CA Pratibha Goyal | Dec 11, 2019 |

Interest for Failure to Collect or Deduct & Delayed Payment of TDS or TCS

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government.

What if instead of depositing TDS in the government’s account I use it for my personal needs

Failure to remit tax deducted by me in the government’s account within stipulated time-limit would attract interest, penalty and rigorous imprisonment of upto seven years.

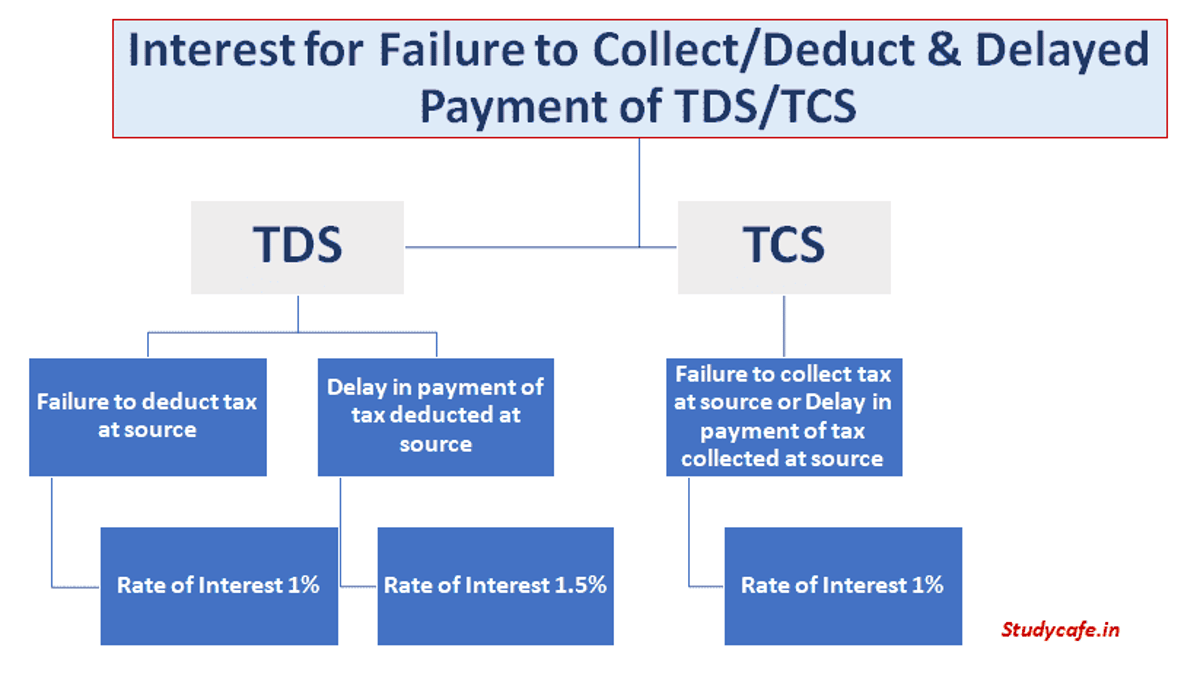

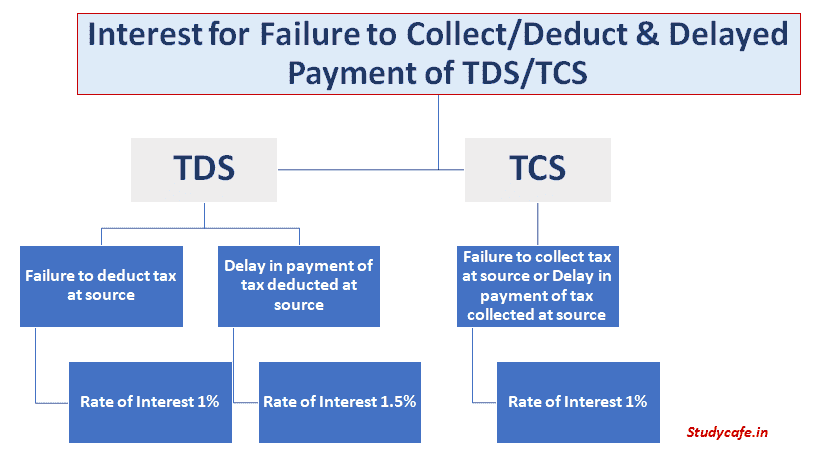

Section 201(1A) for failure to deduct tax at source/delay in payment of tax deducted at source

| Situation | Rate of Interest |

| Failure to deduct tax at source | Interest of 1% pm or Part of the month is applicable from the date on which such tax was deductible to the date on which such tax is deducted |

| Delay in payment of tax deducted at source | Interest of 1.5% pm or Part of the month is applicable from the date on which such tax was deducted to the date on which such tax is actually paid |

