Deepak Gupta | May 19, 2019 |

Brief steps for Online TDS/TCS/Demand Payment

Challan No. ITNS 281 is used by the Deductors to deposit Tax Deducted at source/Tax Collected Source (TDS/TCS) and Demand Payment.

User should have Internet Banking Account in order to avail facility of Online payment of Challans.

Following details required to be filled while payment of Challan ITNS-281:

1. Tax Applicable:-This column has two options:

0020: This is applicable in the case of income tax of companies ( If Deductee is company).

0021: This is applicable to income tax for other than companies (If Deductee is not a company i.e. an individual, HUF, partnership firm, etc.).

2. Assessment Year.

3. TAN No., Name and Address

4. Type of Payment:

200 ( TDS/TCS payable by Taxpayer)

400 ( TDS/TCS payable regular Assessment).

Note : In case of Online Demand Payment Deductor can select Minor Head 400 ( TDS/TCS Regular Assessment ). For TDS/TCS payment Deductor can select Minor Head 200 ( TDS/TCS payable by Taxpayer).

5. Nature of Payment: Deductor has to select Section Code as per the section under which TDS/TCS is deducted

Go to www.tin nsdl .com website .

Step 1: Click on e- payment Pay Taxes Online available at home page under Services tab.

Step 2: Select Challan ITNS 281 for Demand payment from the list. Challan ITNS-281 Form will appear.

Step 3: Select Major Head (0020/0021), Enter valid 10-digit Tax Deduction and Collection Account Number (TAN), Assessment Year, Address. Minor Head/Type of Payment (200/400), Nature of payment, Mode of Payment & Bank Name then Click on Proceed button.

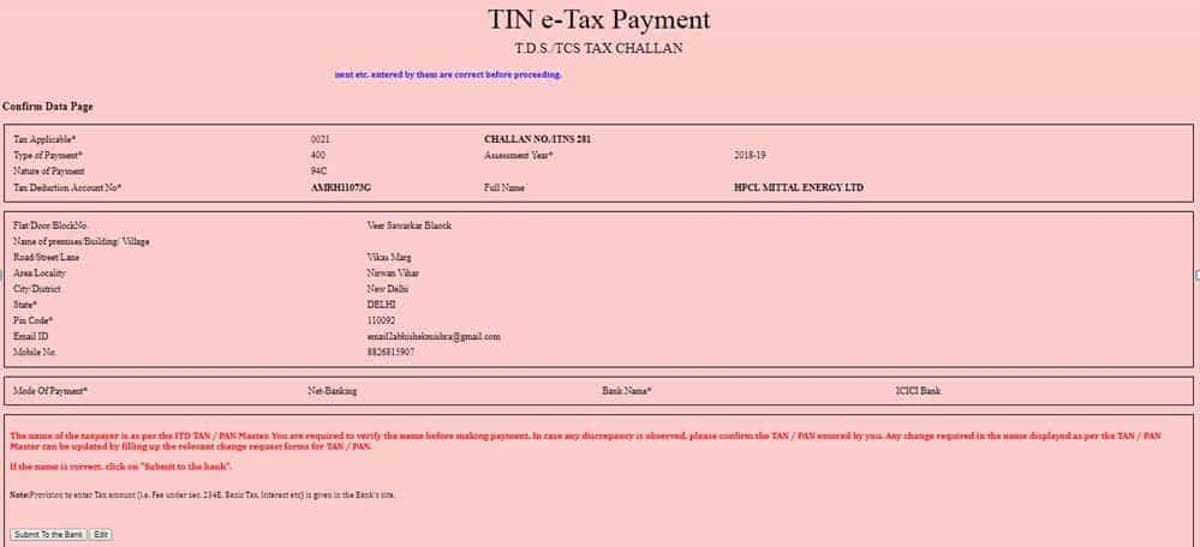

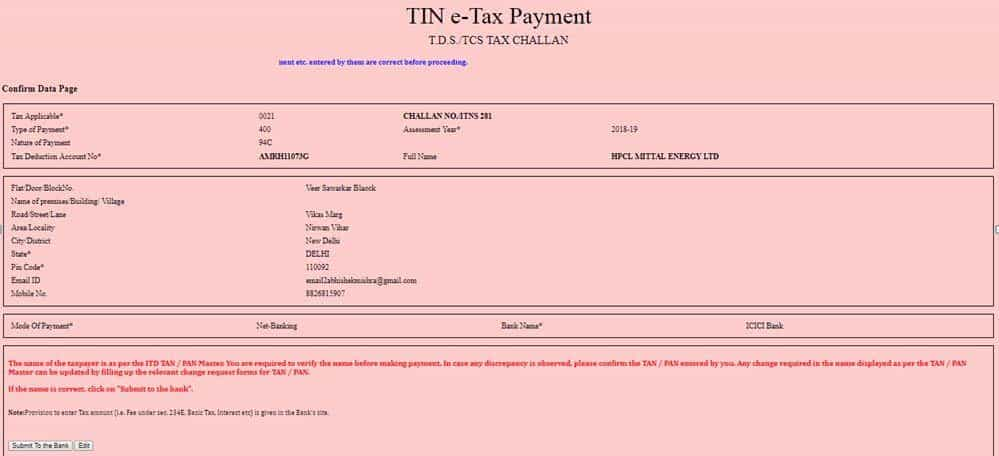

Step 4: Confirmation Screen will appear to confirm the details entered in Challan . On Confirming the details entered in Challan. Click on Submit to Bank button.

Step 5: Deductor will be re-directed to the Internet- Banking site of the bank. Enter the User- ID and Password provided by the bank.

Step 6: Enter payment details at Bank website and make the TDS payment.

Note: On Successful payment , A Challan counterfoil will be generated containing Challan Identification Number (CIN), payment details and Bank Name through which e- Payment has been made. This counterfoil is proof of payment being made

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"