CA Pratibha Goyal | Mar 28, 2025 |

![18% GST on Restaurant services provided at specified premises [Read CBIC FAQs]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2025/03/GST-on-Restaurant-services.jpg)

18% GST on Restaurant services provided at specified premises [Read CBIC FAQs]

The Central Board of Indirect Taxes & Customs (CBIC) has issued 28 Frequently Asked Questions on ‘Restaurant Service’ supplied at ‘Specified Premises’.

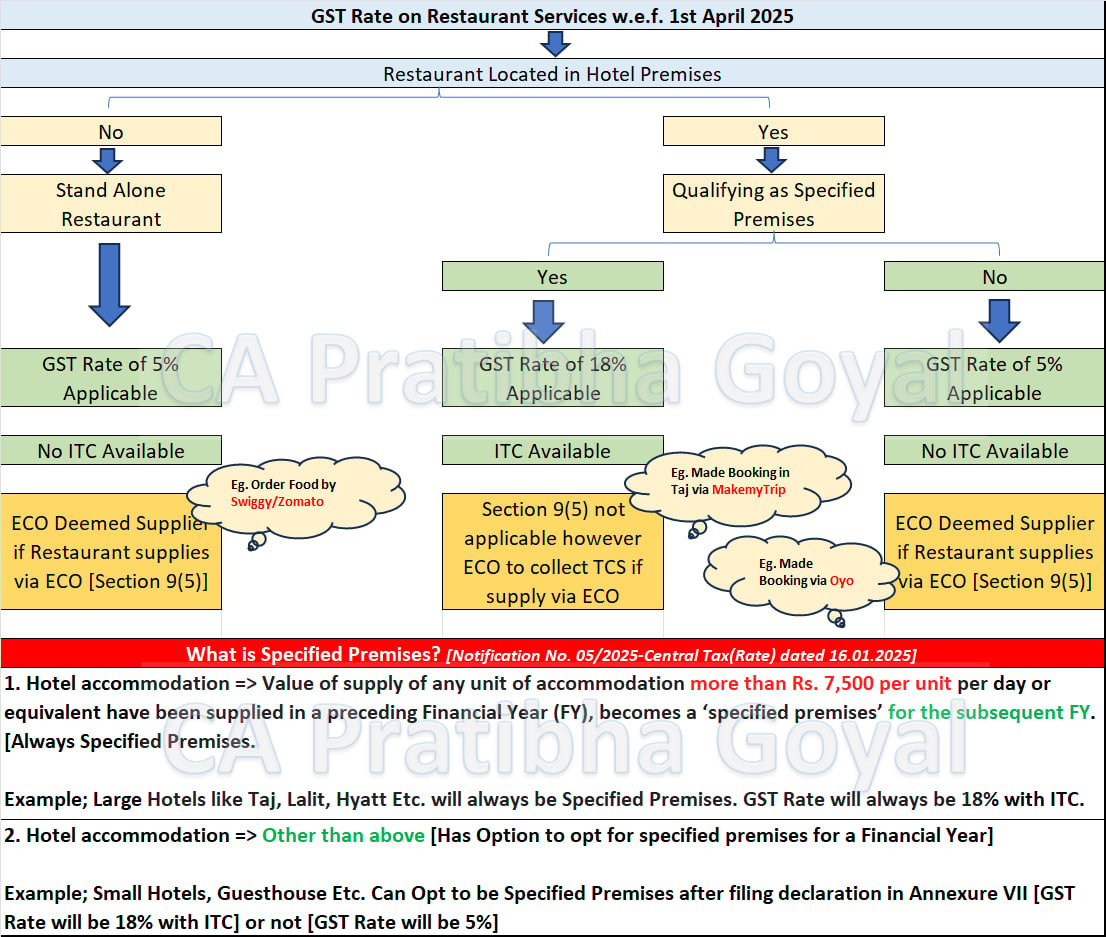

Specified premises are defined as locations where the supplier has provided hotel accommodation services above Rs. 7,500 per unit per day in the previous financial year. Alternatively, premises can be declared as specified through official declarations by registered persons.

Restaurant services provided at specified premises will be subject to GST at a specific rate (likely a different rate than standard restaurant services). Entry 7(vi) of notification No. 11/2017-CTR dated 28.06.2017 prescribes the rate of 18% with ITC for restaurant services supplied at specified premises. For restaurant services supplied outside specified premises, the rate of 5% without ITC is applicable as per entry 7(ii) of notification No. 11/2017-CTR dated 28.06.2017.

Consumers dining at restaurants within specified premises may experience changes in pricing due to GST implications. Businesses operating within these premises must adjust their billing and accounting practices accordingly.

Registered businesses must submit declarations between January 1 and March 31 if they wish to classify their premises as specified.

New businesses must submit their declaration within 15 days of obtaining registration.

Click on the below given link to download the FAQs.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"