CA Pratibha Goyal | Mar 11, 2020 |

Analysis of various provisions of Tax Audit & Presumptive Taxation Scheme, Article Also Contains, Change in Due Date of Tax Audit and Income Tax Return Filing

Applicability of Section 44AB – Tax Audit

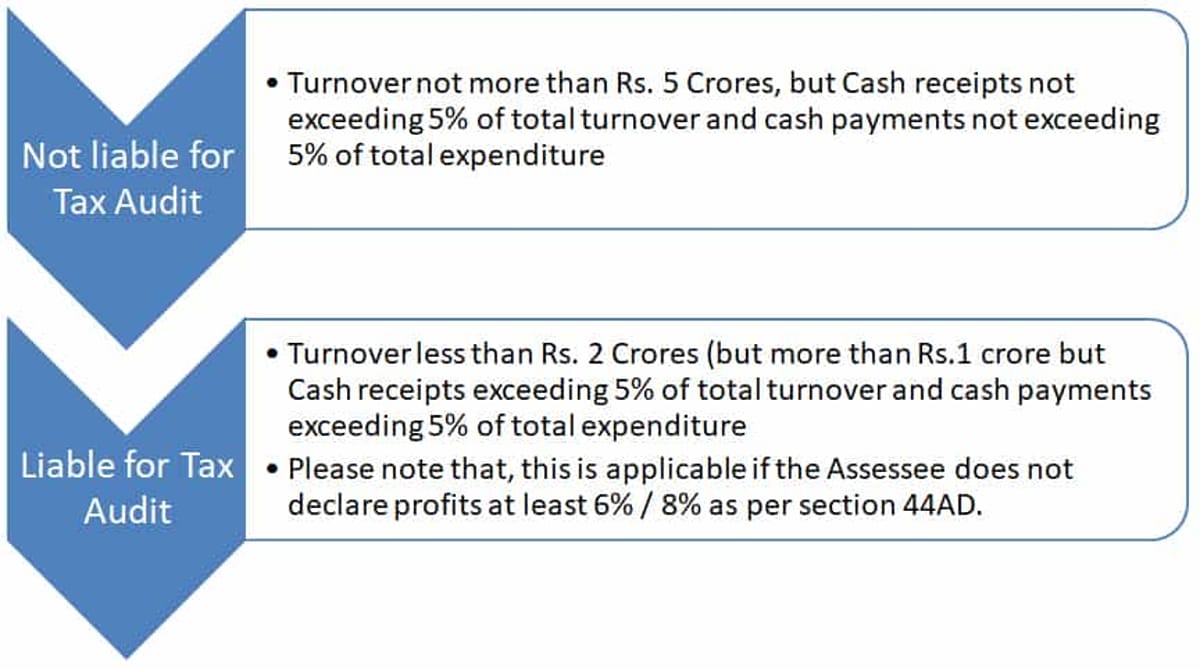

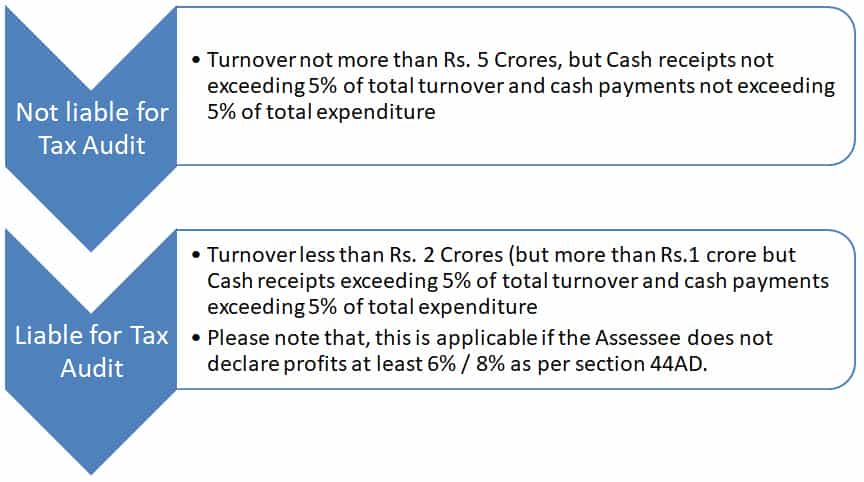

• Every Person who is carrying on business, and whose total sales/turnover/gross receipts from business exceeds Rs. 1 crore shall get his accounts of such previous year audited by an accountant.

Exception – The above provision is not applicable to the person, who opts for presumptive taxation scheme under section 44AD of Income Tax and his total sales/turnover does not exceeds Rs. 2 crores. (Previously this limit was Rs. 1 Crore before 2016 Budget)

• A person who is eligible to opt for the presumptive taxation scheme of section 44AD but claims the profits or gains for such business under non – presumptive scheme which is lower than the profits and gains computed as per the presumptive taxation scheme of section 44AD and his income exceeds the amount which is not chargeable to tax.

Applicability of Section 44AD – Presumptive Taxation Scheme

• A person can opt for presumptive scheme under section 44AD

In case of a person adopting the provisions of section 44AD, income will be computed on presumptive basis, i.e., at least @ 8% of the turnover or gross receipts (6% in respect of total turnover or gross receipts which is received by an account payee cheque or draft or use of electronic clearing system or through such other electronic mode) of the eligible business for the year and the provisions of allowance/disallowances as provided under the Income tax Law will not apply.

However, the assessee can claim deduction under chapter VI-A.

Amendments in Budget 2020-2021

Analysis of various provisions of Tax Audit & Presumptive Taxation Scheme

Change in Due Date of Tax Audit and Income Tax Return Filing:

| Due Date of filing ITR for tax payers who are required to get their Accounts Audited | 31st October |

| Due Date of filing Tax Audit Report | 30th September (One month prior to due date of Income Tax Return Filing) |

Form 3CA is required in the case of a person who carries on business or profession and who is required by or under any other law to get his accounts audited.

Form 3CB is required in case other than case covered by Form 3CA.

These forms are required to be filed along with Form 3CD which is again a detailed form having 44 clauses analyzing and auditing the accounts of taxpayer as per Income Tax Act.

Penalty for Non Filing Tax Audit Report

A minimum penalty can be 0.5% of the total sales, turnover or gross receipts, which can go up to Rs. 1,50,000 is applicable in case Tax Audit Report is not filed. However, if the taxpayer gives reasonable cause for non-compliance, no penalty will be imposed.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"