ELSS: Open-ended scheme with a 3-year lock-in. 80% assets in equity. Tax exemption up to Rs 1.5 lakh under Section 80C.

PRATEEK MAURYA | May 10, 2024 |

Best Tax Saving ELSS Mutual Funds

Equity-Linked Saving Scheme (ELSS) is a popular tax-saving investment option in India. This is an open-ended equity-oriented scheme with a statutory lock-in period of three years. As per SEBI, the scheme invests at least 80 per cent of its total assets in equity and equity-related instruments (in accordance with Equity Linked Saving Scheme, 2005, notified by Ministry of Finance). Tax benefit is the most attractive aspect of these funds, with investors getting tax exemption up to Rs 1.5 lakh Section 80C of Income Tax Act, 1961.

Here is the Best Tax-saving ELSS Mutual Funds

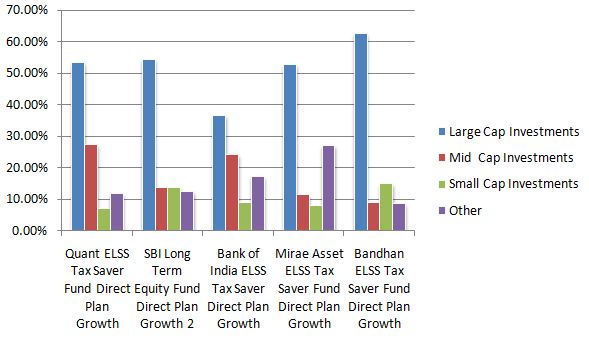

Quant ELSS Tax Saver Fund Direct Plan Growth: Its Fund size is about 9360.89 crore with 5-star ratings. One year annual return is 56.3% and last Three-year return is 28.6%

SBI Long Term Equity Fund Direct Plan Growth: Its Fund size is about 21,976 crore with a 5-star rating. One year annual return is 56.3% and the last Three-year return is 28.1%

Bank of India ELSS Tax Saver Direct Plan Growth: Its Fund size is about 1210.15 crore with a 5-star rating. One year annual return is 51.9% and last Three-year return is 25.0%

Mirae Asset ELSS Tax Saver Fund Direct Plan Growth: Its Fund size is about 21,475 crore with a 4-star rating. One year return is 34.15% and last Three-year return is 18.79%

Bandhan ELSS Tax Saver Fund Direct Plan Growth: Its Fund size is about 6,252.84 crore with a 4-star rating. One year annual return is 36% and last Three-year return is 22.2%

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"