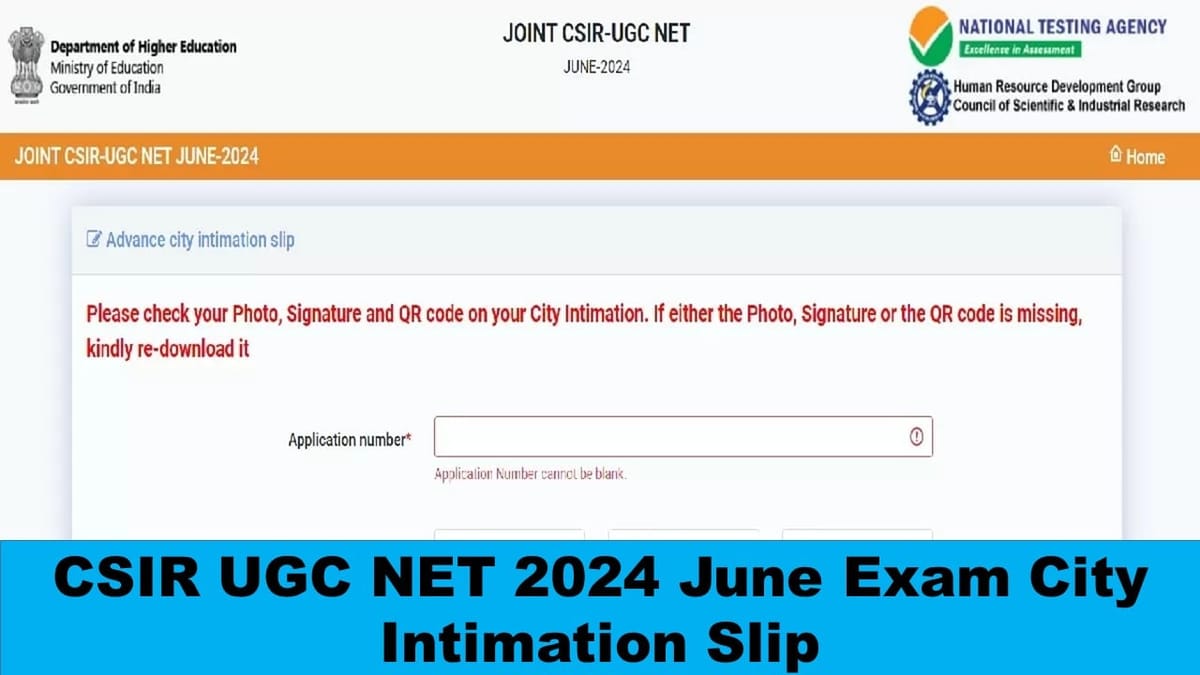

The city intimation slip for the CSIR UGC NET 2024 June Exam has been released on the official website. This slip is not the admit card; it only has information about the exam centre. The admit card for the exam will be released a few days before the CSIR UGC NET 2024 June Exam. The city intimation slip will be available on the official website, i.e., https://csirnet.nta.ac.in. Candidates need to enter their application number and date of birth to download it. The downloading procedure is mentioned.

The overview of CSIthe R UGC NET 2024 June Exam is below:

The procedure to download the city intimation slip for the CSIR UGC NET 2024 June Exam is below:

The FAQs related to the CSIR UGC NET 2024 June Exam are below:

1. When will the exam be conducted?

The exam will be conducted from July 25, 2024, to July 27, 2024.

2. How do I download the city intimation slip?

The procedure for downloading the city intimation slip is mentioned above.

3. Are the admit card and city intimation slip the same?

The admit card and city intimation slip are not the same. The city intimation slip gives information only about the exam centre but the admit card gives all the details about the exam along with instructions.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"