Reetu | Oct 11, 2021 |

All About ICEGATE’s RoDTEP Scheme Script Generation

The government has announced a new scheme for exporters called Remission of Duties and Taxes on Exported Products (RoDTEP). The scheme offers rebates on Central, State, and Local duties, taxes, and levies that are not covered by any other duty remission scheme.

The E-scrip module was created by ICEGATE, CBIC to give exporters with a digital solution that allows them to take advantage of various incentive programmes such as RoDTEP and RoSCTL. The scheme reimburses Central, State, and Local duties, taxes, and levies that are not repaid under any other duty remission scheme.

After selecting the required shipping invoices, the exporter can go into his account and build a script. Here’s everything you need to know.

Only after creating an Escrip account at ICEGATE may the Importer/Exporter/CHA use it. The user must be a legitimate IEC Holder with a DSC who has registered on ICEGATE. The steps for setting up an Escrip account with ICEGATE are outlined below.

Step-By-Step guide for the user to create an escrip account, generate scrips and transfer the scrips to any other IEC to avail the benefit of the scheme.

E-scrip account can be used by the Importer/Exporter/CHA only after creating it at ICEGATE. The user has to be a valid IEC Holder registered on ICEGATE with a DSC. Below are the steps to create an Escrip Account with ICEGATE.

Step 1) User can select the option of Escrip account creation by clicking on the “Escrip” tab under the “Our Services” section of https://www.icegate.gov.in/ as indicated below.

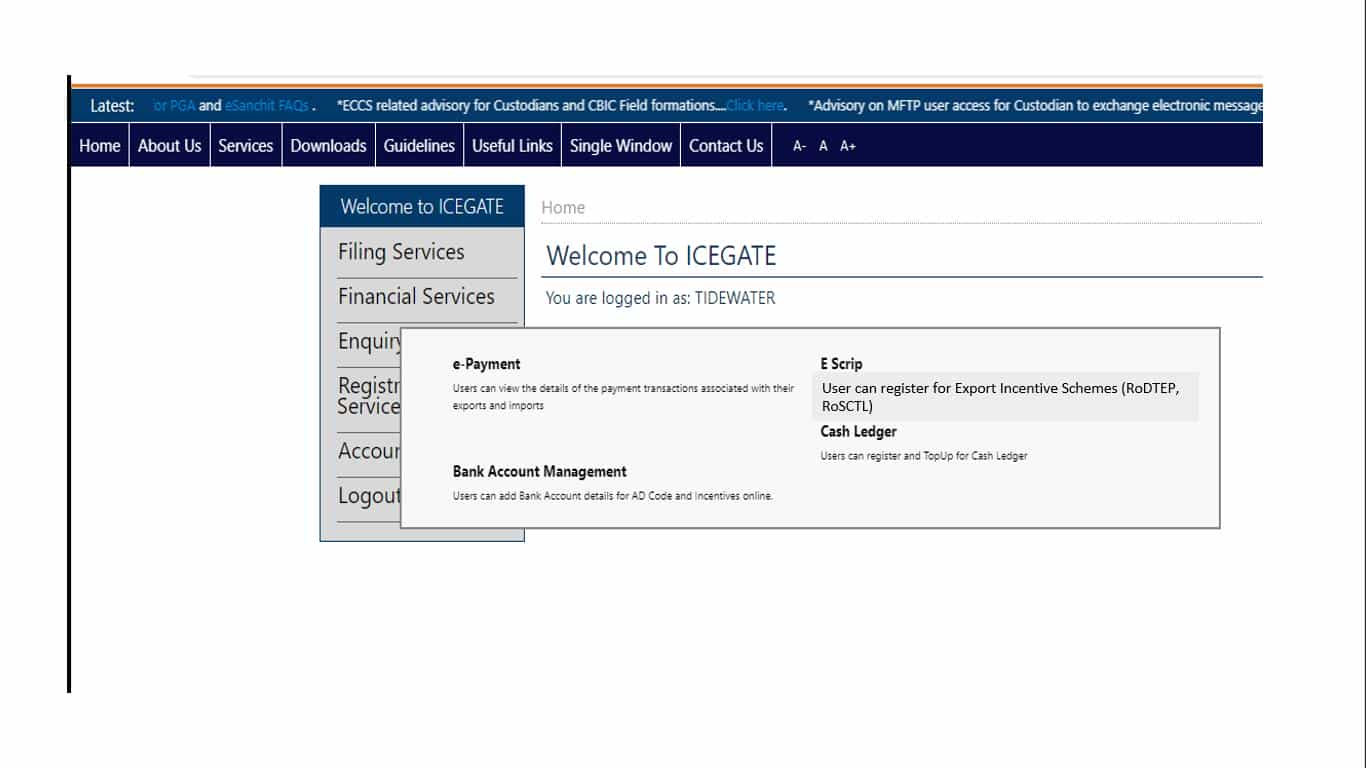

Step 2) User will be directed to the login page. After log in using valid credentials, user will be able to see the escrip option under the Financial Services on the left panel as shown below. If user is not registered they can get themselves registered as per advisory through this link: https://icegate.gov.in/Download/JavaSetupForDSC.pdf

Step 3) Since the user has not created an escrip account initially, the following page will be displayed. The user can select the scheme name from the drop-down as RoSCTL or RoDTEP and click on Create Escrip Account button as shown below.

Step 4) After escrip account creation is done by the user, a grid view with the following details will be displayed to the user.

User can perform various operations mentioned as follows from this Home Page:

Step 1) From the Escrip Home Page as shown below, user can select SB Details Tab for scrip generation.

Step 2) User is provided with the feature of selecting Shipping bills/scrolls for which the scrips are to be generated. User can select RoSCTL or RoDTEP under scheme name and location as mentioned below.

Step 3) An error message will be displayed if the scheme is not selected since it is a mandatory field.

Step 4) User can view and select the shipping bills and can click on “Generate Scrip” button to generate scrip. User can select all the shipping bills at once by checking box in first row.

Step 5) Scrip will be generated for the selected shipping bill/ scroll. After successful Scrip Creation the following message will be displayed on the screen.

To Read the Full Advisory Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"