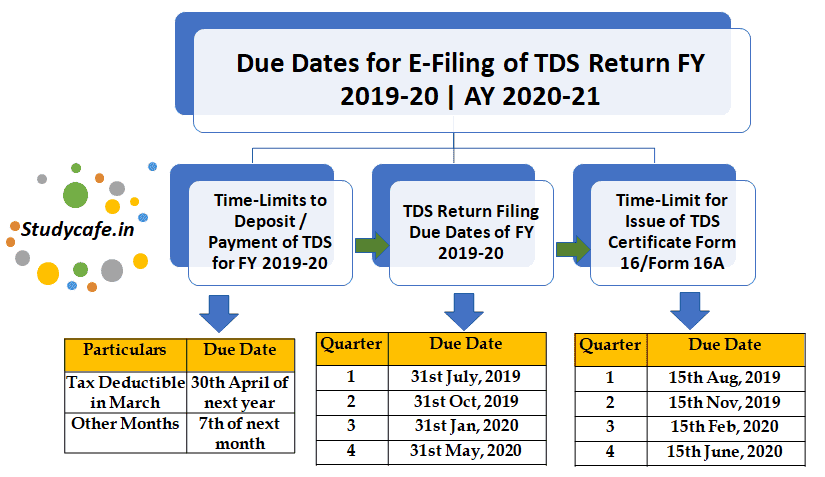

Basic provisions relating to due date of payment of TDS to the credit of Government

For Due Dates of Filing TDS Return and Payment of TDS Please Refer Below :

Please Note that tax deducted under section 194-IA (i.e., on immovable property) & Section 194-IB (i.e. on rent) should be paid to the credit of the Government on or before 30 days from the end of the month in which deduction is made.

Some Other Consequences if Tax is not deducted

A deductor would face the following consequences if he fails to deduct TDS or after deducting the same fails to deposit it to the credit of Central Government’s account:-

As per section 40(a)(i) of the Income-tax Act, any sum (other than salary) payable outside India or to a non-resident, which is chargeable to tax in India in the hands of the recipient, shall not be allowed to be deducted if it is paid without deduction of tax at source or if tax is deducted but is not deposited with the Central Government till the due date of filing of return.

However, if tax is deducted or deposited in subsequent year, as the case may be, the expenditure shall be allowed as deduction in that year. Similarly, as per section 40(a)(ia), any sum payable to a resident, which is subject to deduction of tax at source, would attract 30% disallowance if it is paid without deduction of tax at source or if tax is deducted but is not deposited with the Central Government till the due date of filing of return. However, where in respect of any such sum, tax is deducted or deposited in subsequent year, as the case may be, the expenditure so disallowed shall be allowed as deduction in that year.

As per Section 58(1A) (as amended with effect from the assessment year 2018-19), the provisions of section 40(a)(ia) and 40(a)(iia) shall also apply in computing the income chargeable under the head Income from other sources.

Penalty of an amount equal to tax not deducted or paid could be imposed under section 271C

Section 206C(7) for failure to collect tax at source/delay in payment of tax collected at source

| Situation | Rate of Interest |

| Failure to collect tax at source or Delay in payment of tax collected at source | Interest of 1% pm or Part of the month is applicable from the date on which such tax was required to be collected to date on which collected tax is paid to government |

Basic provisions relating to due date of payment of TCS to the credit of Government

Due date for Depositing TCS is seven days from the end of the month in which it was collected. This means For the Month of March 2019 the Due date for depositing TCS would be 7th April 2019

A Small Summary is given below for reference:

I have not deducted TDS of one of the vendor. But the Vendor has Filed his return and Paid the Relevant Tax. Will I be Assessee In default in this case

As per Section 201 (1) Where any person, including the principal officer of a company does not deduct, or fails to pay TDS, then he shall be deemed to be an assessee in default in respect of such tax.

But the Person shall not be deemed to be an assessee in default in respect of such tax if the deductee:

(i) has furnished his return of income under section 139;

(ii) has taken into account such sum for computing income in such return of income; and

(iii) has paid the tax due on the income declared by him in such return of income,

(iv) has furnished a certificate to this effect from an accountant in Form No. 26A.

In this case, interest shall be payable from the date on which such tax was deductible to the date of furnishing of return of income by such payee.

Interest in such a case will be levied at 1% for every month or part of the month.

With effect from September 1, 2019, Section 201 has been amended to extend the benefit to a deductor even in respect of failure to deduct tax from sum paid to non-resident.

As per Section 206 (6a) Where any person, including the principal officer of a company does not collects, or fails to pay TCS, then he shall be deemed to be an assessee in default in respect of such tax.

But the Person shall not be deemed to be an assessee in default in respect of such tax if the buyer or licensee or lessee :

(i) has furnished his return of income under section 139;

(ii) has taken into account such sum for computing income in such return of income; and

(iii) has paid the tax due on the income declared by him in such return of income,

(iv) has furnished a certificate to this effect from an accountant in Form No. 27BA.

In this case, interest shall be payable from the date on which such tax was deductible to the date of furnishing of return of income by such buyer or licensee or lessee .

Interest in such a case will be levied at 1% for every month or part of the month.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"