CA Pratibha Goyal | Jan 26, 2020 |

GSTN started giving advisory of reversal of ITC for FY 2018-19

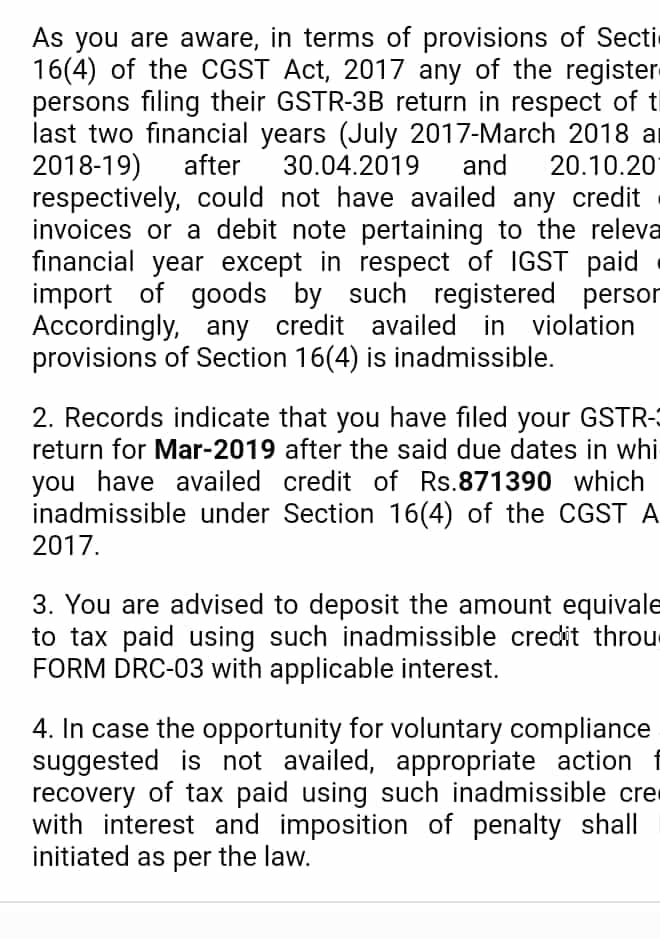

The advisory reads as follows:

“As you are aware, in terms of provisions of Section 16(4) of the CGST Act, 2017 any of the registerd persons filing their GSTR-3B return in respect of the last two financial years (July 2017-March 2018 and 2018-19) after 30.04.2019 and 20.10.2019 respectively, could not have availed any credit of invoices or a debit note pertaining to the relevant financial year except in respect of IGST paid for import of goods by such registered person. Accordingly, any credit availed in violation provisions of Section 16(4) is inadmissible.”

GSTN started giving advisory of reversal of ITC for FY 2018-19

Points to note:

1. Firstly, this is an advisory and not a notice. The message is system generated.

2. Also, no Document Identification Number has been mentioned in it. Hence, this shall be deemed to have never been issued as per GST Law.

3. The last date to claim ITC of FY 2017-18 was GSTR 3B of March 2019 [i.e. 20/04/2019] and of FY 2018-19 was GSTR 3B of September 2019 [i.e. 20/10/2019)

4. Further, merely late filing of any GSTR 3B does not invalidate the ITC claimed in such month, unless any ITC of preceding FY has been claimed therein and return is filed belated.

5. Since GSTR 3B is summary return, wherein no line item wise detail have been uploaded, without detailed scrutiny, it can never be substantiated that the whole or any part of ITC claimed in any tax period is pertaining to preceding FY and is time barred.

6. Therefore, it can be concluded that this advisory might be generated out of data analytics tool of GSTN. However, it is not in line with the provisions of the law. Hence, no action should be initiated from our end. However, a general submission stating above mentioned facts can be submitted to jurisdiction office without mentioning any figures.

7. Also Taxpayers should do the whole analysis at their end as well, so that they can prepare themself in advance in case of future litigation.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"