Studycafe | Nov 22, 2019 |

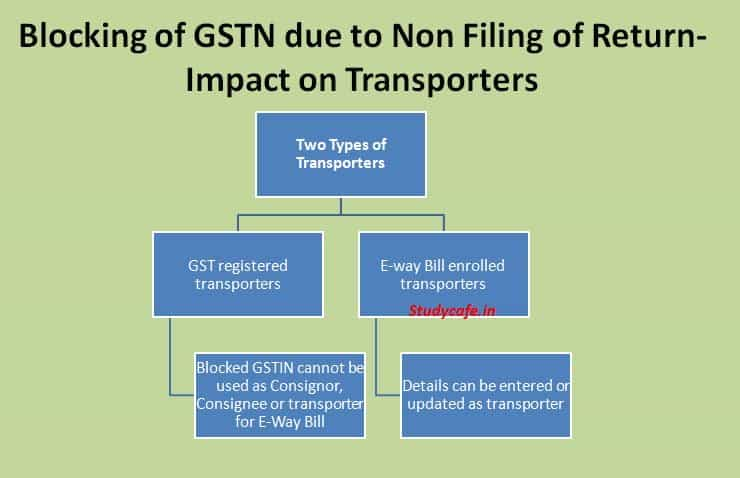

Blocking of GSTN due to Non Filing of Return-Impact on Transporters

There are two types of transporters – GST registered transporters and E-way Bill enrolled transporters. If the GSTIN of the GST registered transporter is blocked, then that GSTIN cannot be used as Consignor, Consignee or transporter while generating e-way bill and updating transporter details. However, enrolled transporter details can be entered or updated as transporter, while generating e-way bills as he/she is just enrolled on e-way bill portal for movement of goods and he/she is not registered for GST.

Whether recipient can generate e-way bill on blocked supplier and vice versa

Ans: No, if supplier or recipient is blocked for e-way bill generation, then neither supplier nor recipient can generate e-way bill between them.

Can transporter generate e-way bill on blocked supplier or recipient

Ans: No, the transporter also cannot generate the e-way bills, if supplier or recipient is blocked due to non-filing of returns.

Will the e-way bill system block the updating of Transporter Id, if transporter id is blocked

Ans: Yes, the e-way bill system will also block the updating of Transporter Id, provided he is registered in GST and has not filed the Returns for latest two successive months. However, there will not be any problem in updating of the enrolled transporter id, while generating the e-way bills.

You May Also Refer : Blocking/Unblocking of E way bill generation

What happens to the already generated e-way bills of the blocked GSTINs, which are active and in transit

Ans: There will not be any effect/impact on the already generated e-way bills of the blocked GSTINs. These e-way bills are valid and can be moved to the destination without any problem. And for these e-way bills, any transporters/tax payers including blocked GSTINs, can update the vehicle and transporter details and carry out the extension, if required, as per the rule.

You May Also Refer : How to Unblock the GSTIN for generation of e-waybill

Can one update the vehicle and transporter details and extend the e-way bills, if required, for the e-way bills belonging to the blocked GSTINs

Ans: The e-way bills, that are already generated and valid, can be updated with vehicle and transporter details and can be extended, if required, by the authorized stake holder (tax payer/transporter) as per rule.

For Regular Updates Join:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"