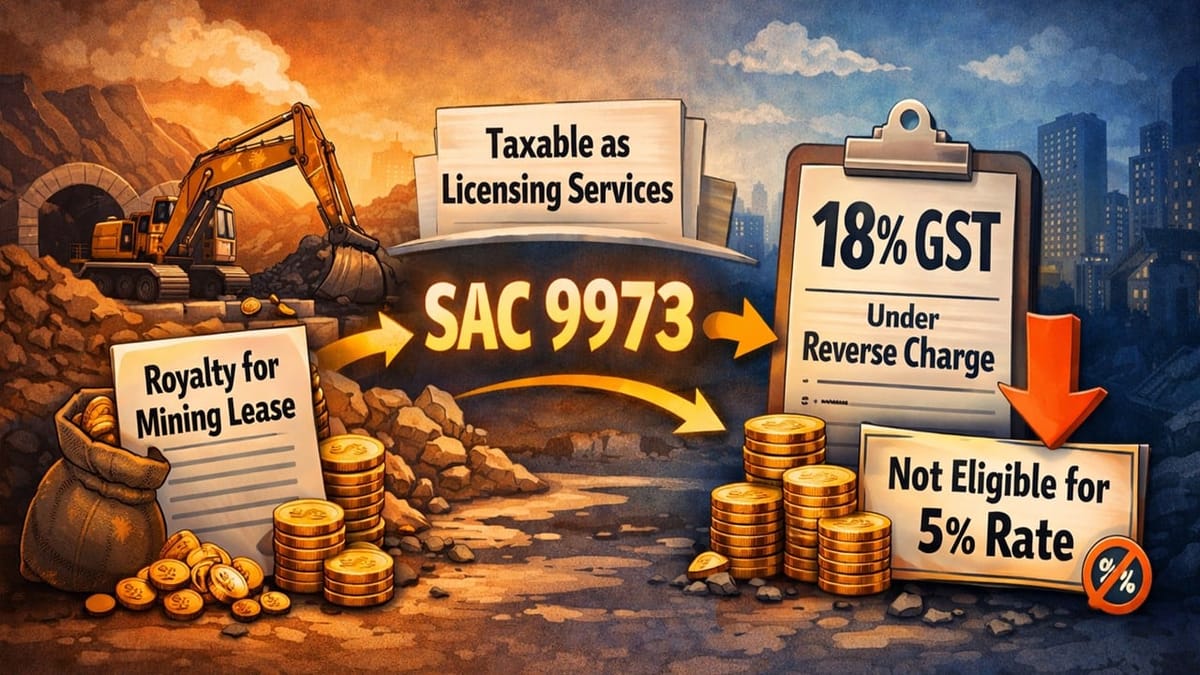

AAR held that royalty paid for a mining lease is taxable as licensing services under SAC 9973 at 18% GST under reverse charge and not eligible for the concessional 5% rate.

Saloni Kumari | Feb 13, 2026 |

AAR Rejects Concessional GST Rate on Mining Lease Services; Upholds 18% GST on Mineral Extraction Royalty

The company, Ramandeep Upkarsingh Bindra (Black Rock Crusher), has filed an application dated August 19, 2020, seeking the Maharashtra Authority for Advance Ruling (AAR) under Section 97 of the Central Goods and Services Tax Act, 2017, and the Maharashtra Goods and Services Tax Act, 2017.

The applicant is registered under the Goods and Services Tax Act 2017 and has a registered address at Haladgaon, Panchgaon Road, Nagpur, Maharashtra, 440103. The applicant is engaged in the business of extracting minerals, crushing them, and then selling them.

The applicant wanted to obtain a mining lease from the state government for the exploration of minerals like black rock, stones, and other minerals against consideration in the form of royalty/dead rent to the state government. In the context of the same applicant, they entered into a lease transfer agreement. But the applicant obtained a title to the land under the mining operation through a sale agreement, enforced on April 29, 2015.

The applicant has asked the following questions seeking the Maharashtra Authority for Advance Ruling (AAR):

“Question 1. Whether the services of leasing of mines for which royalty is charged by the government merit classification under the heading No. 9973, specifically under subheading No. 997337 (licensing services for the right to use minerals, including their exploration and evaluation)?

Question 2. Whether the said service can be classified under SL No. 17(iii) of the notification no. 11/2017 central tax (rate) dated 28/06/2017, attracting a rate of 5 per cent (the same rate of central tax as on the supply of like goods involving the transfer of title of goods)?”

The Maharashtra Authority for Advance Ruling (AAR) has given the following answers to the questions asked by the applicant:

Answer 1: The royalty paid to the government in respect of the service of leasing of mines is a part of the consideration payable for the licensing services for the right to use minerals, including exploration and evaluation, falling under the Head 9973, which is liable to be taxed at 18% GST (9% CGST and 9% SGST) under the entry at Serial No. 17(viii) of the Notification No. 11/2017-Central Tax dated June 28, 2017. As services supplied by the government to a business located in the taxable territory are classified under the entry at Serial No. 17(viii) of the Notification No. 11/2017-Central Tax dated June 28, 2017, the recipient of such services becomes liable to pay tax on it under the reverse charge mechanism, as the licensing services are provided by the state government to a business entity, i.e., the applicant in the present case.

Answer 2: As per the authority, the said service cannot be classified under serial no. 7(iii) of the notification no. 11/2017 central tax (rate) dated June 28, 2017, attracting GST at 5%.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"