Studycafe | Feb 16, 2021 |

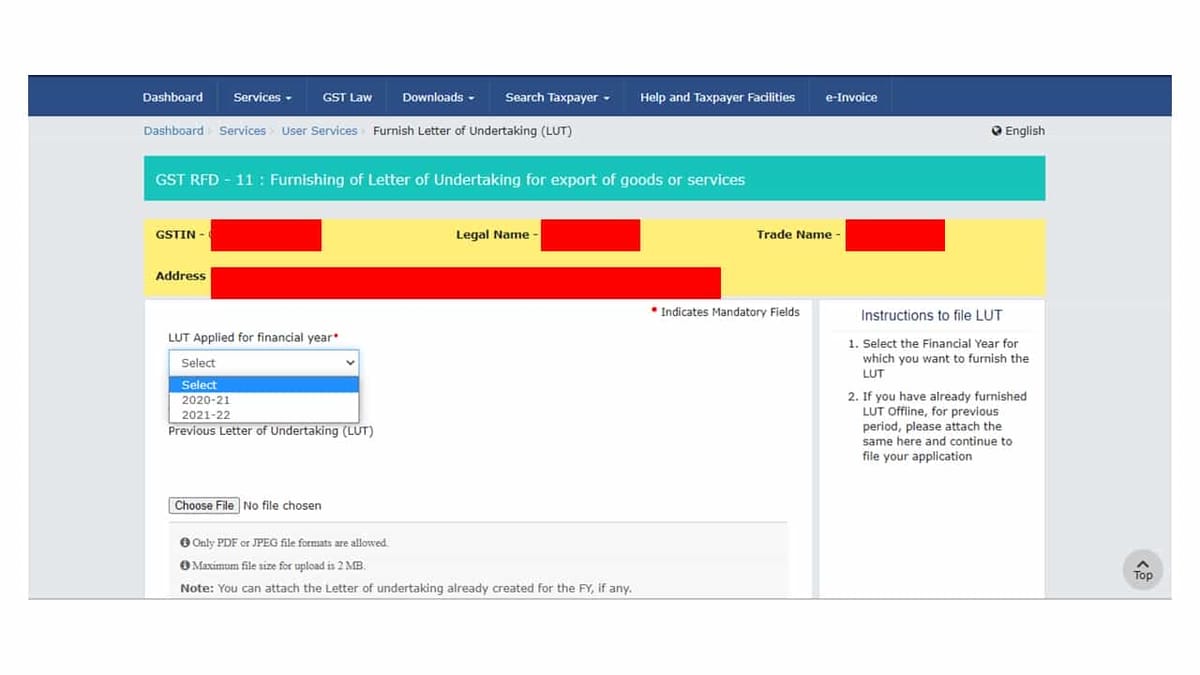

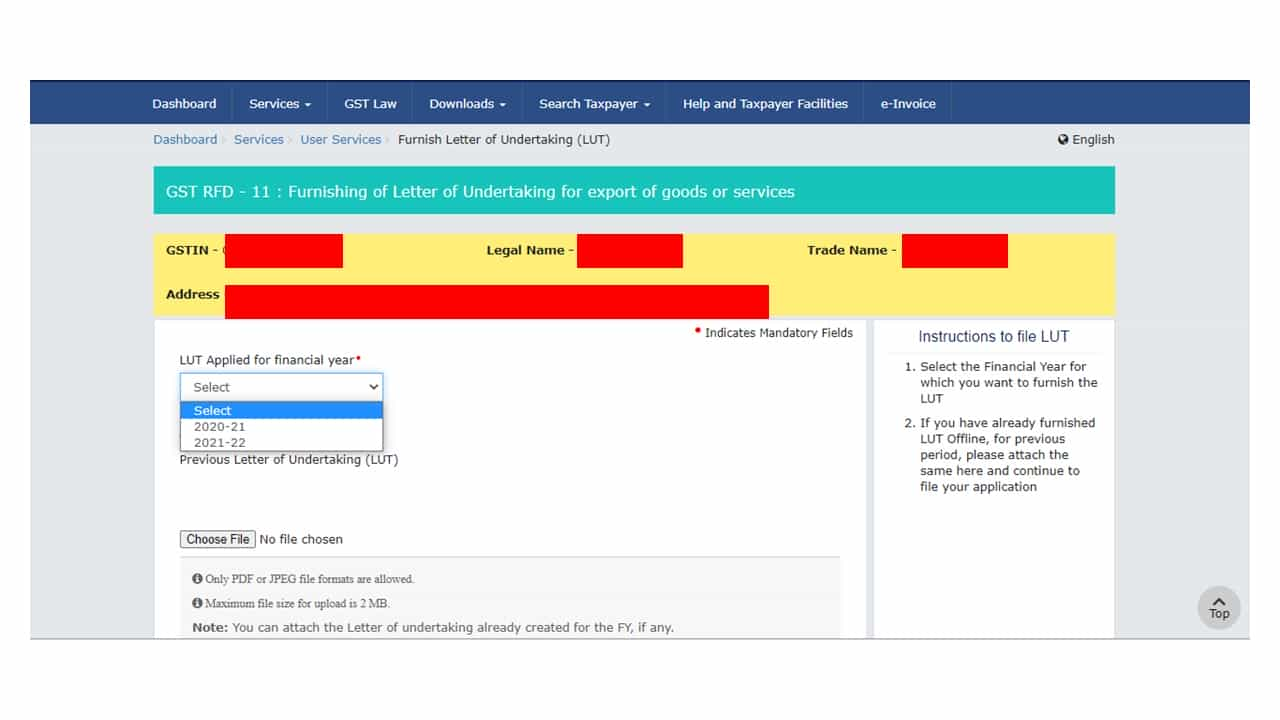

Facility to furnish Letter of Undertaking (LUT) for Financial Year 2021-2022 not available on GSTN

Form GST RFD – 11 or Letter of Undertaking is furnished for export of goods or services, where Export is made without payment of GST.

Any registered person availing the option to supply goods or services for export /SEZs without payment of integrated tax has to furnish, prior to export/SEZs supply, a Letter of Undertaking (LUT). Provided, he has not been prosecuted for tax evasion for an amount of Rs 2.5 Crore or above under the CGST Act/IGST Act/Existing law.

Example of transactions for which LUT can be used are:

Facility to furnish LUT for Financial Year 2021-2022 now available on GSTN

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"