shashank kothiyal | Jun 29, 2019 |

Analysis related to Latest Notification issued on 28/06/2019

CBIC issued the Notification No. 26/2019, 27/2019, 28/2019, 29/2019, 30/2019, 31/2019, 32/2019 on 28th June 28, 2019 related to various issues. The detailed analysis are mentioned below:

| S.No | Notification No | Description | Analysis |

| 1 | 26/2019 | Seeks to extend the due date of filing returns in FORM GSTR-7 | The due date for filing GSTR-7 from October, 2018 to July, 2019 extended till the 31st day of August, 2019. |

| 2 | 27/2019 | Seeks to prescribe the due date for furnishing FORM GSTR-1 for registered persons having aggregate turnover of up to 1.5 crore rupees for the months of July, 2019 to September,2019. | The due date for filing GSTR-1 for registered persons having aggregate turnover of up to 1.5 crore rupees for the months of July, 2019 to September,2019 is 31st October, 2019. |

| 3 | 28/2019 | Seeks to extend the due date for furnishing FORM GSTR-1 for registered persons having aggregate turnover of more than 1.5 crore rupees for the months of July, 2019 to September,2019 | The due date for filing GSTR-1 for registered persons having aggregate turnover of more than 1.5 crore rupees for the months of July, 2019 to September,2019 is eleventh day of the month succeeding such month. |

| 4 | 29/2019 | Seeks to prescribe the due date for furnishing FORM GSTR-3B for the months of July, 2019 to September,2019. | The due date for filing GSTR-3B for the months of July, 2019 to September, 2019 is on or before the twentieth day of the month succeeding such month. |

| 5 | 30/2019 | Seeks to provide exemption from furnishing of Annual Return / Reconciliation Statement for suppliers of Online Information Database Access and Retrieval Services(OIDAR services). | The said category of taxpayers shall not be required to furnish an annual return in FORM GSTR-9 under sub-section (1) of section 44 of the said Act read with sub-rule (1) of rule 80 of the said rules.The said category of taxpayers shall not be required to furnish an annual return in FORM GSTR-9C under sub-section (2) of section 44 of the said Act read with sub-rule (3) of rule 80 of the said rules. |

| 5 | 31/2019 | Seeks to carry out changes in the CGST Rules, 2017. | The detailed analysis related to this is mentioned below. |

| 6 | 32/2019 | Seeks to extend the due date for furnishing the declaration FORM GST ITC-04 | The due date for filing ITC-04 from July, 2017 to June, 2019 extended till the 31st day of August, 2019. |

Analysis related to Notification No. 31/2019

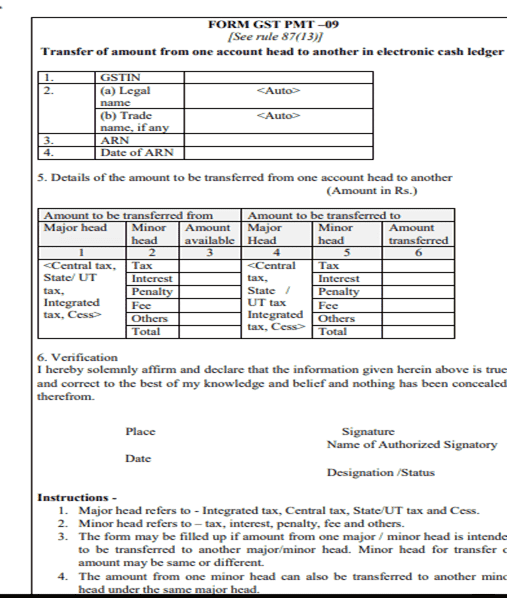

A registered person may, on the common portal, transfer any amount of tax, interest, penalty, fee or any other amount available in the electronic cash ledger under the Act to the electronic cash ledger for integrated tax, central tax, State tax or Union territory tax or cess in FORM GST PMT-09..

4. New Rule Introduced (Rule 95A) effective from 01.07.2019

Rule 95A: Refund of taxes to the retail outlets established in departure area of an international Airport beyond immigration counters making tax free supply to an outgoing international tourist.-

A. Retail outlet established in departure area of an international airport, beyond the immigration counters, supplying indigenous goods to an outgoing international tourist who is leaving India shall be eligible to claim refund of tax paid by it on inward supply of such goods.

B. Retail outlet claiming refund of the taxes paid on his inward supplies, shall furnish the application for refund claim in FORM GST RFD- 10B on a monthly or quarterly basis, as the case may be, through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

C. The self-certified compiled information of invoices issued for the supply made during the month or the quarter, as the case may be, along with concerned purchase invoice shall be submitted along with the refund application.

D. The refund of tax paid by the said retail outlet shall be available if-

(a) the inward supplies of goods were received by the said retail outlet from a registered person against a tax invoice;

(b) the said goods were supplied by the said retail outlet to an outgoing international tourist against foreign exchange without charging any tax; (c) name and Goods and Services Tax Identification Number of the retail outlet is mentioned in the tax invoice for the inward supply; and

(c) such other restrictions or conditions, as may be specified, are satisfied.

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"