Studycafe | Dec 5, 2019 |

Revocation of Cancelled GST Registration : Revocation of cancellation of registration under GST

Now a Days, a large number of GST Registrations are being cancelled by GST Department, due to non-filing of GSTR-Returns. Here are some FAQ’s on what we can do if our GST Registration has been cancelled by GST Department due to non-filing of GSTR-Returns.

1. What are various situations in which, GST Registrations can be cancelled by GST Department

Suo Moto Cancellation of registration may be initiated by the Tax Official for various situations as mentioned in the provisions of GST law like: –

2. Will I be intimated before the Suo Moto Cancellation of Registration

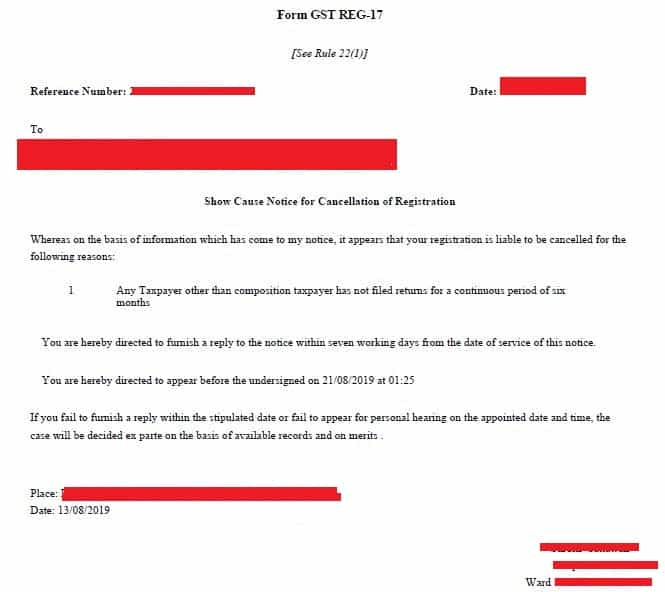

Yes, Registration cannot be cancelled without a Show Cause Notice being given to taxpayer and a reasonable opportunity of being heard by the Tax Official. Thus, in case of Suo Moto cancellation of registration, a Show Cause Notice shall be issued by the Tax Official/ Proper officer to the taxpayer in Form GST REG -17 and taxpayer would be given a chance to file clarifications in the stipulated time limit in Form GST REG -18.

Revocation of Cancelled GST Registration

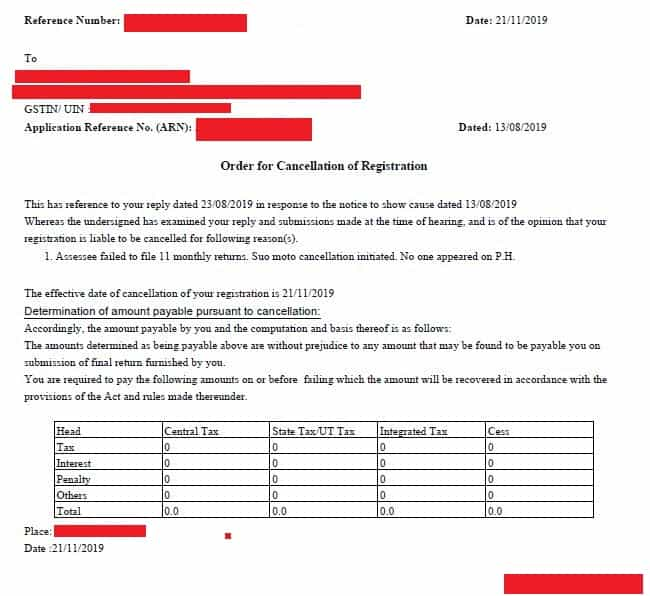

If the GST Officer is not satisfied by the reason of registered person as replied in Form REG -18 in relation to Show cause notice of GST Cancellation or if no reply is filed by registered person within stipulated time, then he will issue GST Cancellation order on Form GST REG-19

Revocation of Cancelled GST Registration

3. Where can I apply for revocation of cancelled registration

A taxpayer, whose registration has been cancelled by the tax official, by initiating suo moto proceedings, can apply at GST portal for revocation of cancelled registration.

However, no application for revocation shall be filed if the registration has been cancelled for the failure of the taxable person to furnish returns, unless such returns are filed and any amount due as tax, in terms of such returns has been paid along with any amount payable towards interest, penalties or late fee payable in respect of the said returns.

4. From where can I apply for revocation of cancelled registration

Application for revocation of cancelled registration can be accessed within 30 days, from issuance of the Cancellation Order on the GST Portal, after logging in.

The path is Services > Registration > Application for Revocation of Cancelled Registration.

You can login using your earlier login credentials (i.e. credentials using which you were logging into the GST Portal earlier).

5. Who all cannot apply for revocation of cancelled registration

UIN Holders (i.e. UN Bodies, Embassies and Other Notified Persons), GST Practitioner or in case the registration is cancelled on the request of the taxpayer or legal heir of the taxpayer, cannot apply for revocation of cancelled registration.

6. What happens when application for revocation of cancelled registration is approved by the Tax Official

Once an application for revocation of cancelled registration is approved by the Tax Official, the system generates an approval order and an intimation is sent to the Primary Authorized Signatory of the taxpayer via e-mail and SMS, about the same.

Consequent to the approval of the Application for Revocation of Cancelled Registration, the taxpayer’s GSTIN Status will be changed to from Inactive to Active status with effect from the effective date of cancellation.

7. What happens when application for revocation of cancelled registration is rejected by the Tax Official

When application for revocation of cancelled registration is rejected by the Tax Official then

1. Rejection order will be generated

2. GSTIN status will remain “Inactive” on the GST Portal.

3. Primary Authorized Signatory will be intimated via SMS and email of the rejection of the application.

4. Rejection Order will be made available on the taxpayer’s dashboard.

For Regular Updates Join:

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

Tags : Revocation of Cancelled GST Registration, how to activate cancelled gst registration, revocation of cancellation of registration under gst

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"