CBDT has amended Form 3CD of the Tax Audit Report for AY 2025-26 by notifying the Income-tax (Eighth Amendment) Rules 2025 via a released Notification effective from the 1st day of April 2025.

Reetu | Mar 29, 2025 |

CBDT Amends Form 3CD of Tax Audit Report; Changes effective 1st April 2025

The Central Board of Direct Taxes (CBDT) has amended Form 3CD of the Tax Audit Report for AY 2025-26 by notifying the Income-tax (Eighth Amendment) Rules 2025 via a released Notification effective from the 1st day of April 2025.

The Notification Read as Follows:

In exercise of the powers conferred by section 44AB and section 295 of the Income-tax Act (43 of 1961), the Central Board of Direct Taxes hereby, makes the following rules further to amend the Income-tax Rules, 1962, namely:

Short title and commencement – (1) These rules may be called the Income-tax (Eighth Amendment) Rules, 2025.

(2) They shall come into force on the 1st day of April 2025.

In the Income-tax Rules, 1962, in Appendix II, in Form no. 3CD, in Part B,

(a) in clause (12), after the figures and letters “44BBB,” , the figures and letters “44BBC” shall be inserted;

(b) in clause (19), the rows labelled as “32AC,” “32AD,” “35AC,” and “35CCB” shall be omitted;

(c) in the table, in clause (21), in sub-clause (a), after the row starting with the words “Expenditure incurred to provide any benefit or perquisite”, a row with the words “Expenditure incurred to settle proceedings initiated in relation to contravention under such law as notified by the Central Government in the Official Gazette in this behalf” shall be inserted;

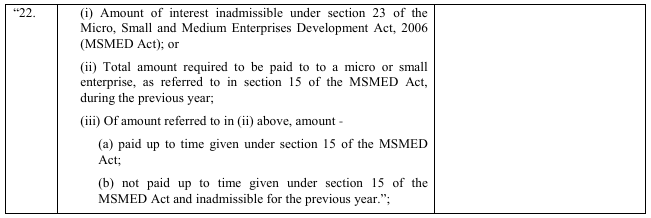

(d) for clause (22), the following clause shall be substituted –

(e) in clause (26), –

(i) the words, brackets and letters “clause (a), (b), (c), (d), (e), (f) or (g) of” shall be omitted;

(ii) in sub-clause (A), for the word “allowed”, the word “allowable” shall be substituted;

(iii) in sub-clause (B), for the words “and was”, the words, brackets, letters and figures, “and (for clauses other than clause (h) of section 43B) was,” shall be substituted;

(f) clauses (28) and (29) shall be omitted;

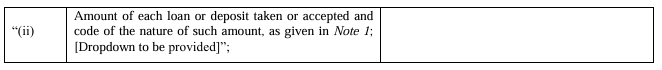

(g) in clause (31), in sub-clauses (a) and (b), for item (ii), the following item shall be substituted, namely :–

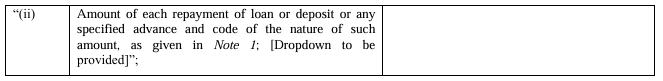

(h) in clause (31), in sub-clause (c), for item (ii), the following item shall be substituted, namely :–

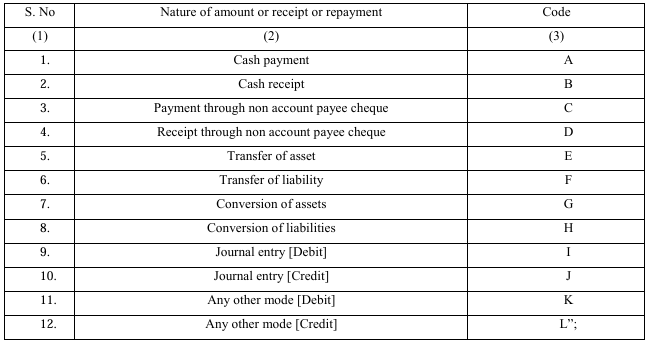

(i) after clause (31), the following Note shall be inserted, namely:

“Note 1. – The code for the nature of amount/receipt/repayment is as below –

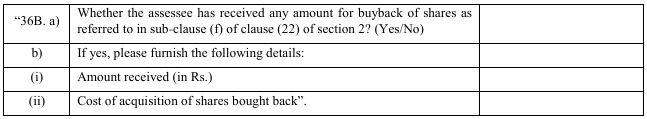

(j) after clause (36A), the following clause shall be inserted, namely:

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"