Taxpayers had to adhere to a single tax regime till 2020-21. However, in Budget 2020, a new tax system was implemented, that has been made the default tax system in Budget 2023.

Reetu | Jun 12, 2024 |

ITR Filing: Switch from New Tax Regime to Old Tax Regime; Let’s Understand How!

Indian taxpayers till 2020-21 had to adhere to a single tax regime. However, in Budget 2020, a new system was implemented that allowed individuals and HUF taxpayers to pay lower income tax rates. The new tax regime system went into effect in the financial year 2020-21 (Assessment year 2021-22).

The old tax system was the default until FY 2022–2023, at which point taxpayers had to choose between the old tax system and the new tax system.

On the other hand, Budget 2023 modified the tax laws and made the new tax system the default, beginning with the financial year 2023-2024.

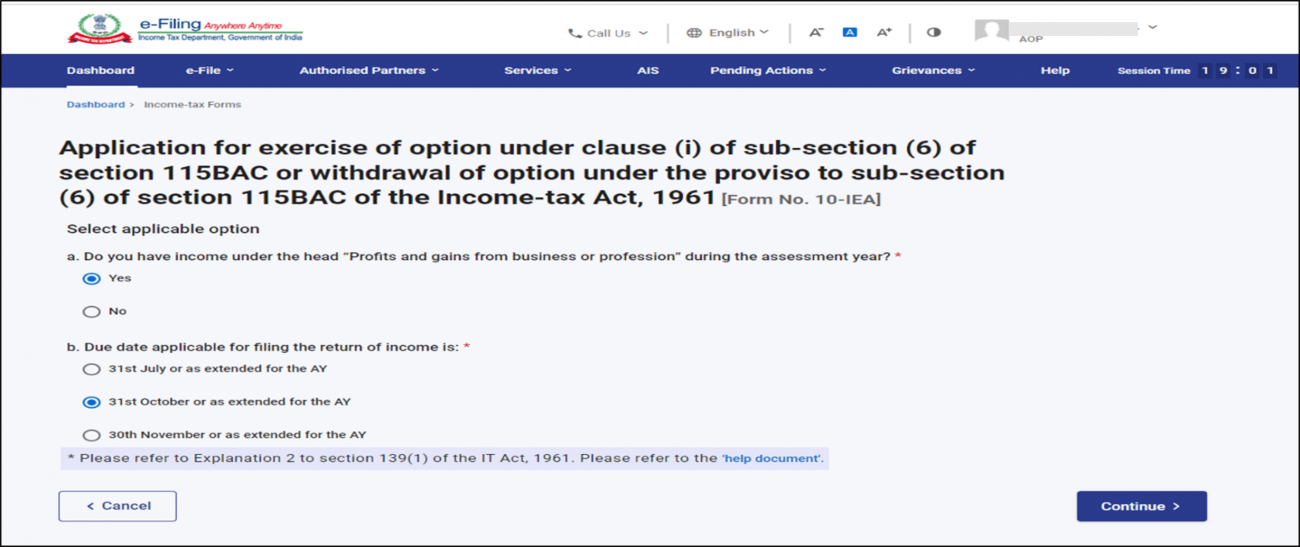

Earlier, till FY 2022-23 when the new tax regime was not the default tax regime, individuals had to file Form 10-IE to specify their willingness to choose the new tax regime. However, starting FY 2023-24, the new tax regime has been set as the default tax regime. This means that if the taxpayer does not specify their intent to choose the old regime, they will be automatically enrolled in the new regime. The New Regime is the Default regime, and thus you need to file Form 10IEA.

The new form 10 IEA can be used to indicate the preference for the old tax regime by Individuals, HUF, AOP (other than co-operative societies), BOI & Artificial Judicial Persons (AJP) having income from business and profession. They have to mandatorily submit Form 10-IEA within the specified time frame under section 139(1) if they want to switch their tax regime from new to old or if they want to re-enter in the new scheme.

Those who do not have income from business and profession will be automatically subject to the new tax regime; however, they have the option to select the old tax system when filling their Income Tax Return (ITR). Employees having a salary Income should indicate their Tax regime to their employer for deduction of TDS in the beginning of the year itself; however, they have the option to change the regime when filling their Income Tax Return (ITR)

For salaried taxpayers, the new tax regime is now the default regime. This means that unless you voluntarily opt out of the new regime and return to the old regime, you will be taxed under the new tax system, which has lower tax rates but no deductions for common expenses like health insurance, house rent allowance (HRA), and so on.

You can switch every year if calculations show that the old tax regime, with its deductions, is more beneficial to your tax situation.

Unlike salaried Taxpayers, a business/professional taxpayer has only one chance to switch Tax Regime. Once opted out, the taxpayer cannot choose new tax regime again.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"