Priyanka Kumari | Nov 29, 2023 |

Bank Account Attachment order passed u/s 83 of GST Act inoperative after expiry of 1 year

The Delhi High Court, in the matter of M/S. VAIDHE STAINLESS STEEL Vs. UNION OF INDIA THROUGH ITS SECRETARY MINISTRY OF FINANCE, has issued an order regarding the Bank Account Attachment order passed u/s 83 of the GST Act inoperative after the expiry of 1 year.

The Relevant Text of the Judgment:

The petitioner has filed the present petition, inter alia, praying that the respondents be directed to revoke the cancellation of the petitioner’s GST registration.

The petitioner is aggrieved by the order dated 18.08.2022, whereby the petitioner’s GST registration was canceled with retrospective effect from 15.06.2021. The petitioner has filed an application seeking revocation of cancellation of its GST registration, however, the same has not been processed.

The learned counsel appearing for Respondent Nos. 2 and 3 states on instructions that the petitioner’s application for revocation of the order canceling its GST registration would be processed within a period of two weeks.

In view of the aforesaid statement, no further orders are required to be passed in this regard.

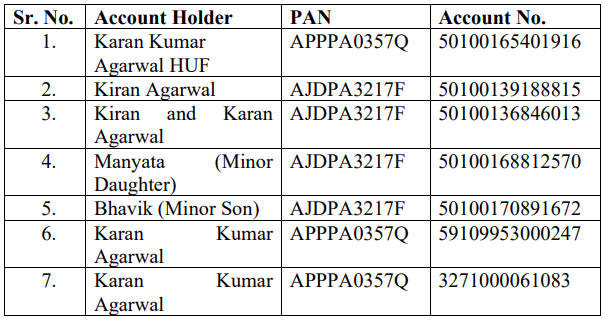

The petitioner is also aggrieved by orders dated 04.08.2022 and 24.08.2022 passed under Section 83 of the Central Goods and Services Tax Act, 2017 (hereafter ‘CGST Act’), provisionally attaching the following bank accounts of the petitioner and his family members:

The prayer made in the present petition is confined to the attachment of the bank account of the petitioner. However, the learned counsel for the petitioner submits by an inadvertent error, a specific prayer in respect of other bank accounts has not been made, although the grievance is articulated in the body of the petition.

In terms of Section 83(2) of the CGST Act, any order passed under Section 83(1) of the CGST Act would be inoperative after the expiry of a period of one year from the date of the said order.

The learned counsel appearing for Respondent Nos. 2 and 3 fairly states on instruction that the orders dated 04.08.2022 and 24.08.2022, provisionally attaching the aforesaid bank accounts, are no longer operative by virtue of Section 83(2) of the CGST Act.

In these circumstances, we consider it apposite to direct the concerned banks not to interdict the operation of the aforesaid bank accounts on the basis of the orders dated 04.08.2022 and 24.08.2022 passed under Section 83(1) of the CGST Act.

The petition is disposed of in the aforesaid terms.

For Official Judgment Download the PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"