Budget 2024 has proposed an increase in the Standard deduction from Rs. 50,000 to Rs. 75,000 for salaried taxpayers

CA Pratibha Goyal | Jul 23, 2024 |

Budget 2024: No Tax on Salary of Rs. 775000

The Government has proposed an increase in the Standard deduction from Rs. 50,000 to Rs. 75,000 for salaried taxpayers. This would mean that now the Effective Tax on Income of Rs. 775000 for salaried taxpayers is Zero.

Suppose a person has a salary of Rs. 775000. After a Standard deduction of Rs. 75000, his income would be Rs. 7 Lakhs and The Tax would be zero in the New Tax Regime as the same would be eligible for rebate of Rs. 20000 u/s 87A.

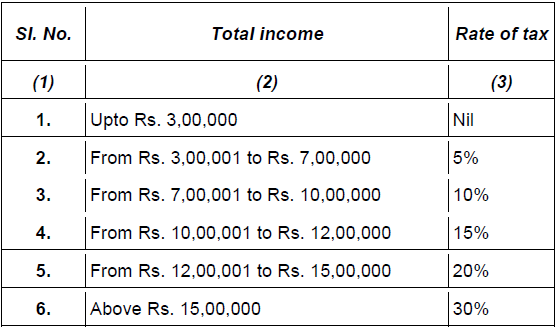

Changes have been made in slab rates of the New Tax Regime. The Slab Rates of the New Tax Regime are as follows:

The standard deduction on income in the nature of family pension has also been enhanced to Rs. 25000 from Rs. 15000.

These amendments will take effect from the 1st day of April 2025, and will accordingly apply to assessment year 2025-26 and subsequent assessment years.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"