Budget 2024 has introduced a major changes in Capital Gain Taxation. The Article discusses the same.

CA Pratibha Goyal | Jul 23, 2024 |

Budget 2024 introduces major changes in Capital Gain Taxation: Takes away indexation benefit

The Budget 2024 was presented by our Finance Miniter Smt. Nirmala Sitaram today. The Budget 2024 proposes to make some major changes in the Taxation of Capital Gain Income. Let us discuss the same in this article.

There will only be two holding periods, 12 months and 24 months, for determining whether the capital gains is short-term capital gains or long term capital gains. For all listed securities, the holding period is proposed to be 12 months and for all other assets, it shall be 24 months.

Major Changes have been made in Tax Rates:

Short-term capital gain (STCG) under provisions of section 111A of the Act on STT paid equity shares, units of equity oriented mutual fund and unit of a business trust is proposed to be increased to 20% from the present rate of 15%

Long-term capital gain (LTCG) under provisions of section 112A of the Act on STT paid equity shares, units of equity oriented mutual fund and unit of a business trust is proposed to be increased to 12.5% from the present rate of 10%

Exemption from Long-term capital gain (STCG) under provisions of section 112A has been increased to Rs. 125,000 from Rs. 100,000.

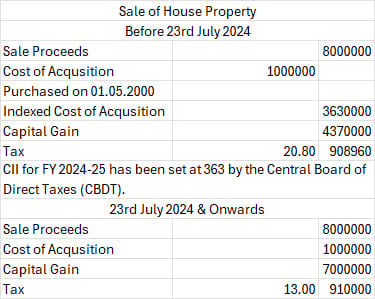

Long-term capital gain (LTCG) under provisions of section 112 was reduced to 12.5% from the present rate of 20%. But the Indexation benefit has been taken away.

Impact of taking away Indexation benefit

These proposals are proposed to be given effect immediately i.e. with effect from the 23rd of July, 2024.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"