Some Changes have been made in the income tax regime like an increment in the standard deduction limit and Changes in the slab rate of the new tax regime etc.

Reetu | Jul 25, 2024 |

Budget 2024: Brief Comparison between New and Old Tax Regime

The Finance Minister of India was presented the Budget 2024 on 23rd July this year. She proposed changes various to simplify taxation and ease of doing business. Some Changes have been made in the income tax regime like an increment in the standard deduction limit, a hike in the interest rate on late payment of TCS, Changes in the slab rate of the new tax regime etc.

Let’s discuss changes approved in the New and Old Tax Regimes.

New Tax Regime

After Budget 2024, the new income-tax regime has improved and now offers more benefits than before. Standard deduction has increased from Rs. 50000 to Rs.75,000. Tax slabs have been made more generous.

Old Tax Regime

No changes have been made in the old tax regime this year in the Budget. The Slabs of Old Tax Regime are as follows:

| Particular | Old Tax Regime | |

| Income Ranges | Rate | |

| Slab Rate | 0-2 Lakh | 0% |

| 2.5L -5L | 5% | |

| 5L -10L | 20% | |

| Above 10L | 30% | |

Slab Rate Change

| Particular | New Tax Regime | |

| Income Ranges | Rate | |

| Slab Rate | 0-3L | 0% |

| 3L – 7L | 5% | |

| 7L -10L | 10% | |

| 10L – 12L | 15% | |

| 12L -15L | 20% | |

| Above 15L | 30% | |

| Standard Deduction | New Tax Regime | Old Tax Regime |

| Rs.75,000 | Rs.50,000 |

| Particular | New Tax Regime | Old Tax Regime | |

| Section 80C | Not Allowed | Allowed | |

| Section 80D | Not Allowed | Allowed | |

| NPS u/s 80CCD (2) Employer Share Deduction | Allowed (14% of Basic + DA) | Allowed | |

| (10 % of Basic + DA) Non-Govt. Employer | (14 % of Basic + DA) Govt. Employer | ||

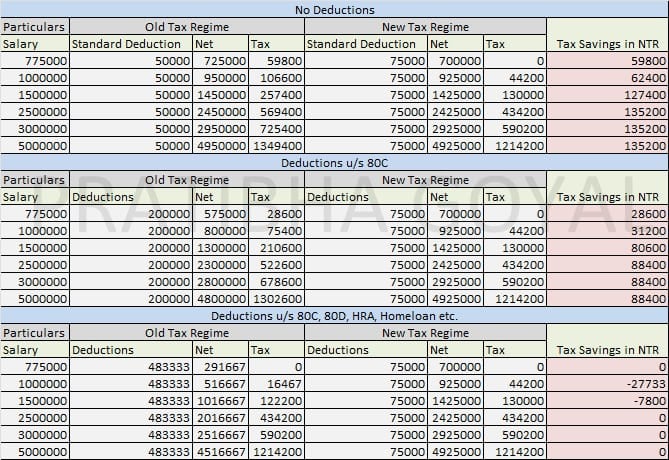

We have compared beneficial tax regimes for salaries up to Rs. 50,00,000.

Please note that in this chart, deductions include Standard deductions.

As you can see the Old Tax Regime would no longer be beneficial if you only have section 80C Deductions. To benefit from the old tax regime, now you need more deductions like HRA, Home Loan etc. in your kitty. As you can see in our example, for a salary of Rs. 25,00,000, you at least need deductions of Rs. 483333 to Break Even.

It seems like the government is promoting the New Tax Regime and slowly, the Old Tax Regime will become a thing of the past.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"