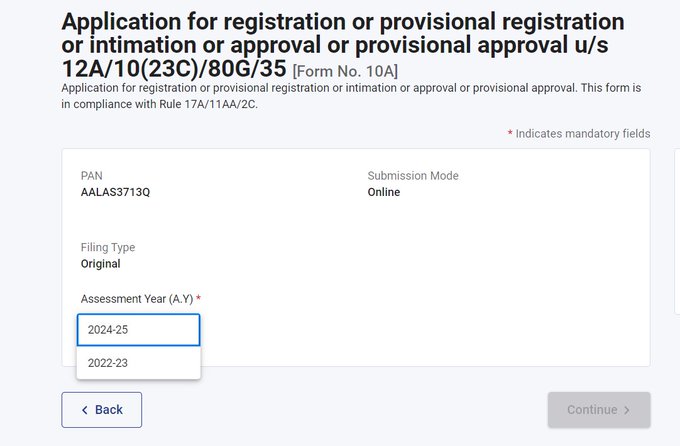

The Income Tax E-filing Portal has now enabled E-filing of Form 10A from AY 2022-23 as per directions given vide CBDT Circular 06/2023 dt.24.05.2023.

Reetu | Jun 2, 2023 |

BREAKING: E-filing of Form 10A from AY 2022-23 onwards now been enabled for Filing

The Income Tax E-filing Portal has now enabled E-filing of Form 10A from AY 2022-23 as per directions given vide CBDT Circular 06/2023 dt.24.05.2023.

Form 10A for trusts, NPOs, NGOs and other section 8 companies can be used to apply for provisional registration or permanent registration under Section 12A of the Income Tax Act, 1961. All trusts and charitable/religious organisations can claim full tax exemptions under this section.

The Circular mentioned above stated as:-

All the existing trusts were required to apply for registration/approval on or before 30.06.2021. However, on consideration of difficulties in the electronic filing of Form No. 10A, the Central Board of Direct Taxes (the Board) in exercise of the powers conferred upon it under Section 119 of the Act extended the due date for filing Form No. 10A in such cases to 31.08.2021 vide Circular No.12 of 2021 dated 25 .06.2021, to 3 1.03.2022 vide Circular No. 16 of 2021 dated 29.08.2021 and further till 25.11.22 vide Circular No. 22 of 2022 dated 01.11.2022. Such registration/approval shall be valid for a period of 5 years. Thus, existing trusts are required to apply for fresh registration/approval and once the registration/approval is granted it is valid for five years.

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"